Question: please help with income statement , owner equity and post trial balance C D M N Jenny Watson started her consulting business, Benny Consulting in

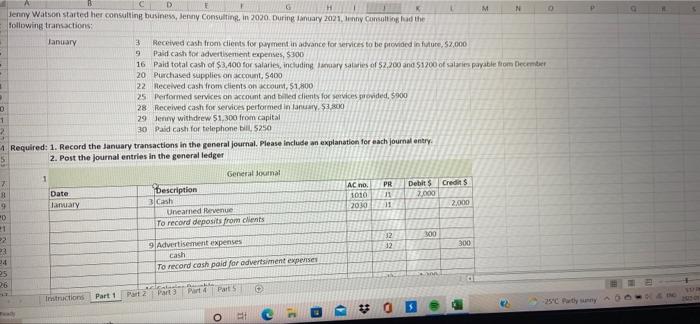

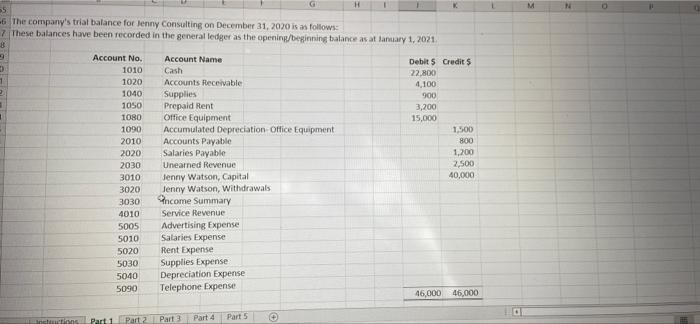

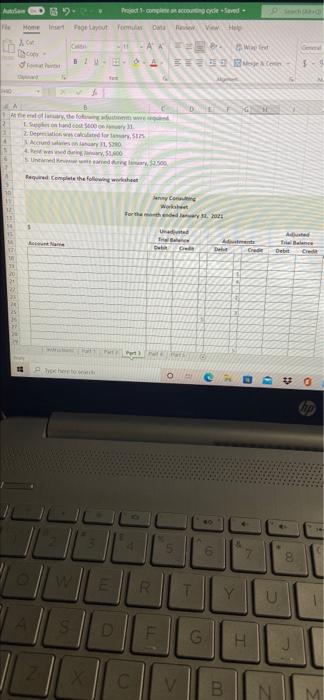

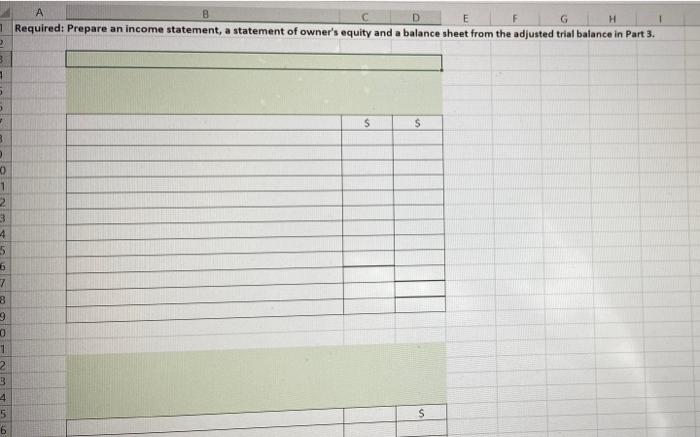

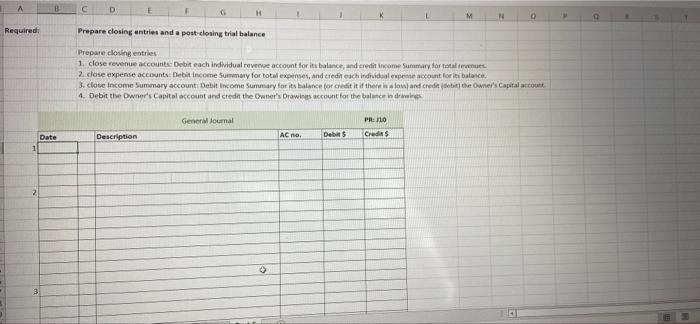

C D M N Jenny Watson started her consulting business, Benny Consulting in 2030. During lanuary 2021. lenny Consulting had the following transactions January 3 Received cash from dients for payment in advance for services to be provided in future, 52.000 - 9 Paid cash for advertisement expenses $300 16 Pald total cash of $3.400 for salaries, including Mary Salaries of 52,200 and $1200 of salaries payable from December 20 Purchased supplies on account, 5400 1 22 Received cash from clients on account, $1,800 25 Performed services on account and billed clients for services provided. 5900 28 Received cash for services performed in January, 53200 1 29 Jenny withdrew 51,300 from capital 2 30 Paid cash for telephone bil 5250 4 Required: 1. Record the January transactions in the general journal. Please include an explanation for each journal entry 5 2. Post the journal entries in the general ledger 1 Credits Date January Acino 1010 2030 Debit 7.000 General Journal Description Cash Unearned Revenue To record deposits from clients PR 11 11 7 3 9 D 21 22 2,000 300 32 12 300 9 Advertisement expenses cash To record cash paid for advertiment expenses 25 26 Part 5 Instructions Part 1 POZ PNE Pt2 05 o 11 O M Na 5 1 -6 The company's trial balance for Jenny Consulting on December 31, 2020 is as follows: 7 These balances have been recorded in the general ledger as the opening/beginning balance as at January 1, 2021 B Account No. Account Name Debit Credits 1010 Cash 1 22.800 1020 Accounts Receivable 4,100 . 1040 Supplies 900 1050 Prepaid Rent 3,200 1080 Office Equipment 15,000 1090 Accumulated Depreciation Office Equipment 1,500 2010 Accounts Payable 800 2020 Salaries Payable 1,200 2030 Unearned Revenue 2,500 3010 Jenny Watson, Capital 40,000 3020 Jenny Watson, Withdrawals 3030 Ancome Summary 4010 Service Revenue 5005 Advertising Expense 5010 Salaries Expense 5020 Rent Expense 5030 Supplies Expense 5040 Depreciation Expense 5090 Telephone Expense 46,000 46,000 Part 5 instations Parta Part 4 Part 2 Part 3 Prot.com mode-S - getut Fonds VH Home Good Icon - Aten 5 All the foc Land 2. Depois Vary, A.S. S500 Bad Complete the following what any con Torte 102 wted TH DR G Ante Del Thule Debat Cr GE o E R D LI G H V B N M 8 E F G H Required: Prepare an income statement, a statement of owner's equity and a balance sheet from the adjusted trial balance in Part 3. 2 3 5 S $ 3 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 S B D G H M N 0 Required Prepare closing entries and a post-closing trial balance Prepare closing entries 1. close revenue accounts: Debit each individual revent account for its balance, and credit income Summary fortalen 2. close expense accounts: Debit Income Summary for total expenses, and creditsch individuales count for it balance 3. close Income Summary account Debit Income Summary for its balance for credit it if there is slow and credit date Owner's Capital account 4. Debit the Owner's Capital account and credit the Cwner's Drawing account for the balance in de General Journal PR: 110 Date Description AC no. Debits Credits 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts