Question: please help with number 8 but only in excel CHAPTER 2 The Time Value of Money 47 5. (PV single cash flow) Your friend comes

please help with number 8 but only in excel

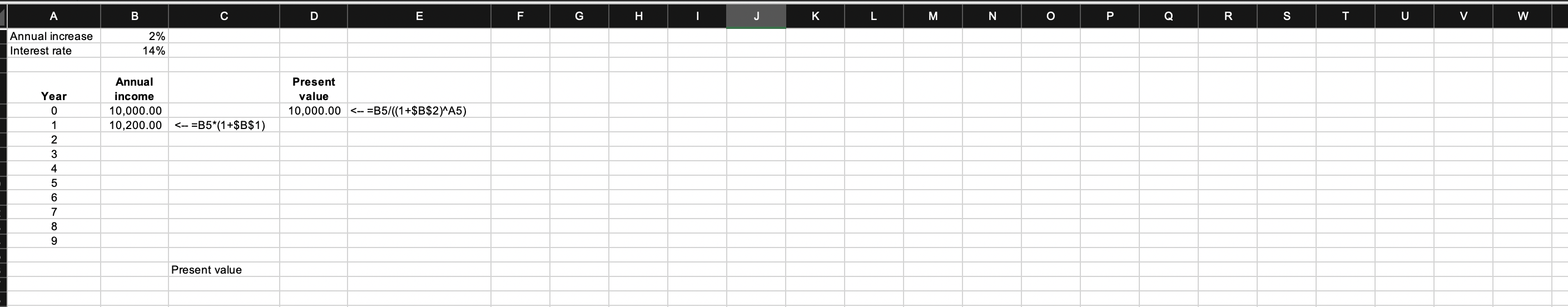

CHAPTER 2 The Time Value of Money 47 5. (PV single cash flow) Your friend comes to you with a $2,000 post-dated check. The check is due 2 years from today. If the interest rate is 5%, what is the value of the check today? 6. (PV single cash flow, finding r) If you deposit $25,000 today, Union Bank offers to pay you $50,000 at the end of 10 years. What is the annual interest rate offered by the bank? 7. (PV annuity) Your uncle has just announced that he's going to give you $10,000 per year at the end of each of the next 4 years. If the relevant interest rate is 7%, what's the value today of this promise? 8. (PV growing annuity) "Starving artists" is an organization that supports painters by giving them a guaranteed annual income. Majd has been prom- ised an annual payment from Starving Artists. The 10 payments start today ($10,000) and increase by 2% per year. Assume that the interest rate is 14%. What is the value today of the Starving Artist grant? 9. (Annuity, calculating r) Screw-'Em-Good Corp. (SEG) has just announced a revolutionary security. If you pay SEG $1,000 now, you will get back $150 at the end of each of the next 15 years. What is the internal rate of return (IRR) of this investment? 10. (FV single cash flow, two interest rates) You have just received a $15,000 signing bonus from your new employer and decide to invest it for 2 years. Your banker suggests two alternatives, both of which require a commitment for the full 2 years. The first alternative will earn 8% per year for both years. The second alternative earns 6% for the first year and 10% for the second year. Interest compounds annually. Which alternative should you choose? 11. (FV of annuity) In the spreadsheet, below we calculate the future value of 5 deposits of $100, with the first deposit made at time 0. As shown in Section 2.1, this calculation can also be made using the Excel function =FV(interest,periods,-amount,, 1). a. Show that you can also compute this by EFV(interest,periods, -amount)*(1+interest). b. Can you explain why FV(1,5,-100,,1)=FV(1,5,-100)*(1+r)? TCTDT FUTURE VALUE 6% Account balance Deposit at Interest Total in G H I J K L M N O P Q R S A BC Annual increase 2% Interest rate 14% Year Annual income 10,000.00 10,200.00 Present value 10,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts