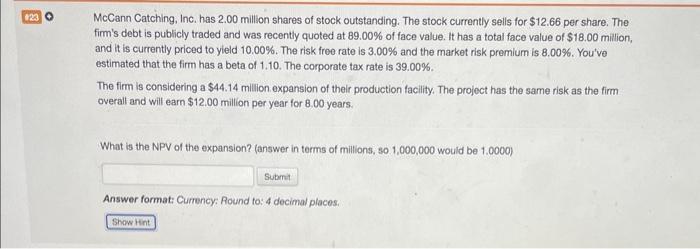

Question: please help with number 23 MeCann Catching, Inc. has 2.00 million shares of stock outstanding. The stock currently sells for $12.66 per share. The firm's

MeCann Catching, Inc. has 2.00 million shares of stock outstanding. The stock currently sells for $12.66 per share. The firm's debt is publicly traded and was recently quoted at 89.00% of face value. It has a total face value of $18.00million, and it is currently priced to yield 10.00%. The risk free rate is 3.00% and the market risk premium is 8.00%. You've estimated that the firm has a beta of 1.10. The corporate tax rate is 39.00%. The firm is considering a $44.14 million. expansion of their production facility. The project has the same risk as the firm overall and will earn $12.00 million per year for 8.00 years. What is the NPV of the expansion? (answer in terms of millions, so 1,000,000 would be 1.0000) Answer format: Currency: Round to: 4 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts