Question: Please help with journal entries!! Week 1 Week 1 Date Transaction description 1 Purchased 3 9 packages of Customized Paper Cups from Abejundio Coffee for

Please help with journal entries!!

Week Week

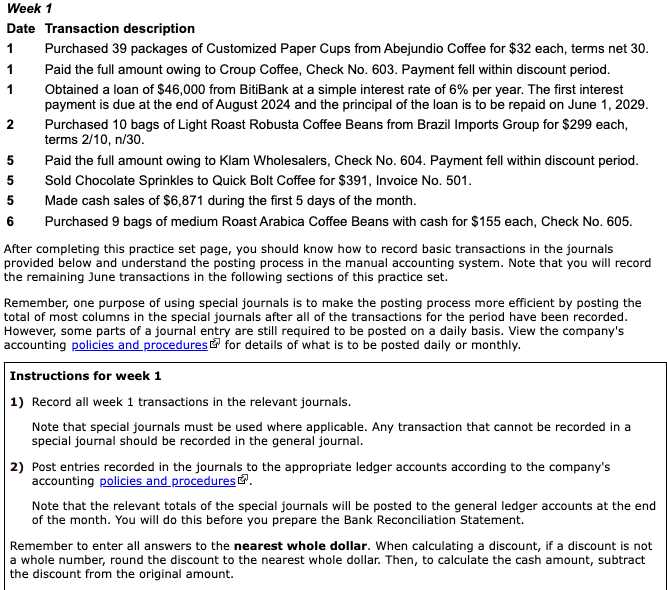

Date Transaction description

Purchased packages of Customized Paper Cups from Abejundio Coffee for $ each, terms net

Paid the full amount owing to Croup Coffee, Check No Payment fell within discount period.

Obtained a loan of $ from BitiBank at a simple interest rate of per year. The first interest

payment is due at the end of August and the principal of the loan is to be repaid on June

Purchased bags of Light Roast Robusta Coffee Beans from Brazil Imports Group for $ each,

terms

Paid the full amount owing to Klam Wholesalers, Check No Payment fell within discount period.

Sold Chocolate Sprinkles to Quick Bolt Coffee for $ Invoice No

Made cash sales of $ during the first days of the month.

Purchased bags of medium Roast Arabica Coffee Beans with cash for $ each, Check No

After completing this practice set page, you should know how to record basic transactions in the journals

provided below and understand the posting process in the manual accounting system. Note that you will record

the remaining June transactions in the following sections of this practice set.

Remember, one purpose of using special journals is to make the posting process more efficient by posting the

total of most columns in the special journals after all of the transactions for the period have been recorded.

However, some parts of a journal entry are still required to be posted on a daily basis. View the company's

accounting policies and procedures for details of what is to be posted daily or monthly.

Instructions for week

Record all week transactions in the relevant journals.

Note that special journals must be used where applicable. Any transaction that cannot be recorded in a

special journal should be recorded in the general journal.

Post entries recorded in the journals to the appropriate ledger accounts according to the company's

accounting policies and procedures

Note that the relevant tota

Date Transaction description

Purchased packages of Customized Paper Cups from Abejundio Coffee for $ each, terms net

Paid the full amount owing to Croup Coffee, Check No Payment fell within discount period.

Obtained a loan of $ from BitiBank at a simple interest rate of per year. The first interest

payment is due at the end of August and the principal of the loan is to be repaid on June

Purchased bags of Light Roast Robusta Coffee Beans from Brazil Imports Group for $ each,

terms

Paid the full amount owing to Klam Wholesalers, Check No Payment fell within discount period.

Sold Chocolate Sprinkles to Quick Bolt Coffee for $ Invoice No

Made cash sales of $ during the first days of the month.

Purchased bags of medium Roast Arabica Coffee Beans with cash for $ each, Check No

After completing this practice set page, you should know how to record basic transactions in the journals

provided below and understand the posting process in the manual accounting system. Note that you will record

the remaining June transactions in the following sections of this practice set.

Remember, one purpose of using special journals is to make the posting process more efficient by posting the

total of most columns in the special journals after all of the transactions for the period have been recorded.

However, some parts of a journal entry are still required to be posted on a daily basis. View the company's

accounting policies and procedures for details of what is to be posted daily or monthly.

Instructions for week

Record all week transactions in the relevant journals.

Note that special journals must be used where applicable. Any transaction that cannot be recorded in a

special journal should be recorded in the general journal.

Post entries recorded in the journals to the appropriate ledger accounts according to the company's

accounting policies and procedures

Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end

of the month. You will do this before you prepare the Bank Reconciliation Statement.

Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not

a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash amount, subtract

the discount from the original amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock