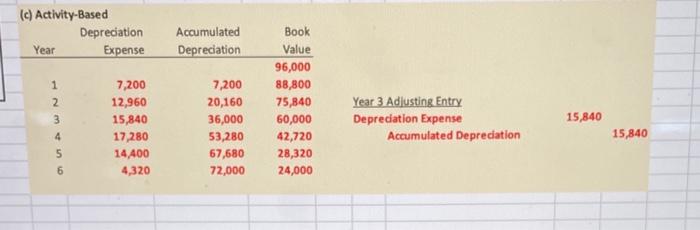

Question: Please help with new information (c) Activity-Based Depreciation Year Expense Accumulated Depreciation 1 2 3 4 7,200 12,960 15,840 17,280 14.400 4,320 Book Value 96,000

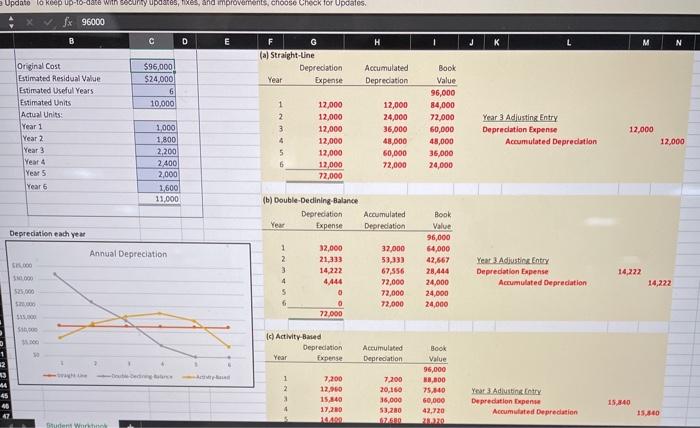

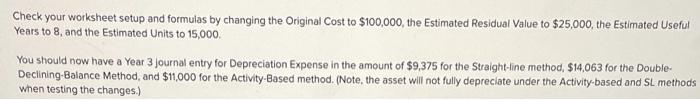

(c) Activity-Based Depreciation Year Expense Accumulated Depreciation 1 2 3 4 7,200 12,960 15,840 17,280 14.400 4,320 Book Value 96,000 88,800 75,840 60,000 42,720 28,320 24,000 7,200 20,160 36,000 53,280 67,680 72,000 15,840 Year 3 Adlusting Entry Depreciation Expense Accumulated Depreciation 15,840 Update to keep up-to-date with security updates, mixes, and improvements, choose Check for Updates. fx 96000 D E H M F G (a) Straight-Line Deprecation Year Expense $96,000 $24.000 6 10,000 Accumulated Depreciation Original Cost Estimated Residual Value Estimated Useful Years Estimated Units Actual Units: Year 1 Year 2 Year 3 Year 4 Years Year 6 1 2 3 4 5 6 1000 Book Value 96,000 84,000 72,000 60,000 43,000 36,000 24,000 12,000 12,000 12,000 12,000 12,000 12,000 72,000 12.000 24,000 36,000 48,000 60,000 72,000 12,000 Year 3 Adiusting Entry Depreciation Expense Accumulated Depreciation 1,800 2,200 2.400 2,000 1,500 11,000 12.000 (b) Double-Dedining-Balance Depreciation Accumulated Year Expense Depreciation Depreciation each year Annual Depreciation 1 2 3 4 5 6 32,000 21,333 14.222 4444 6 0 22.000 37,000 53,33) 67,556 72,000 72,000 72,000 Book Value 96,000 64,000 42,667 28,444 24,000 24,000 24,000 Year 3 Adiustine Entry Deprecation Expense Accumulated Depreciation 14,222 14,222 525.000 $ Sino c) Activity Based Depreciation Year Expense Book Accumulated Depredation 1 12 13 Valve 1 2 3 7,200 12.060 15,840 17,280 45 96,000 H3,000 75.140 60,000 42,720 7,200 20,160 36,000 53,280 17. Year 3 Adiutint Deprecation Expense Accumulated Deprecation 15,840 47 15.840 Student Wur Check your worksheet setup and formulas by changing the Original Cost to $100,000, the Estimated Residual Value to $25,000, the Estimated Useful Years to 8, and the Estimated Units to 15,000 You should now have a Year 3 journal entry for Depreciation Expense in the amount of $9,375 for the Straight-line method, $14,063 for the Double- Declining-Balance Method, and $11,000 for the Activity-Based method. (Note, the asset will not fully depreciate under the Activity based and SL methods when testing the changes.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts