Question: please help with part C Gary was driving back to the office from his off-site construction job on Friday. He had put in a long

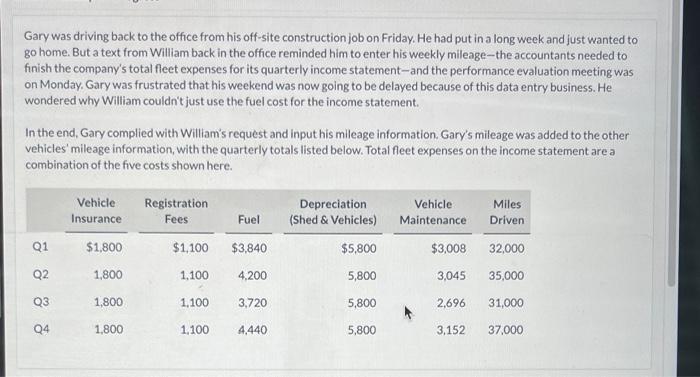

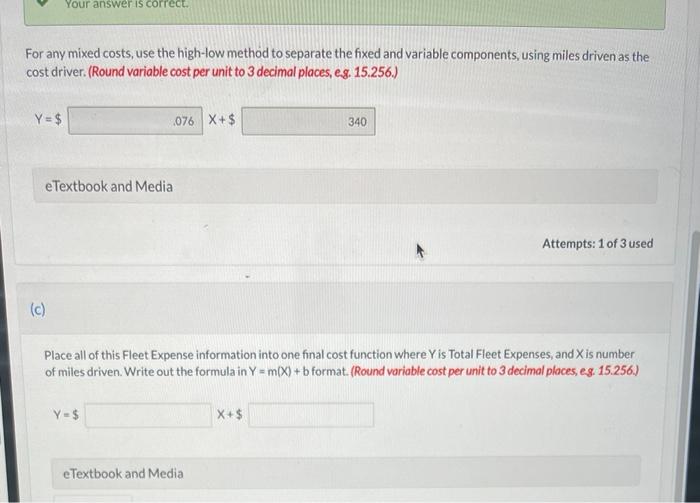

Gary was driving back to the office from his off-site construction job on Friday. He had put in a long week and just wanted to go home. But a text from William back in the office reminded him to enter his weekly mileage-the accountants needed to finish the company's total fleet expenses for its quarterly income statement-and the performance evaluation meeting was on Monday. Gary was frustrated that his weekend was now going to be delayed because of this data entry business. He wondered why William couldn't just use the fuel cost for the income statement. In the end, Gary complied with William's request and input his mileage information. Gary's mileage was added to the other vehicles' mileage information, with the quarterly totals listed below. Total fleet expenses on the income statement are a combination of the five costs shown here. For any mixed costs, use the high-low method to separate the fixed and variable components, using miles driven as the cost driver. (Round variable cost per unit to 3 decimal places, e.g. 15.256.) Y=$ x+$ Attempts: 1 of 3 used (c) Place all of this Fleet Expense information into one final cost function where Y is Total Fleet Expenses, and X is number of miles driven. Write out the formula in Y=m(X)+b format. (Round variable cost per unit to 3 decimal places, es. 15.256.) Y=$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts