Question: PLEASE HELP WITH LAST 2. Average tax rate and effective tax rate. In 2022, Madden, who is single, has adjusted gross income of $145,600, uses

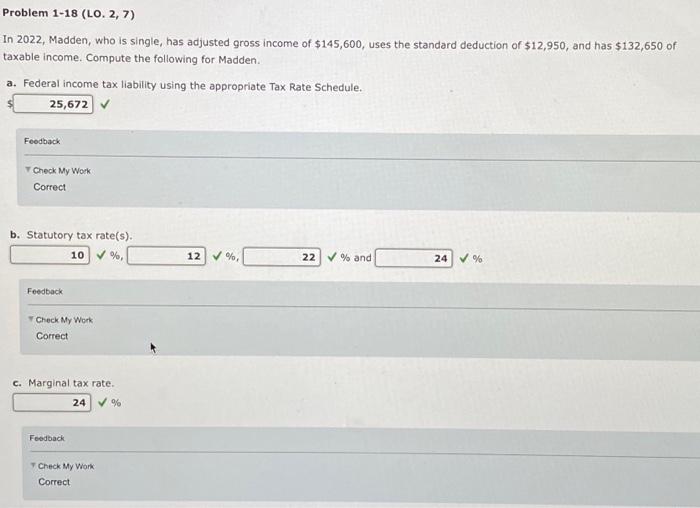

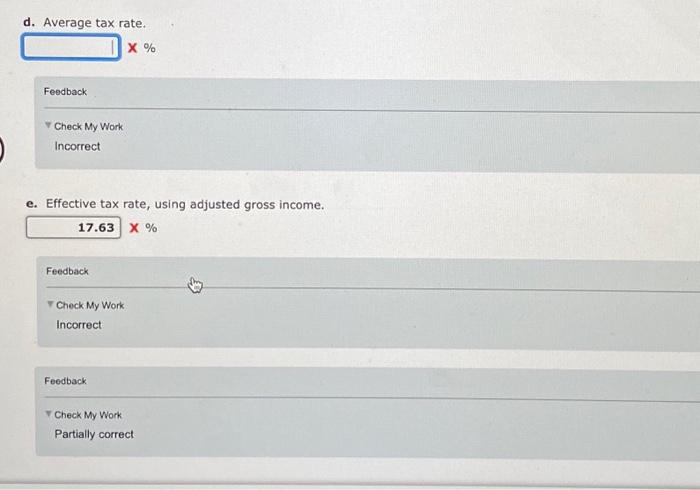

In 2022, Madden, who is single, has adjusted gross income of $145,600, uses the standard deduction of $12,950, and has $132,650 of taxable income. Compute the following for Madden. a. Federal income tax liability using the appropriate Tax Rate Schedule. Feodback T Check My Work Correct b. Statutory tax rate(s). d. Average tax rate. % Feedback Check My Work Incorrect e. Effective tax rate, using adjusted gross income. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts