Question: Please help with line 16. I've checked the 2022 tax table for a married filing jointly couple for $38,442 and it says it should be

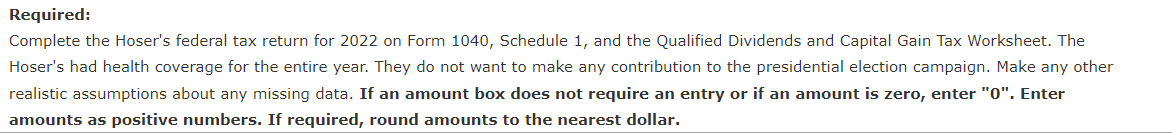

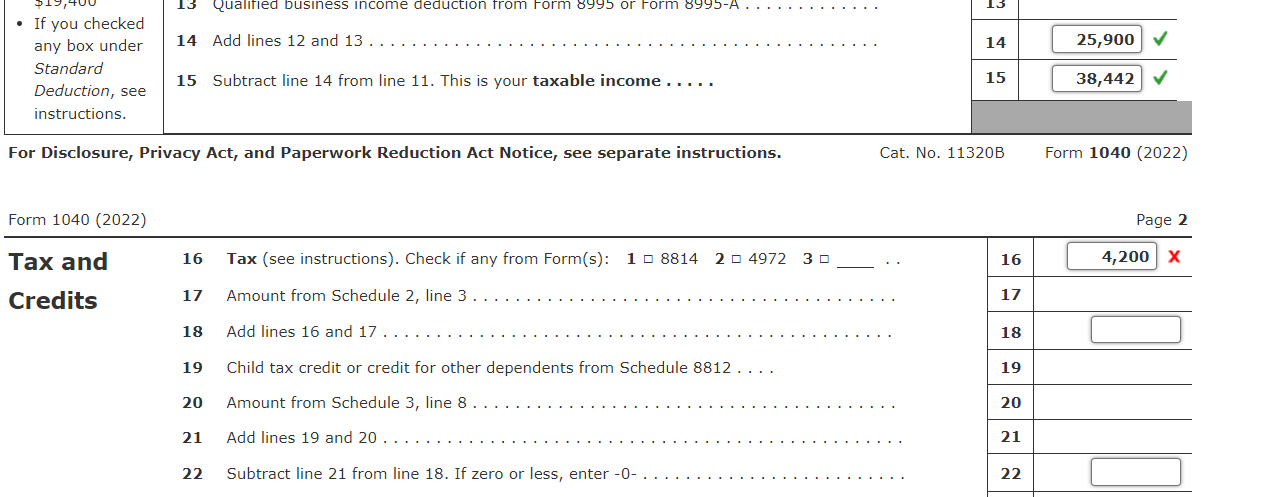

Please help with line 16. I've checked the 2022 tax table for a married filing jointly couple for $38,442 and it says it should be $4,200, but as you can see its incorrect. I'm not sure if I'm missing something or reading something wrong. Any help figuring it out would be appreciated! Thank you!

Please help with line 16. I've checked the 2022 tax table for a married filing jointly couple for $38,442 and it says it should be $4,200, but as you can see its incorrect. I'm not sure if I'm missing something or reading something wrong. Any help figuring it out would be appreciated! Thank you!

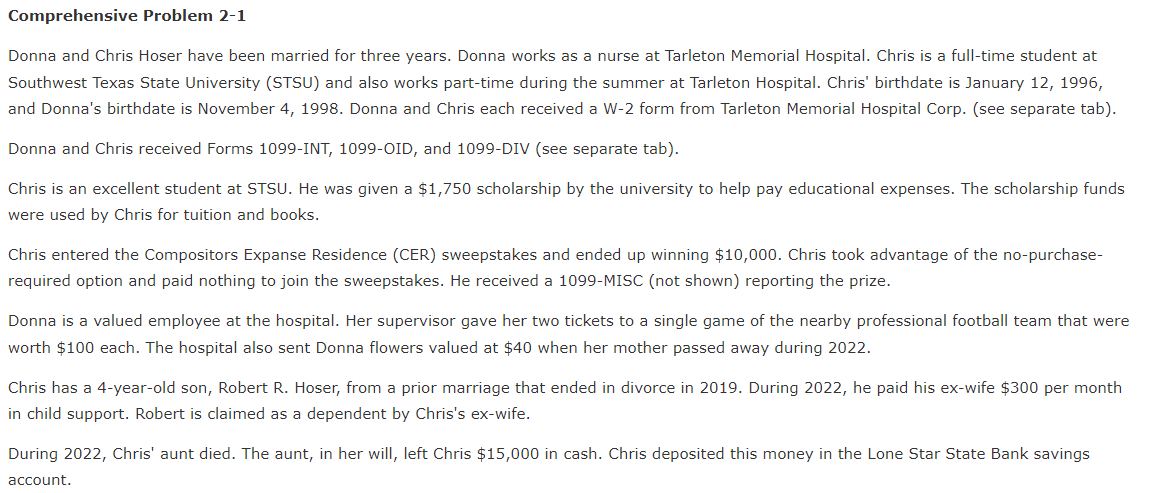

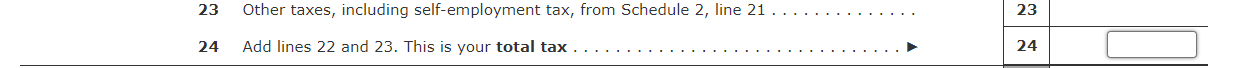

- If you checked any box under Standard Deduction, see instructions. 14 Add lines 12 and 13 15 Subtract line 14 from line 11 . This is your taxable income ..... For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040 (2022) Form 1040 (2022) Tax and Credits 16 Tax (see instructions). Check if any from Form(s): 18814249723 17 Amount from Schedule 2, line 3 18 Add lines 16 and 17. 19 Child tax credit or credit for other dependents from Schedule 8812 20 Amount from Schedule 3, line 8 21 Add lines 19 and 20 22 Subtract line 21 from line 18 . If zero or less, enter 0 Page 2 \begin{tabular}{|l|l} \hline 16 & 4,200 \\ \hline 17 & \\ \hline 18 & \\ \hline 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline \end{tabular} 23 Other taxes, including self-employment tax, from Schedule 2 , line 21 24 Add lines 22 and 23. This is your total tax \begin{tabular}{|l|l|} \hline 23 & \\ \hline 24 & \\ \hline \end{tabular} Required: Complete the Hoser's federal tax return for 2022 on Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet. The Hoser's had health coverage for the entire year. They do not want to make any contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or if an amount is zero, enter "0". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Comprehensive Problem 2-1 Donna and Chris Hoser have been married for three years. Donna works as a nurse at Tarleton Memorial Hospital. Chris is a full-time student at Southwest Texas State University (STSU) and also works part-time during the summer at Tarleton Hospital. Chris' birthdate is January 12, 1996, and Donna's birthdate is November 4, 1998. Donna and Chris each received a W-2 form from Tarleton Memorial Hospital Corp. (see separate tab). Donna and Chris received Forms 1099-INT, 1099-OID, and 1099-DIV (see separate tab). Chris is an excellent student at STSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Chris for tuition and books. Chris entered the Compositors Expanse Residence (CER) sweepstakes and ended up winning $10,000. Chris took advantage of the no-purchaserequired option and paid nothing to join the sweepstakes. He received a 1099-MISC (not shown) reporting the prize. Donna is a valued employee at the hospital. Her supervisor gave her two tickets to a single game of the nearby professional football team that were worth $100 each. The hospital also sent Donna flowers valued at \$40 when her mother passed away during 2022. Chris has a 4-year-old son, Robert R. Hoser, from a prior marriage that ended in divorce in 2019. During 2022, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Chris's ex-wife. During 2022, Chris' aunt died. The aunt, in her will, left Chris $15,000 in cash. Chris deposited this money in the Lone Star State Bank savings account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts