Question: Please help with part D and E. Preparing the [I] consolidation entries for sale of depreciable assets-Cost method Assume that on January 1, 2013, a

![Please help with part D and E. Preparing the [I] consolidation](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fc0196540f2_50966fc0195a9e18.jpg)

Please help with part D and E.

Please help with part D and E.

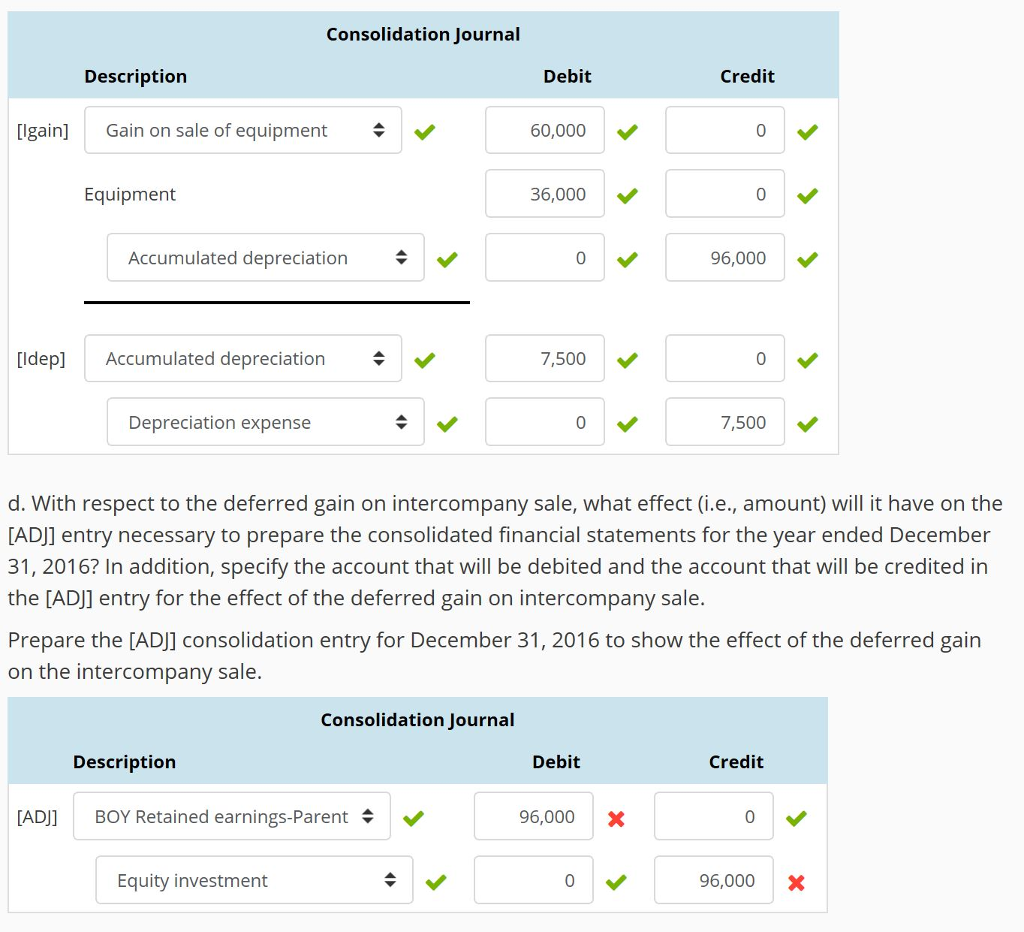

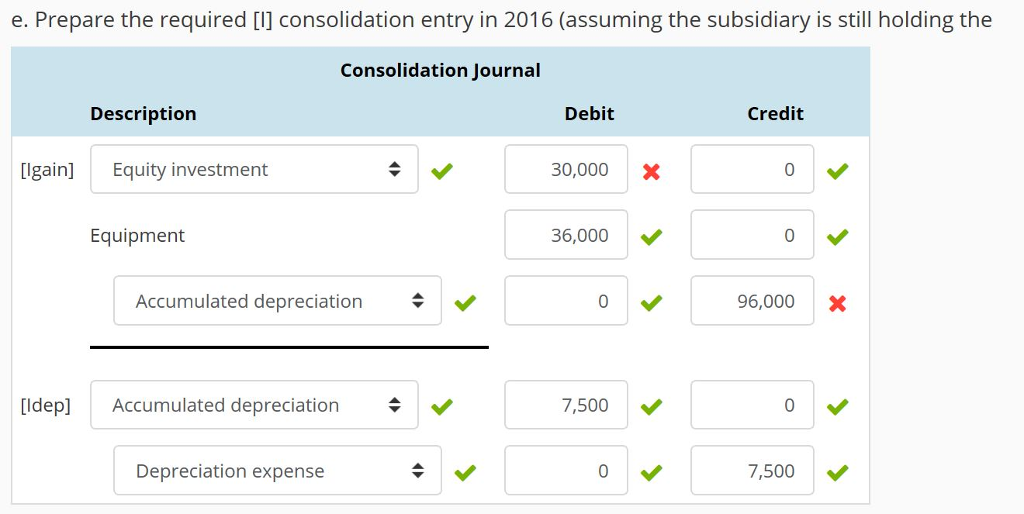

Preparing the [I] consolidation entries for sale of depreciable assets-Cost method Assume that on January 1, 2013, a parent sells to its wholly owned subsidiary, for a sale price of $252,000 equipment that originally cost $288,000 The parent originally purchased the equipment orn January 1, 2009, and depreciated the equipment assuming a 12-year useful life (straight-line with no salvage value). The subsidiary has adopted the parent's depreciation policy and depreciates the equipment over the remaining useful life of 8 years. The parent uses the cost method of pre- consolidation investment bookkeeping. a. Compute the pre-consolidation annual depreciation expense for the subsidiary (post-intercompany sale) and the parent (pre-intercompany sale) Parent depreciation expense 24,000 Subsidiary depreciation expense b. Compute the pre-consolidation Gain on Sale recognized by the parent during 2013. 60,000 c. Prepare the required [l] consolidation entry in 2013 (assume a full year of depreciation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts