Question: Please help with part 2! Thank you :) 2 Power Corporation acquired 100 percent ownership of Scrub Company on February 12, 20X9. At the date

Please help with part 2! Thank you :)

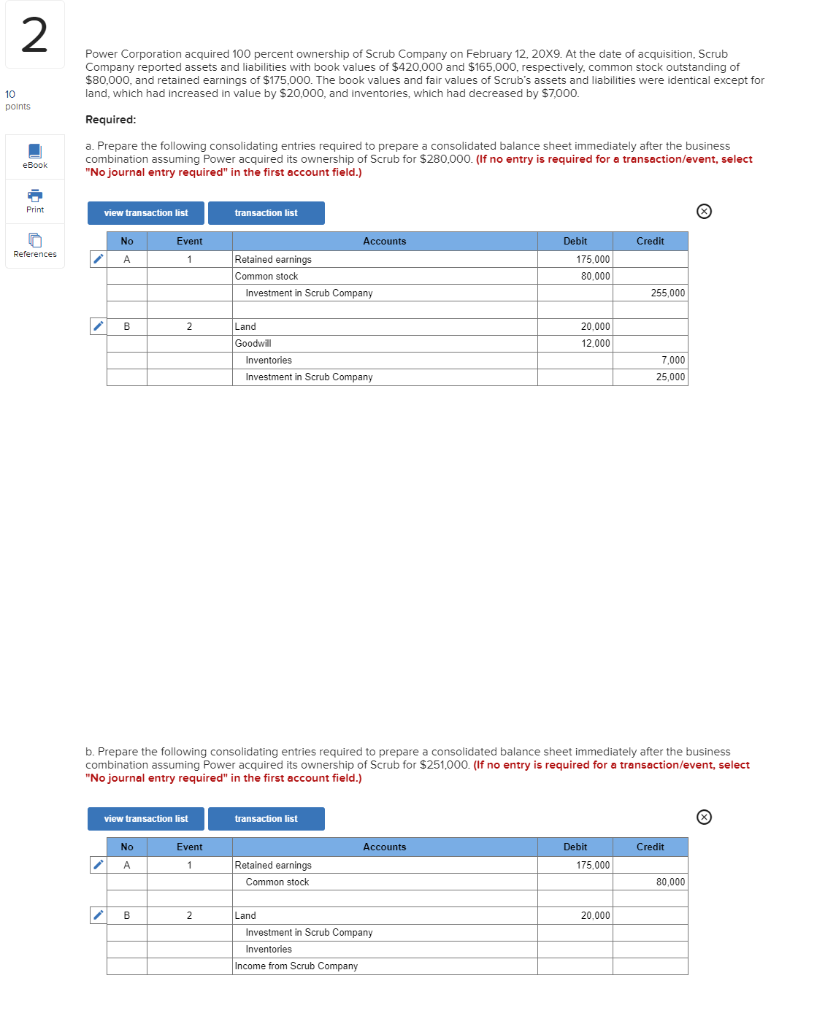

2 Power Corporation acquired 100 percent ownership of Scrub Company on February 12, 20X9. At the date of acquisition, Scrub Company reported assets and liabilities with book values of $420,000 and $165,000, respectively, common stock outstanding of $80,000, and retained earnings of $175,000. The book values and fair values of Scrub's assets and liabilities were identical except for land, which had increased in value by $20,000, and inventories, which had decreased by $7,000. Required: a. Prepare the following consolidating entries required to prepare a consolidated balance sheet immediately after the business combination assuming Power acquired its ownership of Scrub for $280,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 10 points eBook Print References view transaction list I No A B Event 1 No A 2 view transaction list B Event 1 transaction list 2 Retained earnings Common stock Investment in Scrub Company Land Goodwill Inventories Investment in Scrub Company Accounts transaction list Retained earnings Common stock b. Prepare the following consolidating entries required to prepare a consolidated balance sheet immediately after the business combination assuming Power acquired its ownership of Scrub for $251,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Land Accounts Debit Investment in Scrub Company Inventories Income from Scrub Company 175,000 80,000 20,000 12,000 Debit 175.000 Credit 20,000 255,000 7,000 25,000 Credit X 80,000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts