Question: Please help with part D We will use the binomial option pricing model to value the following put option on a stock. Time to expiration

Please help with part D

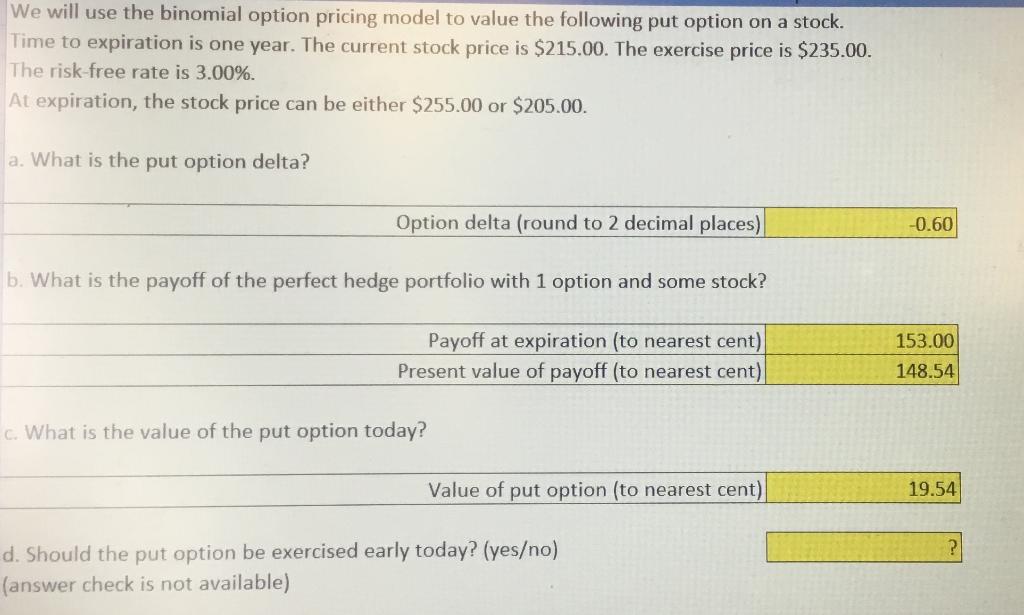

We will use the binomial option pricing model to value the following put option on a stock. Time to expiration is one year. The current stock price is $215.00. The exercise price is $235.00. The risk-free rate is 3.00%. At expiration, the stock price can be either $255.00 or $205.00. a. What is the put option delta? Option delta (round to 2 decimal places) -0.60 b. What is the payoff of the perfect hedge portfolio with 1 option and some stock? Payoff at expiration (to nearest cent) Present value of payoff (to nearest cent) 153.00 148.54 c. What is the value of the put option today? Value of put option (to nearest cent) 19.54 d. Should the put option be exercised early today? (yeso) (answer check is not available) We will use the binomial option pricing model to value the following put option on a stock. Time to expiration is one year. The current stock price is $215.00. The exercise price is $235.00. The risk-free rate is 3.00%. At expiration, the stock price can be either $255.00 or $205.00. a. What is the put option delta? Option delta (round to 2 decimal places) -0.60 b. What is the payoff of the perfect hedge portfolio with 1 option and some stock? Payoff at expiration (to nearest cent) Present value of payoff (to nearest cent) 153.00 148.54 c. What is the value of the put option today? Value of put option (to nearest cent) 19.54 d. Should the put option be exercised early today? (yeso) (answer check is not available)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts