Question: please help with part C Cullumber Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 10.965 percent and

please help with part C

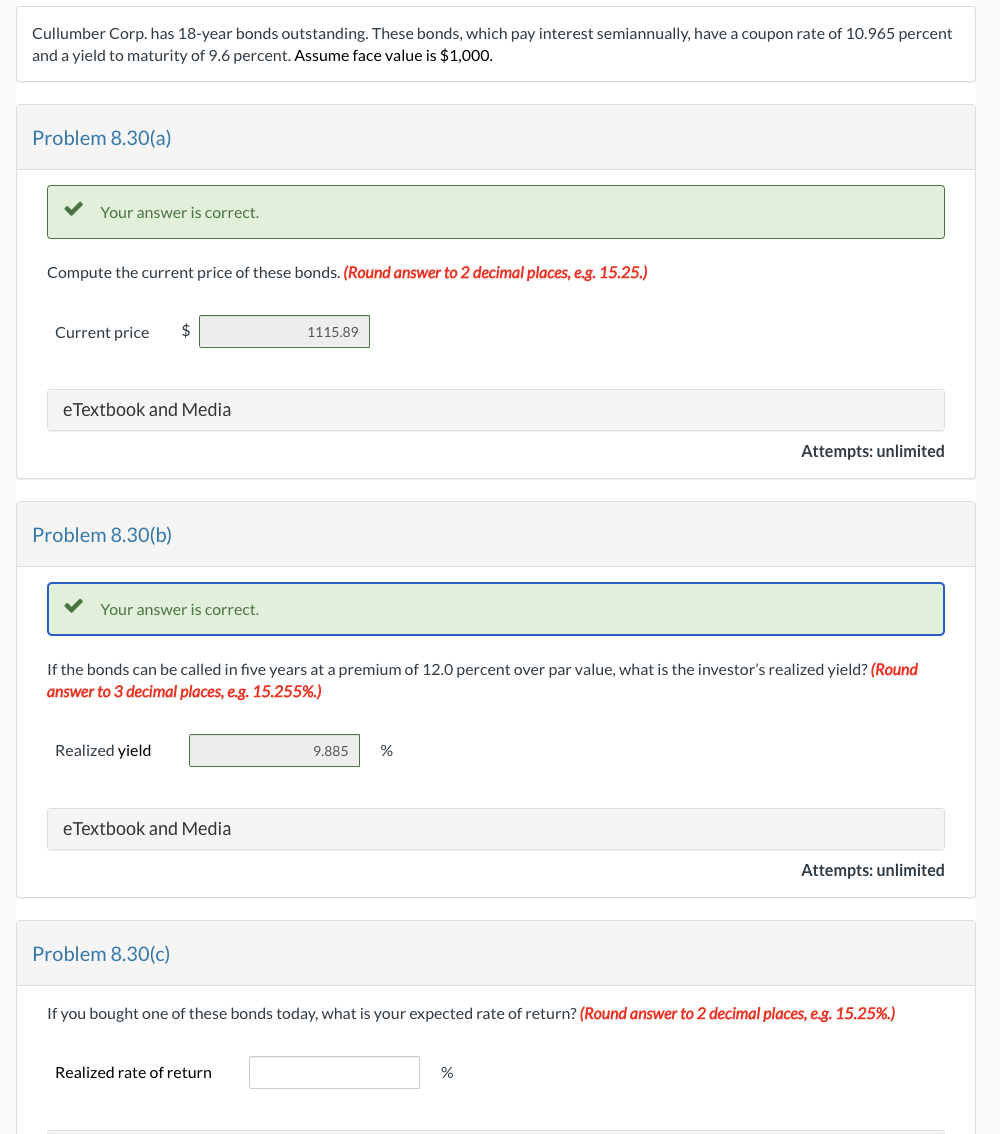

Cullumber Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 10.965 percent and a yield to maturity of 9.6 percent. Assume face value is $1,000. Problem 8.30(a) Your answer is correct. Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) Current price $ eTextbook and Media Attempts: unlimited Problem 8.30(b) If the bonds can be called in five years at a premium of 12.0 percent over par value, what is the investor's realized yield? (Round answer to 3 decimal places, e.g. 15.255\%.) Realized yield % Attempts: unlmted Problem 8.30(c) If you bought one of these bonds today, what is your expected rate of return? (Round answer to 2 decimal places, e.g. 15.25\%.) Realized rate of return %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts