Question: Please help with part b only (need detail solution) , . I have added the solution for part a. 5. Anunderlying asset has a curent

Please help with part b only (need detail solution), . I have added the solution for part a.

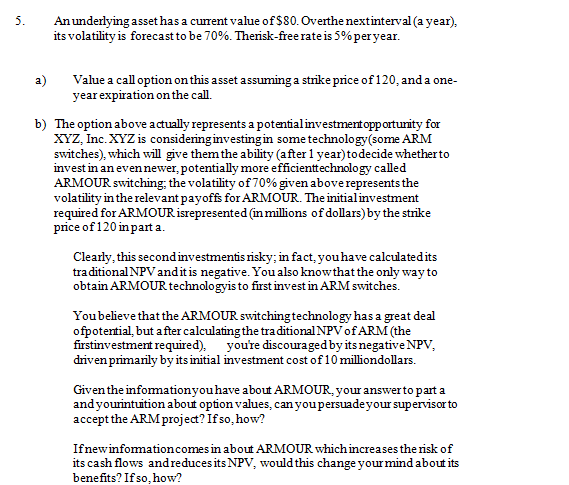

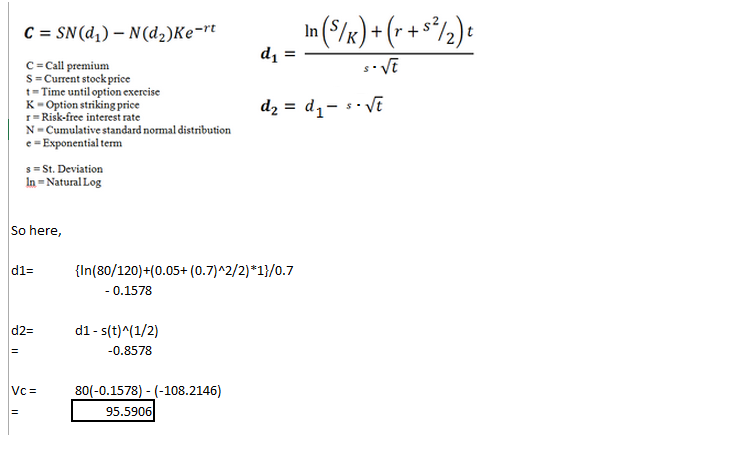

5. Anunderlying asset has a curent value of $80. Overthe nextinterval (a year), its volatility is forecast to be 70%. Then sk-free rate is 5% peryear. a) Value a call option on this asset assuming a strike price of 120, anda one year expiration on the call. b) The option above actually represents a potentialinvestmentopporturity for XYZ, Inc. XYZ is consideringinvestingin some technology(some ARM switches), which will give themthe ability (after 1 year) todecide whetherto invest in an evennewer, potentially more efficienttechnology called ARMOUR switching; the volatility of 70% given above represents the volatility in the relevant payoffs for ARMOUR. The initialinvestment required for ARMOURisrepresented (n millions of dollars)by the strike price of 120 inpart a Clearly, this secondinvestmentis risky; in fact, youhave calculatedits tra ditionalNPV andit is negative. You also knowthatthe only wayto obtain ARMOUR technologyis to first invest in ARM switches. Youbelieve that the ARMOUR switchingtechnology has a great deal ofpotential, but after calculating the tra ditionalNPVof ARM (the firstinvestment required), you're discouraged by its negativeNPV, driven primarily by its initial investment cost of 10 milliondollars. uhave about ARMOUR, your answer to part a Given the informationyo and yourintuition about option values, canyoupersuadeyour supervisor to accept the ARMproject? Ifso,how? Ifnewinfomationcomes in about ARMOUR whichincreases the risk of its cash flows andreduces itsNPV, would this change yourmind about its benefits? Ifso, how

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts