Question: please help with part D Excel Activity: Calculating the WACC Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars):

please help with part D

please help with part D

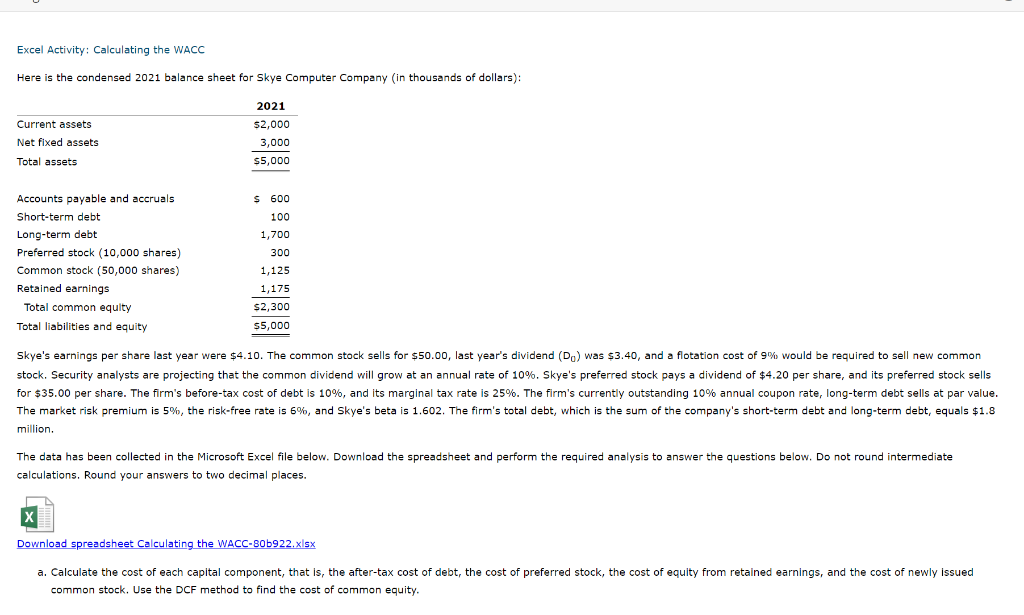

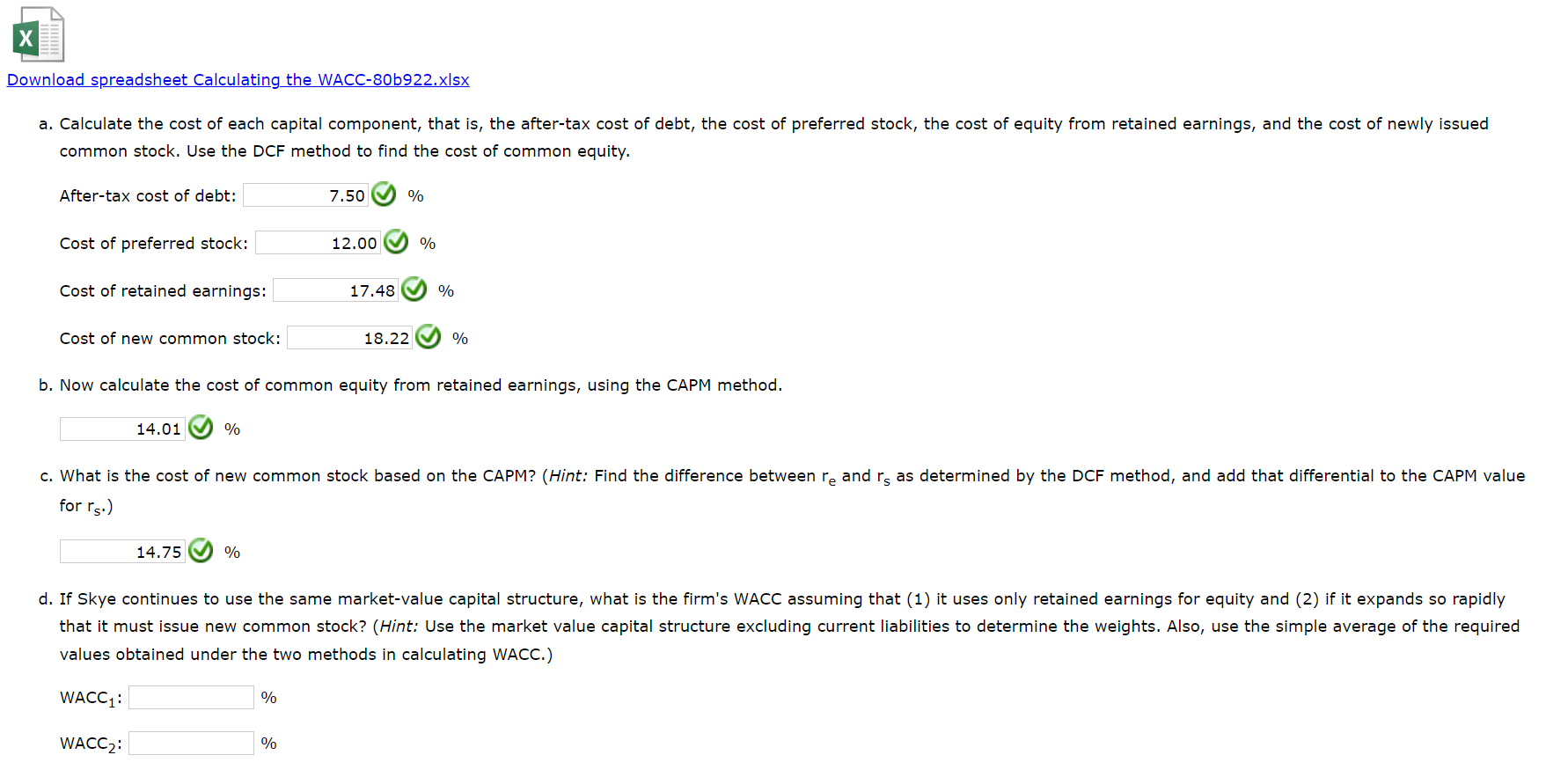

Excel Activity: Calculating the WACC Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars): \begin{tabular}{lr} & 2021 \\ \hline Current assets & $2,000 \\ Net fixed assets & 3,000 \\ Total assets & $5,000 \\ \cline { 4 - 4 } & \\ Accounts payable and accruals & 600 \\ Short-term debt & 100 \\ Long-term debt & 1,700 \\ Preferred stock (10,000 shares) & 300 \\ Common stock (50,000 shares) & 1,125 \\ Retained earnings & 1,175 \\ Total common equity & $2,300 \\ Total liabilities and equity & $5,000 \\ \hline \end{tabular} million. calculations. Round your answers to two decimal places. X Download spreadsheet Calculating the WACC-80b922.xlsx common stock. Use the DCF method to find the cost of common equity. Download spreadsheet Calculating the WACC-80b922.xIsx common stock. Use the DCF method to find the cost of common equity. After-tax cost of debt: % Cost of preferred stock: % Cost of retained earnings: % Cost of new common stock: 9% b. Now calculate the cost of common equity from retained earnings, using the CAPM method. % for rs ) % values obtained under the two methods in calculating WACC.) WACC1: WACC2:%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts