Question: please help with part b! (b) Calculate the first year's net income under the cash basis of accounting. Net income under cash basis In its

please help with part b!

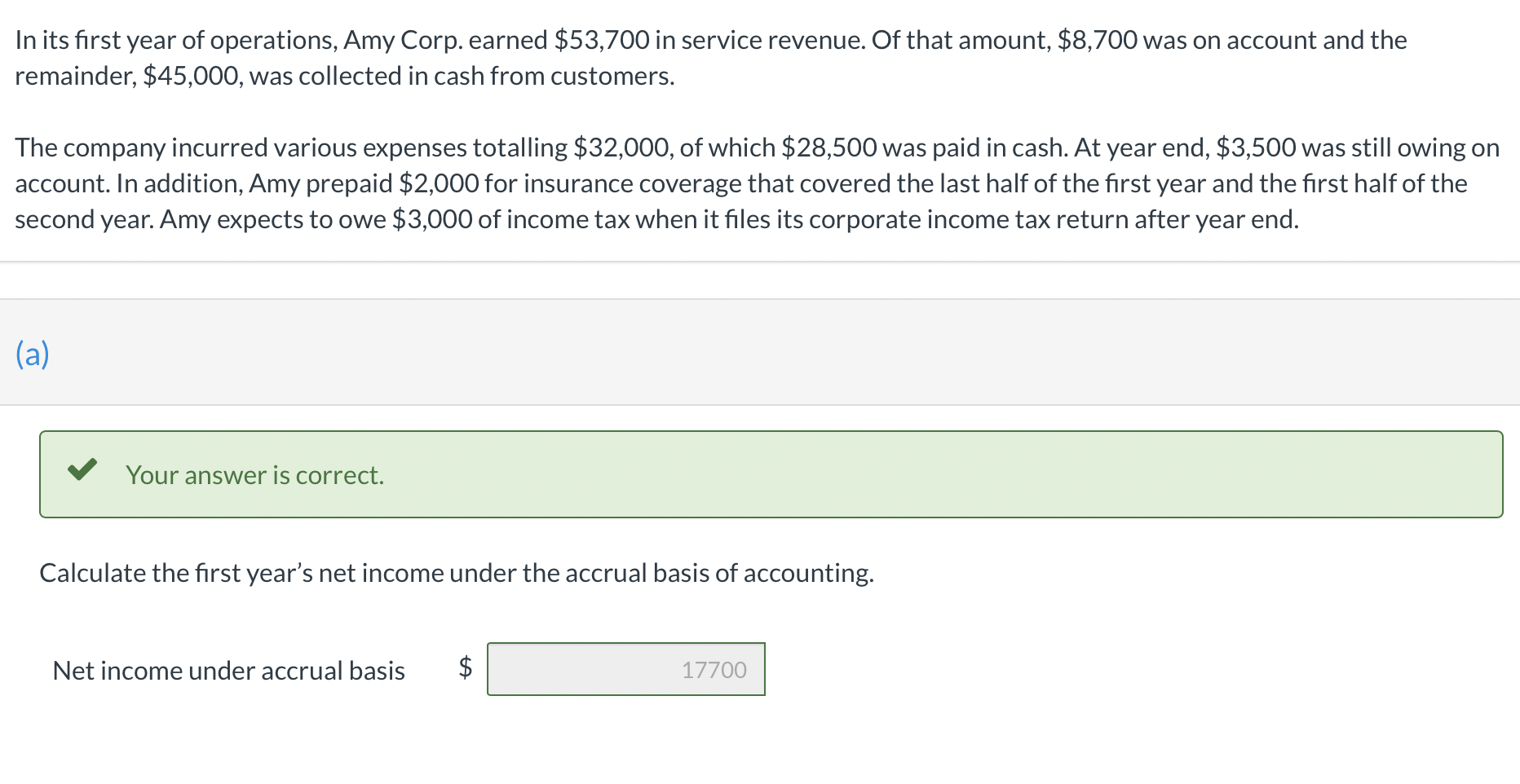

(b) Calculate the first year's net income under the cash basis of accounting. Net income under cash basis In its first year of operations, Amy Corp. earned $53,700 in service revenue. Of that amount, $8,700 was on account and the remainder, $45,000, was collected in cash from customers. The company incurred various expenses totalling $32,000, of which $28,500 was paid in cash. At year end, $3,500 was still owing on account. In addition, Amy prepaid $2,000 for insurance coverage that covered the last half of the first year and the first half of the second year. Amy expects to owe $3,000 of income tax when it files its corporate income tax return after year end. (a) Your answer is correct. Calculate the first year's net income under the accrual basis of accounting. Net income under accrual basis 17700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts