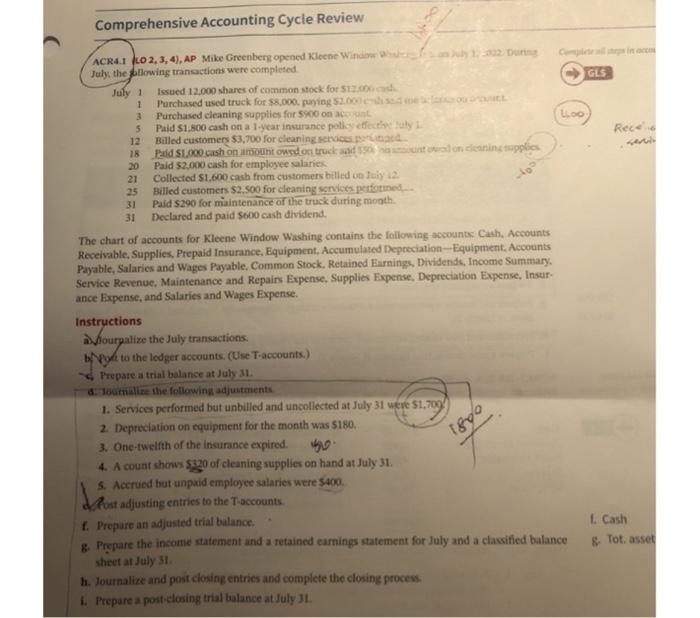

Question: please help with H and I (Post Closing Entries and Post closing trail balance) Comprehensive Accounting Cycle Review GLS LO Receiro ACR4.1 KLO 2,3,4), AP

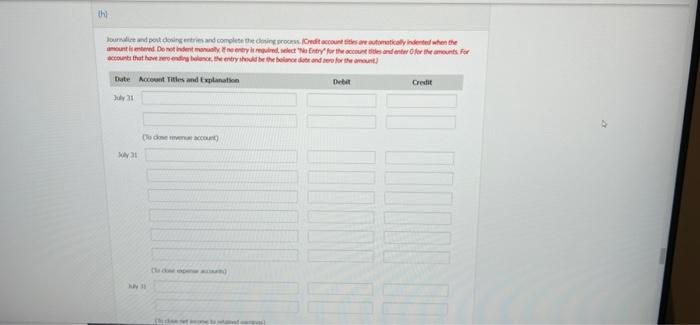

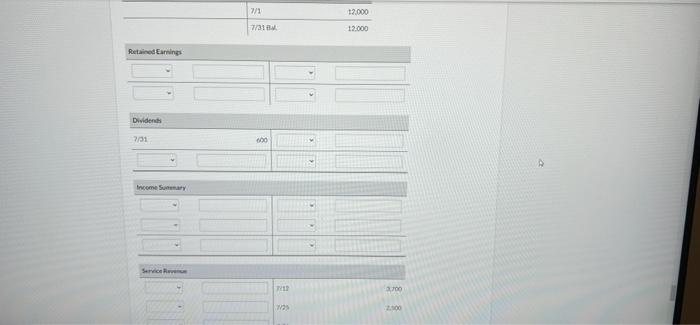

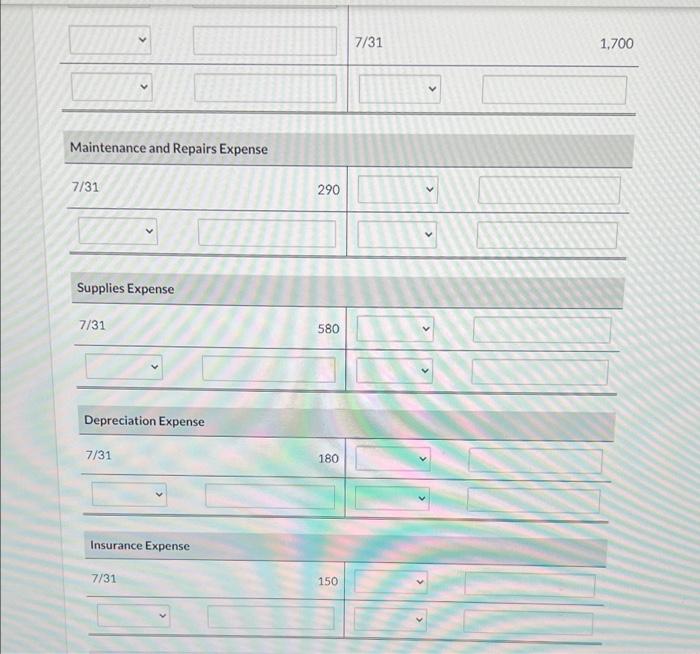

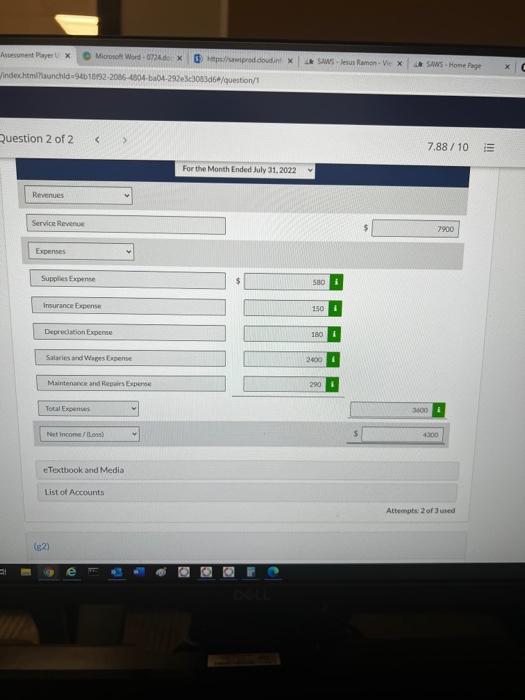

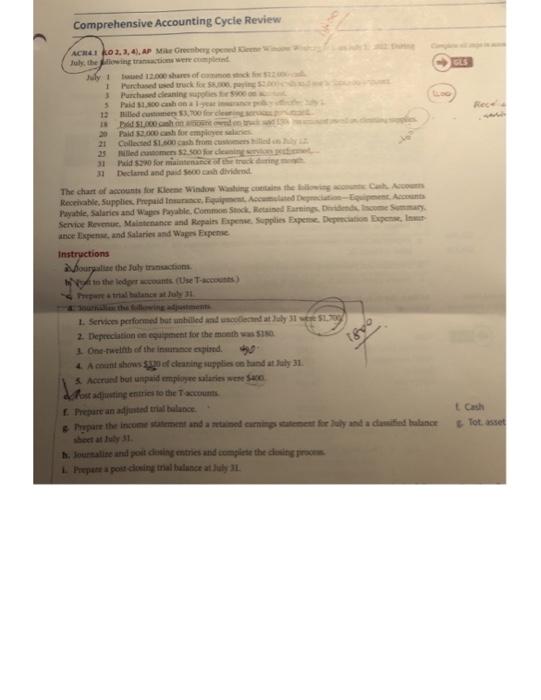

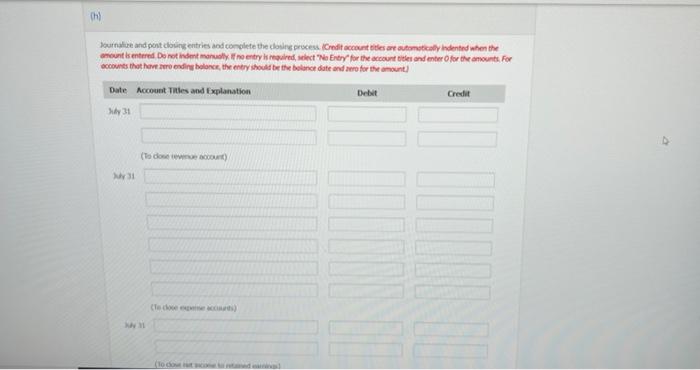

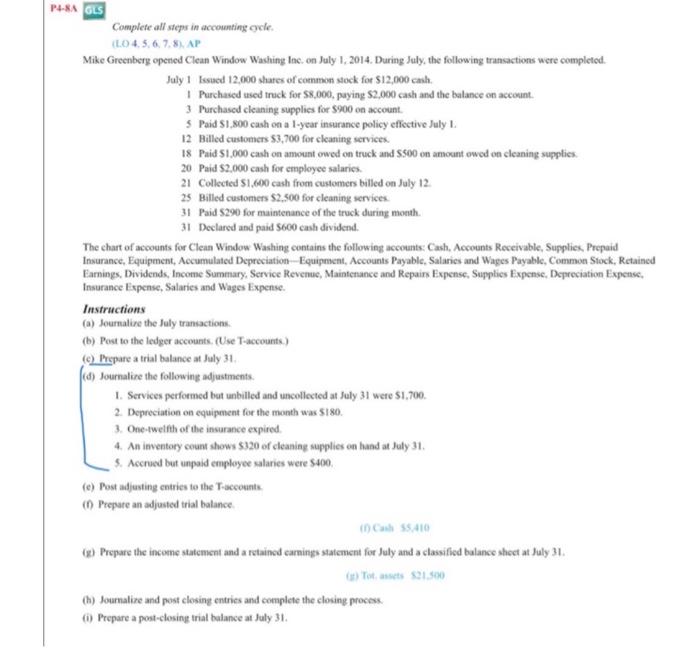

Comprehensive Accounting Cycle Review GLS LO Receiro ACR4.1 KLO 2,3,4), AP Mike Greenberg opened Kleene Window July the pollowing transactions were completed July 1 Issued 12.000 shares of common stock for 573 1 Purchased used truck for $8.000, paying $2.00 3 Purchased cleaning supplies for 5900 on account 5 Pald 51.800 cash on a 1-year insurance policy efethull 12 Billed customers $3,700 for cleaning service 18 Pald S...cash on oht owsido truck santon desine tapplies 20 Paid $2.000 cash for employee salaries 21 Collected $1.600 cash from customers billed on July 2 25 Billed customers $2.500 for cleaning services formed 31 Paid S290 for maintenance of the truck during month 31 Declared and paid S600 cash dividend. The chart of accounts for Kleene Window Washing contains the following accounts Cash, Accounts Receivable, Supplies. Prepaid Insurance, Equipment, Accumulated Depreciation Equipment, Accounts Payable, Salaries and Wages Payable. Common Stock Retained Earnings, Dividends, Income Summary Service Revenue, Maintenance and Repairs Expense, Supplies Expense. Depreciation Expense, Insur ance Expense, and Salaries and Wages Expense. Instructions ourpalize the July transactions pode to the ledger accounts. (Use T-accounts.) Prepare a trial balance at July 31 atomline the following adjustments 1. Services performed but unbilled and uncollected at July 31 were $1.709 2. Depreciation on equipment for the month was $180, 3. One-twelfth of the insurance expired. 4. A count shows $320 of cleaning supplies on hand at July 31. 5. Accrued but unpaid employee salaries were $400 Most adjusting entries to the T-accounts 1. Prepare an adjusted trial balance. & Prepare the income statement and a retained earnings statement for July and a classified balance sheet at July 31 h. Journalive and post closing entries and complete the closing process 1. Prepare a post-closing trial balance at July 31. 1800 L. Cash & Tot asset th Jouw pot designs and complete the proc. Coccount thesautomatically indeed when the amount Donden mer required to her for the countles and enter for the amounts For account that have been be the blood and her for the amount Dute Account Titles and Explanation De Credit July 771 12.000 23 12.000 Retained Earnings Dividends 7/31 000 Income Service III 700 725 2.100 7/31 1,700 Maintenance and Repairs Expense 7/31 290 C Supplies Expense 7/31 580 Depreciation Expense 7/31 180 Insurance Expense 7/31 150 As Payer Micro Word-072X Dipred dodant sws-les amox SWS - Home Page indechlaunchide9466992-2005-6804-04-292e3c308306/question/1 Question 2 of 2 7.88/10 INT For the Month Ended July 31, 2022 Revenues Service Reven 7900 Expenses Supplies Expense 580 i Insurance Expense 150 Depreciation Expense 180 Sataries and Wespense 2400 Maintenance and Response 290 Total Expenses 400 Nu income 300 Textbook and Media List of Accounts Attempts 2 of Jused (82) Comprehensive Accounting Cycle Review ACHI ko 2, 3, 4), AP Mie Groberen Rece July 1 shares of me 1 Puncted duck 3 Purchased ning polis Pald sooshonal 13 miles DiddSLO 20 Paid 3.000 arsch borce 21 Collected $1.500 cash from 25 Nedomen 2.500 forces 31 Pild so fortuna 30 Dectand and paid och dividend The chart of accounts for Kleene Window Mang theo cho Rechable Supplies. Prepaid Ice, Accept Payable, Salaries and Wages Common Stock Head Earnings. Die Service Revenue, Maitenance and Repairs pen. Supplies Expense Deppen ance Expens, and Salaries and Wages Expense Instructions orale the July manuction. to the practs (UT) isyo 1. Service performed botunhilled and med at July 35170 2. Depreciation equipment for the month was 1. One-two of the ice expired. 4. And shows of cleaning supplies on hund at July 31 3 Accrued but unpaid employees were $ fost adjusting entries to the accounts Prepare an adjusted trial balance Prepare the income statement and and caringen for day and add balance hartauly 31 h. Journaline and post ding entries and complete the designs Prepare a poucoing trial balance at July Cash Tot asse thi Journal and post cung entries and complete the closing process Creditoccounts are automaty Indented when the amount is entered De retindent manually entry gred, lect"Ne Entry for the accounts and enter for the amounts. For accounts that have ending on the entry should be the balance date and more for the amount) Date Account Titles and Explanation Det Credit 31 (to down) P-8A GLS Complete all steps in accounting de (L0 4.5.6.7.8) AP Mike Greenberg opered Clean Window Washing Inc. on July 1, 2014. During July, the following transactions were completed. July 1 Issued 12,000 shares of common stock for $12,000 cash. Purchased used truck for $5,000, paying $2,000 cash and the balance on account 3 Purchased cleaning supplies for $900 on account 5 Paid S1,800 cash on a 1-year insurance policy effective July 12 Billed customers $3,700 for cleaning services 18 Paid S1,000 cash on amount owed on truck and S500 on amount owed on cleaning supplies 20 Paid $2.000 cash for employee salaries 21 Collected $1,600 cash from customers billed on July 12. 25 Billed customers $2.500 for cleaning services 31 Paid S290 for maintenance of the truck during month. 31 Declared and paid S600 cash dividend. The chart of accounts for Clean Window Washing contains the following accounts: Cash. Accounts Receivable, Supplier, Prepaid Insurance, Equipment, Accumulated Depreciation Equipment, Accounts Payable, Salaries and Wages Payable, Common Stock, Retained Earnings, Dividends, Income Summary Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation Expense, Insurance Expense, Salaries and Wages Expense. Instructions (a) Journalire the July transactions (b) Post to the ledger accounts. (Use T-accounts) (ePrepare a trial balance at July 31, (a) Journalire the following adjustments. 1. Services performed but unbilled and uncollected at July 31 were $1.700. 2. Depreciation on equipment for the month was 5180. 3. One-twelfth of the insurance expired. 4. An inventory count shows $320 of cleaning supplies on hand at July 31 5. Accrued but unpaid employee salaries were $400, (e) Post adjusting entries to the Taccounts. ( Prepare an adjusted trial balance ( 55410 Prepare the income statement and a retained carnings statement for July and a classified balance sheet at July 31. Tots $21.500 (1) Journalire and post closing entries and complete the closing process Prepare a post-closing trial balance at July 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts