Question: Please help with part a), c), and d). Thanks! James Liu had loved photography ever since he received his first camera as a gift from

Please help with part a), c), and d). Thanks!

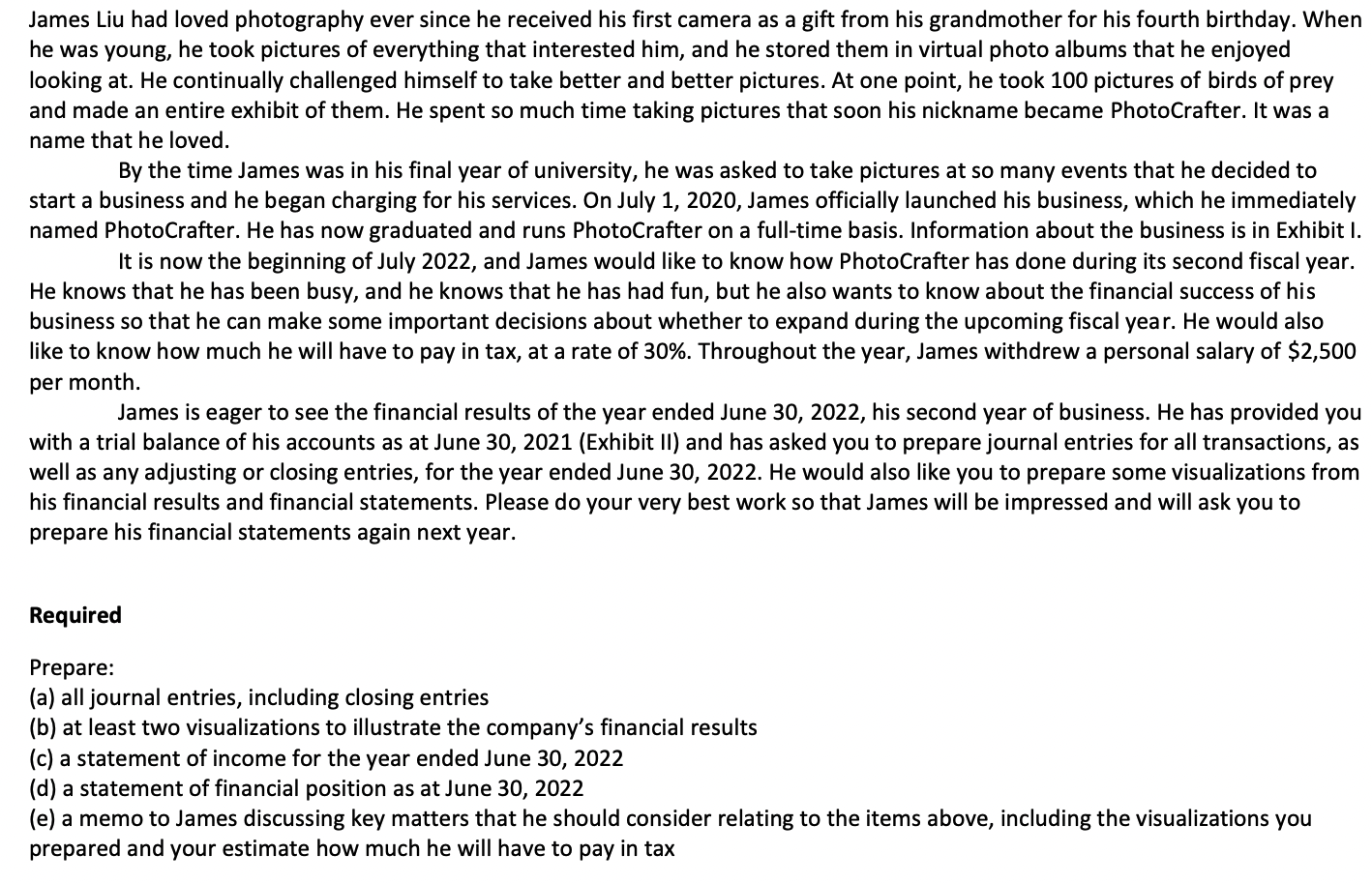

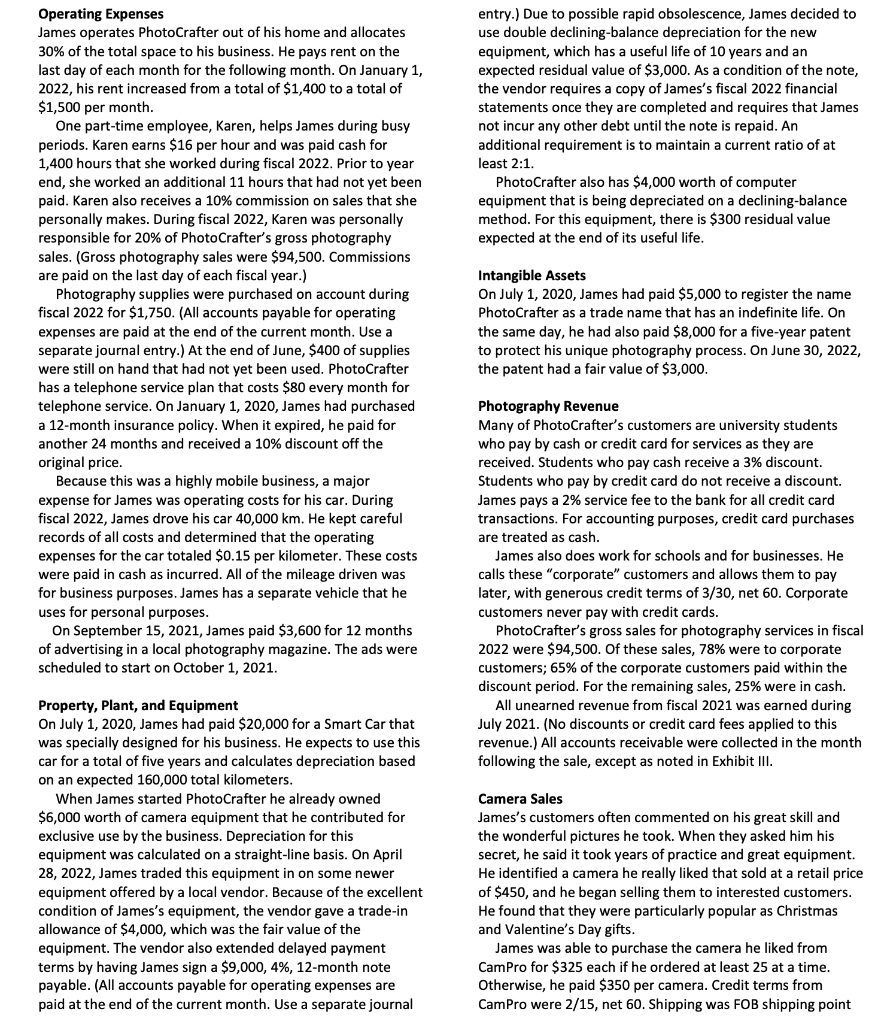

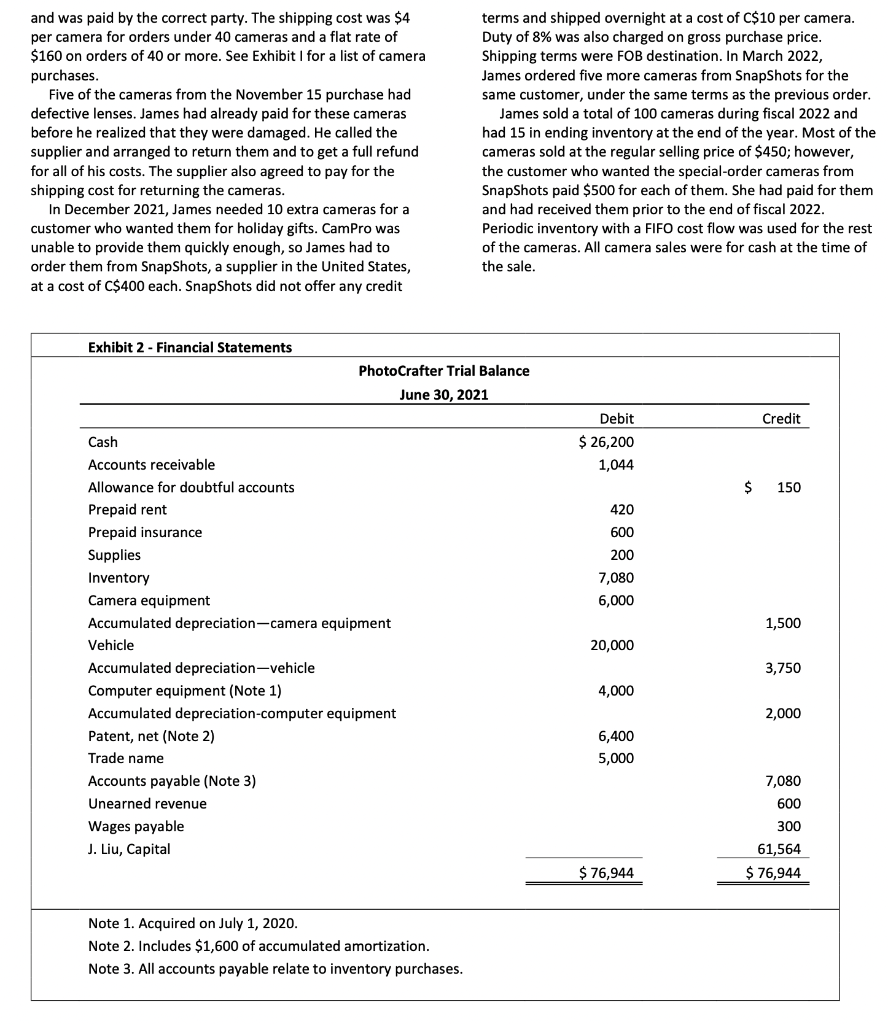

James Liu had loved photography ever since he received his first camera as a gift from his grandmother for his fourth birthday. When he was young, he took pictures of everything that interested him, and he stored them in virtual photo albums that he enjoyed looking at. He continually challenged himself to take better and better pictures. At one point, he took 100 pictures of birds of prey and made an entire exhibit of them. He spent so much time taking pictures that soon his nickname became PhotoCrafter. It was a name that he loved. By the time James was in his final year of university, he was asked to take pictures at so many events that he decided to start a business and he began charging for his services. On July 1, 2020, James officially launched his business, which he immediately named PhotoCrafter. He has now graduated and runs PhotoCrafter on a full-time basis. Information about the business is in Exhibit I. It is now the beginning of July 2022, and James would like to know how PhotoCrafter has done during its second fiscal year. He knows that he has been busy, and he knows that he has had fun, but he also wants to know about the financial success of his business so that he can make some important decisions about whether to expand during the upcoming fiscal year. He would also like to know how much he will have to pay in tax, at a rate of 30%. Throughout the year, James withdrew a personal salary of $2,500 per month. James is eager to see the financial results of the year ended June 30, 2022, his second year of business. He has provided you with a trial balance of his accounts as at June 30, 2021 (Exhibit II) and has asked you to prepare journal entries for all transactions, as well as any adjusting or closing entries, for the year ended June 30, 2022. He would also like you to prepare some visualizations from his financial results and financial statements. Please do your very best work so that James will be impressed and will ask you to prepare his financial statements again next year. Required Prepare: (a) all journal entries, including closing entries (b) at least two visualizations to illustrate the company's financial results (c) a statement of income for the year ended June 30, 2022 (d) a statement of financial position as at June 30,2022 (e) a memo to James discussing key matters that he should consider relating to the items above, including the visualizations you prepared and your estimate how much he will have to pay in tax andwaspaidbythecorrectparty.Theshippingcostwas$4percameraforordersunder40camerasandaflatrateof$160onordersof40ormore.SeeExhibitIforalistofcamerapurchases.FiveofthecamerasfromtheNovember15purchasehaddefectivelenses.Jameshadalreadypaidforthesecamerasbeforeherealizedthattheyweredamaged.Hecalledthesupplierandarrangedtoreturnthemandtogetafullrefundforallofhiscosts.Thesupplieralsoagreedtopayfortheshippingcostforreturningthecameras.InDecember2021,Jamesneeded10extracamerasforacustomerwhowantedthemforholidaygifts.CamProwasunabletoprovidethemquicklyenough,soJameshadtoorderthemfromSnapShots,asupplierintheUnitedStates,atacostofC$400each.SnapShotsdidnotofferanycredittermsandshippedovernightatacostofC$10percamera.Dutyof8%wasalsochargedongrosspurchaseprice.ShippingtermswereFOBdestination.InMarch2022,JamesorderedfivemorecamerasfromSnapShotsforthesamecustomer,underthesametermsasthepreviousorder.Jamessoldatotalof100camerasduringfiscal2022andhad15inendinginventoryattheendoftheyear.Mostofthecamerassoldattheregularsellingpriceof$450;however,thecustomerwhowantedthespecial-ordercamerasfromSnapShotspaid$500foreachofthem.Shehadpaidforthemandhadreceivedthempriortotheendoffiscal2022.PeriodicinventorywithaFIFOcostflowwasusedfortherestofthecameras.Allcamerasaleswereforcashatthetimeofthesale. August 1, 2021 James received a cheque in the mail from a business whose account had been written-off in January 2020 . The cheque was for 30% of the $4,000 that had been written-off. September 5,2021 The London High School called to complain that some of the pictures James had taken for a school function were not the right type. The school had already paid its bill, so James sent them a $200 refund. December 12, 2021 Stanley Company declared bankruptcy, and James decided to write off its outstanding balance of \$1,700. February 10, 2022 The Business Company, a corporate customer, called to ask that their \$2,000 outstanding account be converted to a note. James agreed to convert the account receivable to a 12%, three-month note receivable. The note was paid in full on May 9, 2022. March 9, 2022 Sterling Corporation called to ask James if he would be available to take pictures at a family fun day they were planning for August 2022. James agreed to take the pictures and told Sterling the cost would be $1,500. Sterling gave James a deposit of $500 and will pay the balance when the services are performed. This $500 was not included in the gross sales figure for the year. March 9, 2022 At the end of the fiscal year, the balance in Accounts Receivable was $3,150. James believes that 4% of outstanding accounts receivable at the end of the year will not be collectible. James Liu had loved photography ever since he received his first camera as a gift from his grandmother for his fourth birthday. When he was young, he took pictures of everything that interested him, and he stored them in virtual photo albums that he enjoyed looking at. He continually challenged himself to take better and better pictures. At one point, he took 100 pictures of birds of prey and made an entire exhibit of them. He spent so much time taking pictures that soon his nickname became PhotoCrafter. It was a name that he loved. By the time James was in his final year of university, he was asked to take pictures at so many events that he decided to start a business and he began charging for his services. On July 1, 2020, James officially launched his business, which he immediately named PhotoCrafter. He has now graduated and runs PhotoCrafter on a full-time basis. Information about the business is in Exhibit I. It is now the beginning of July 2022, and James would like to know how PhotoCrafter has done during its second fiscal year. He knows that he has been busy, and he knows that he has had fun, but he also wants to know about the financial success of his business so that he can make some important decisions about whether to expand during the upcoming fiscal year. He would also like to know how much he will have to pay in tax, at a rate of 30%. Throughout the year, James withdrew a personal salary of $2,500 per month. James is eager to see the financial results of the year ended June 30, 2022, his second year of business. He has provided you with a trial balance of his accounts as at June 30, 2021 (Exhibit II) and has asked you to prepare journal entries for all transactions, as well as any adjusting or closing entries, for the year ended June 30, 2022. He would also like you to prepare some visualizations from his financial results and financial statements. Please do your very best work so that James will be impressed and will ask you to prepare his financial statements again next year. Required Prepare: (a) all journal entries, including closing entries (b) at least two visualizations to illustrate the company's financial results (c) a statement of income for the year ended June 30, 2022 (d) a statement of financial position as at June 30,2022 (e) a memo to James discussing key matters that he should consider relating to the items above, including the visualizations you prepared and your estimate how much he will have to pay in tax andwaspaidbythecorrectparty.Theshippingcostwas$4percameraforordersunder40camerasandaflatrateof$160onordersof40ormore.SeeExhibitIforalistofcamerapurchases.FiveofthecamerasfromtheNovember15purchasehaddefectivelenses.Jameshadalreadypaidforthesecamerasbeforeherealizedthattheyweredamaged.Hecalledthesupplierandarrangedtoreturnthemandtogetafullrefundforallofhiscosts.Thesupplieralsoagreedtopayfortheshippingcostforreturningthecameras.InDecember2021,Jamesneeded10extracamerasforacustomerwhowantedthemforholidaygifts.CamProwasunabletoprovidethemquicklyenough,soJameshadtoorderthemfromSnapShots,asupplierintheUnitedStates,atacostofC$400each.SnapShotsdidnotofferanycredittermsandshippedovernightatacostofC$10percamera.Dutyof8%wasalsochargedongrosspurchaseprice.ShippingtermswereFOBdestination.InMarch2022,JamesorderedfivemorecamerasfromSnapShotsforthesamecustomer,underthesametermsasthepreviousorder.Jamessoldatotalof100camerasduringfiscal2022andhad15inendinginventoryattheendoftheyear.Mostofthecamerassoldattheregularsellingpriceof$450;however,thecustomerwhowantedthespecial-ordercamerasfromSnapShotspaid$500foreachofthem.Shehadpaidforthemandhadreceivedthempriortotheendoffiscal2022.PeriodicinventorywithaFIFOcostflowwasusedfortherestofthecameras.Allcamerasaleswereforcashatthetimeofthesale. August 1, 2021 James received a cheque in the mail from a business whose account had been written-off in January 2020 . The cheque was for 30% of the $4,000 that had been written-off. September 5,2021 The London High School called to complain that some of the pictures James had taken for a school function were not the right type. The school had already paid its bill, so James sent them a $200 refund. December 12, 2021 Stanley Company declared bankruptcy, and James decided to write off its outstanding balance of \$1,700. February 10, 2022 The Business Company, a corporate customer, called to ask that their \$2,000 outstanding account be converted to a note. James agreed to convert the account receivable to a 12%, three-month note receivable. The note was paid in full on May 9, 2022. March 9, 2022 Sterling Corporation called to ask James if he would be available to take pictures at a family fun day they were planning for August 2022. James agreed to take the pictures and told Sterling the cost would be $1,500. Sterling gave James a deposit of $500 and will pay the balance when the services are performed. This $500 was not included in the gross sales figure for the year. March 9, 2022 At the end of the fiscal year, the balance in Accounts Receivable was $3,150. James believes that 4% of outstanding accounts receivable at the end of the year will not be collectible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts