Question: ***Please help with only items that are incorrect (marked with x's). Thank you! 2. Shamberly Corp is contemplating making a charitable contribution that would be

***Please help with only items that are incorrect (marked with x's). Thank you!

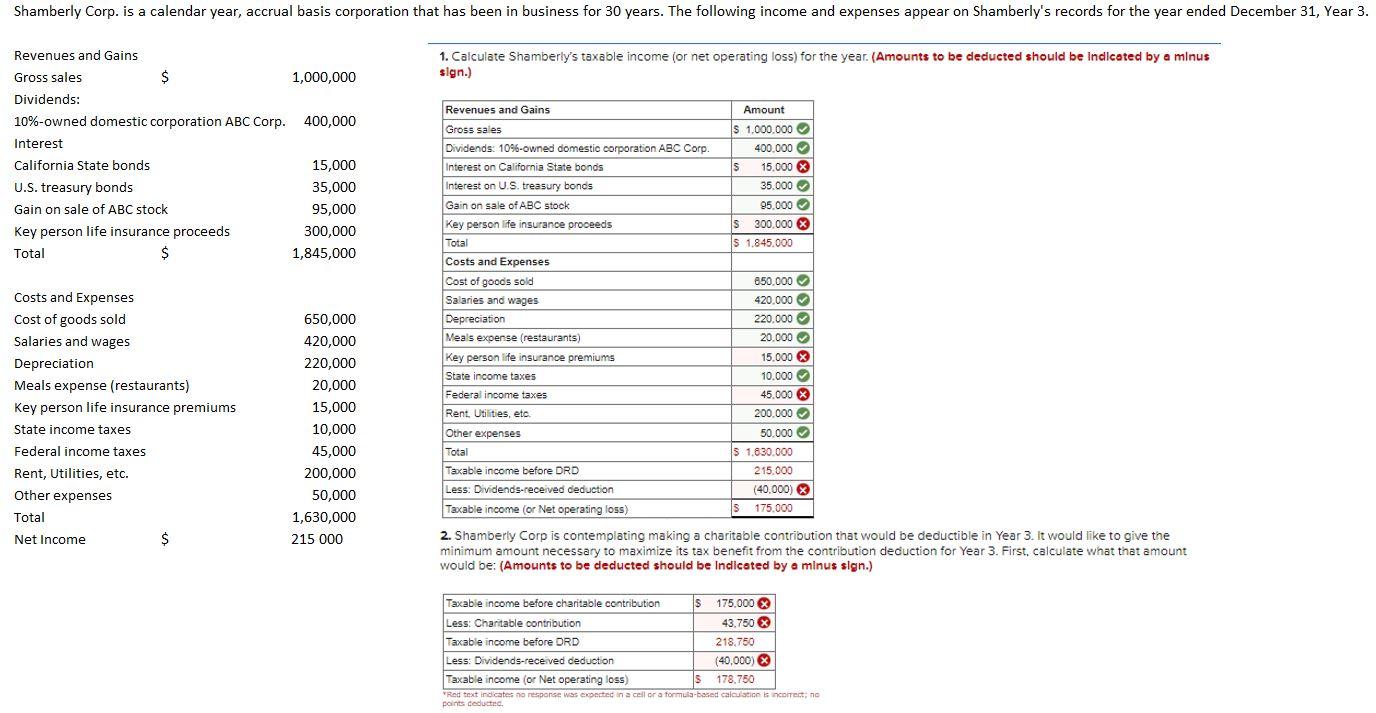

2. Shamberly Corp is contemplating making a charitable contribution that would be deductible in Year 3 . It would like to give the minimum amount necessary to maximize its tax benefit from the contribution deduction for Year 3 . First, calculate what that amount Would be: (Amounts to be deducted should be Indicated by a minus slgn.) 2. Shamberly Corp is contemplating making a charitable contribution that would be deductible in Year 3 . It would like to give the minimum amount necessary to maximize its tax benefit from the contribution deduction for Year 3 . First, calculate what that amount Would be: (Amounts to be deducted should be Indicated by a minus slgn.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts