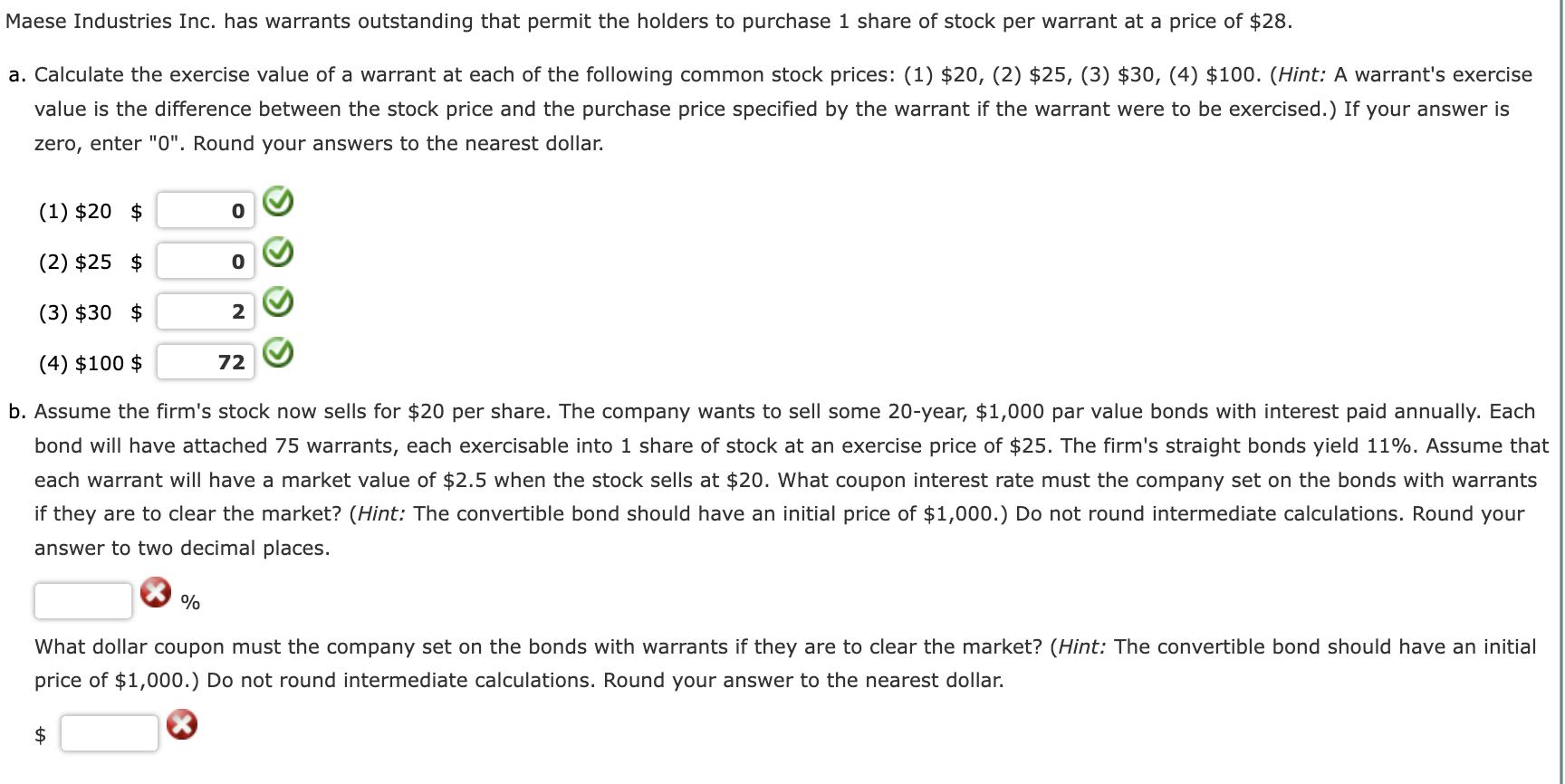

Question: Please help with part b . keep getting wrong answer. Thank you! b . Assume the firm's stock now sells for $ 2 0 per

Please help with part b keep getting wrong answer. Thank you!

b Assume the firm's stock now sells for $ per share. The company wants to sell some year, $ par value bonds with interest paid annually. Each

bond will have attached warrants, each exercisable into share of stock at an exercise price of $ The firm's straight bonds yield Assume that

each warrant will have a market value of $ when the stock sells at $ What coupon interest rate must the company set

if they are to clear the market? Hint: The convertible bond should have an initial price of $ Do not round intermediate calculations. Round your

answer to two decimal places.

What dollar coupon must the company set on the bonds with warrants if they are to clear the market? Hint: The convertible bond should have an initial

price of $ Do not round intermediate calculations. Round your answer to the nearest dollar.

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock