Question: Please help with ONLY question b) (1) and (2). THANKS! After the books have been closed, the ledger of Kenton Corporation at December 31, 2024,

Please help with ONLY question b) (1) and (2). THANKS!

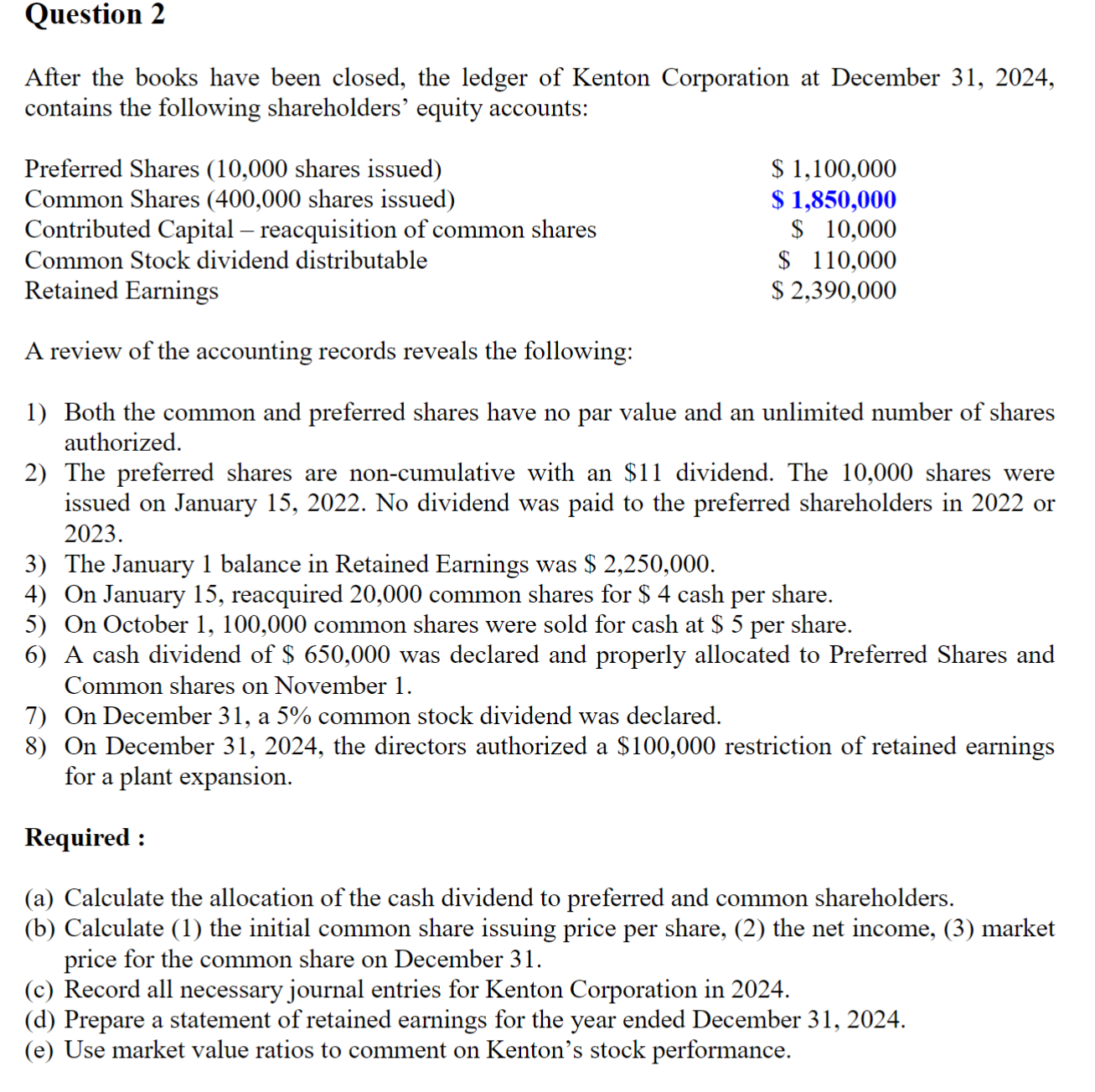

After the books have been closed, the ledger of Kenton Corporation at December 31, 2024, contains the following shareholders' equity accounts: A review of the accounting records reveals the following: 1) Both the common and preferred shares have no par value and an unlimited number of shares authorized. 2) The preferred shares are non-cumulative with an $11 dividend. The 10,000 shares were issued on January 15, 2022. No dividend was paid to the preferred shareholders in 2022 or 2023. 3) The January 1 balance in Retained Earnings was $2,250,000. 4) On January 15 , reacquired 20,000 common shares for $4 cash per share. 5) On October 1,100,000 common shares were sold for cash at $5 per share. 6) A cash dividend of $650,000 was declared and properly allocated to Preferred Shares and Common shares on November 1. 7) On December 31, a 5% common stock dividend was declared. 8) On December 31, 2024, the directors authorized a $100,000 restriction of retained earnings for a plant expansion. Required : (a) Calculate the allocation of the cash dividend to preferred and common shareholders. (b) Calculate (1) the initial common share issuing price per share, (2) the net income, (3) market price for the common share on December 31. (c) Record all necessary journal entries for Kenton Corporation in 2024. (d) Prepare a statement of retained earnings for the year ended December 31, 2024. (e) Use market value ratios to comment on Kenton's stock performance. After the books have been closed, the ledger of Kenton Corporation at December 31, 2024, contains the following shareholders' equity accounts: A review of the accounting records reveals the following: 1) Both the common and preferred shares have no par value and an unlimited number of shares authorized. 2) The preferred shares are non-cumulative with an $11 dividend. The 10,000 shares were issued on January 15, 2022. No dividend was paid to the preferred shareholders in 2022 or 2023. 3) The January 1 balance in Retained Earnings was $2,250,000. 4) On January 15 , reacquired 20,000 common shares for $4 cash per share. 5) On October 1,100,000 common shares were sold for cash at $5 per share. 6) A cash dividend of $650,000 was declared and properly allocated to Preferred Shares and Common shares on November 1. 7) On December 31, a 5% common stock dividend was declared. 8) On December 31, 2024, the directors authorized a $100,000 restriction of retained earnings for a plant expansion. Required : (a) Calculate the allocation of the cash dividend to preferred and common shareholders. (b) Calculate (1) the initial common share issuing price per share, (2) the net income, (3) market price for the common share on December 31. (c) Record all necessary journal entries for Kenton Corporation in 2024. (d) Prepare a statement of retained earnings for the year ended December 31, 2024. (e) Use market value ratios to comment on Kenton's stock performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts