Question: Please help with multiple choice questions. Financial economics Question 1 . If all agents are mean - variance optimizers and have the same information but

Please help with multiple choice questions. Financial economics

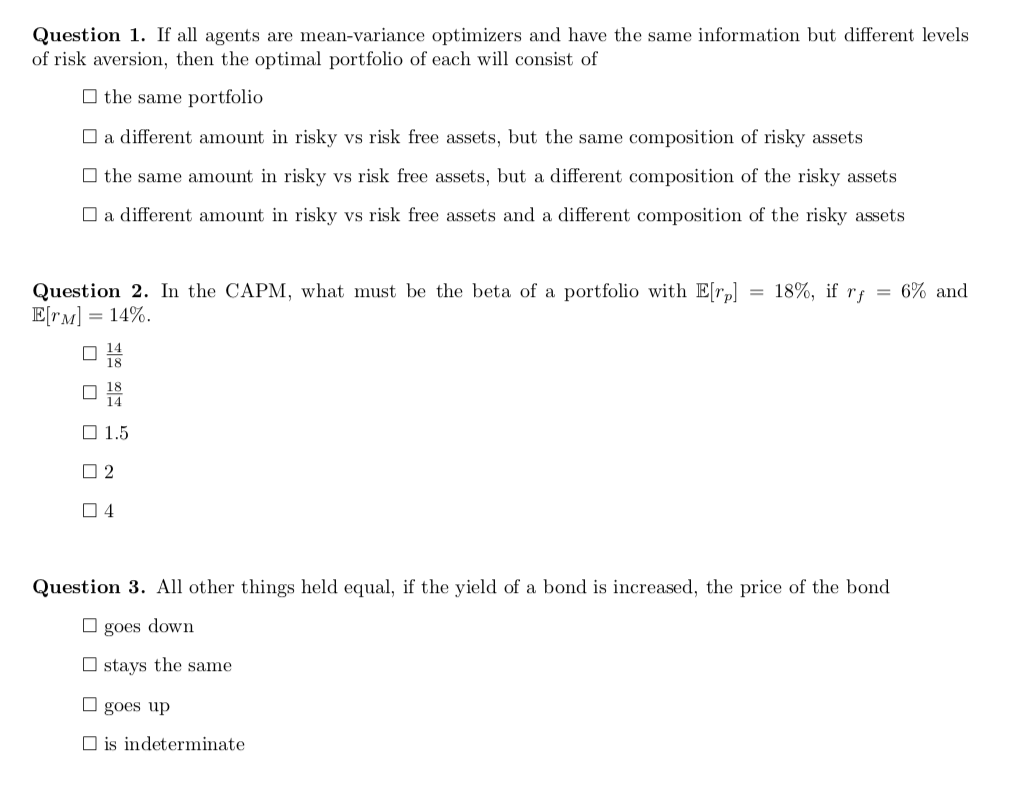

Question 1 . If all agents are mean - variance optimizers and have the same information but different levels* of risk aversion , then the optimal portfolio of each will consist of* I the same portfolio D a different amount in risky vs risk free assets , but the same composition of risky assets I the same amount in risky vs risk free assets , but a different composition of the risky assets D a different amount in risky vs risk free assets and a different composition of the risky assets Question 2 . In the CAPNI , what must be the beta of a portfolio with {|r) = 18% , if ry = 6% and Firm! = 14%. 14 Q 1 . 5 Q 2 2 4 Question 3 . All other things held equal , if the yield of a bond is increased , the price of the bond I goes down D stays the same* D goes up I is indeterminate*

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts