Question: Please help with part A, B and C Our company has the following capital structure, and a 33% Effective Tax Rate. Suppose that the risk-free

Please help with part A, B and C

Please help with part A, B and C

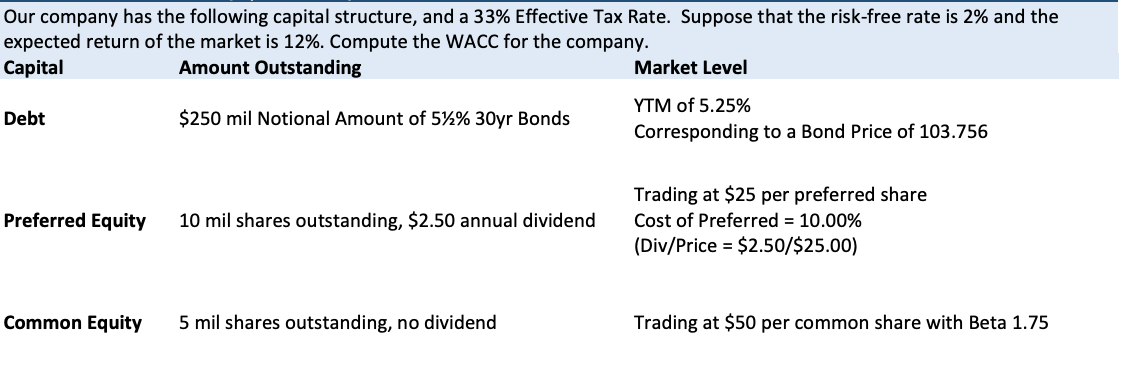

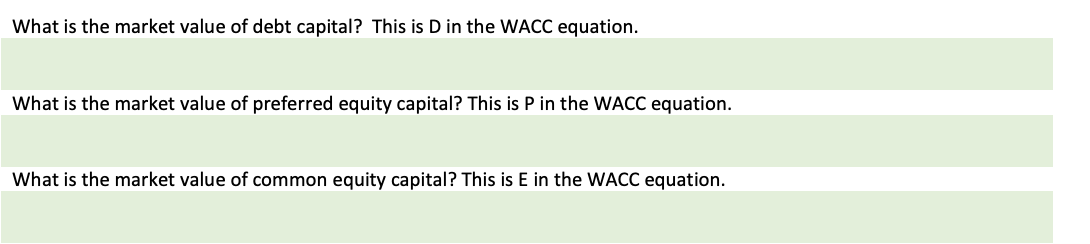

Our company has the following capital structure, and a 33% Effective Tax Rate. Suppose that the risk-free rate is 2% and the expected return of the market is 12%. Compute the WACC for the company. Capital Amount Outstanding Market Level YTM of 5.25% Debt $250 mil Notional Amount of 57% 30yr Bonds Corresponding to a Bond Price of 103.756 Preferred Equity 10 mil shares outstanding, $2.50 annual dividend Trading at $25 per preferred share Cost of Preferred = 10.00% (Div/Price = $2.50/$25.00) Common Equity 5 mil shares outstanding, no dividend Trading at $50 per common share with Beta 1.75 What is the market value of debt capital? This is D in the WACC equation. What is the market value of preferred equity capital? This is P in the WACC equation. What is the market value of common equity capital? This is E in the WACC equation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts