Question: Please help with part A and B. Eliminating Entries, Goodwill Polaris Company acquires all of the stock of SSC, Inc. for $140 million in cash.

Please help with part A and B.

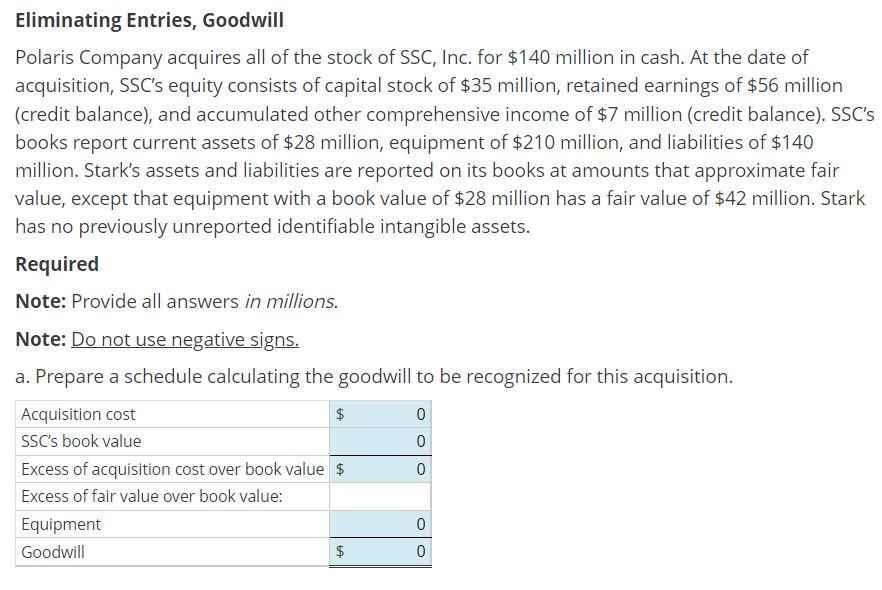

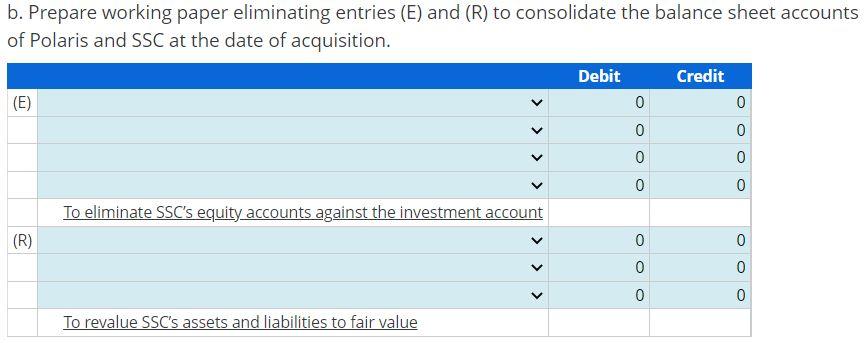

Eliminating Entries, Goodwill Polaris Company acquires all of the stock of SSC, Inc. for $140 million in cash. At the date of acquisition, SSC's equity consists of capital stock of $35 million, retained earnings of $56 million (credit balance), and accumulated other comprehensive income of $7 million (credit balance). SSC's books report current assets of $28 million, equipment of $210 million, and liabilities of $140 million. Stark's assets and liabilities are reported on its books at amounts that approximate fair value, except that equipment with a book value of $28 million has a fair value of $42 million. Stark has no previously unreported identifiable intangible assets. b. Prepare working paper eliminating entries (E) and (R) to consolidate the balance sheet accounts of Polaris and SSC at the date of acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts