Question: Please help with parts A, b, c and D . Calculations Formatting: Market Value: answer is in millions (to two decimal places). For example, if

Please help with parts A, b, c and D

Please help with parts A, b, c and D

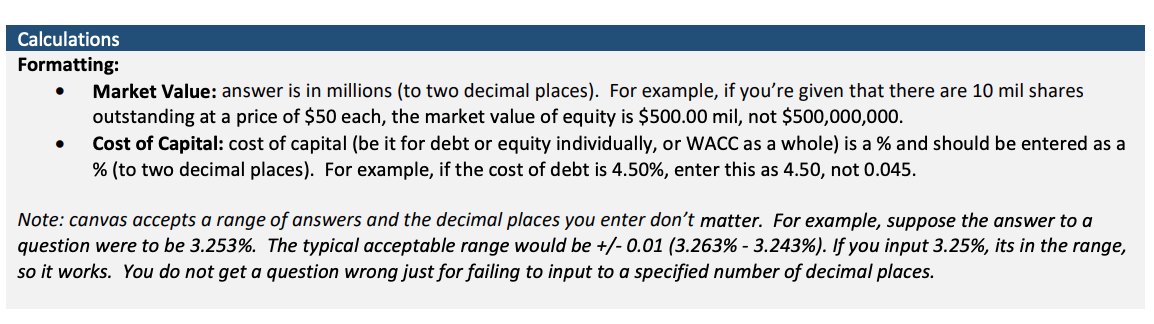

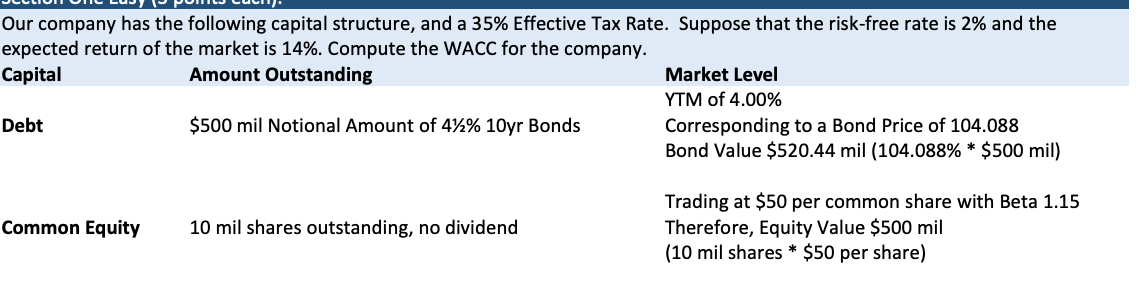

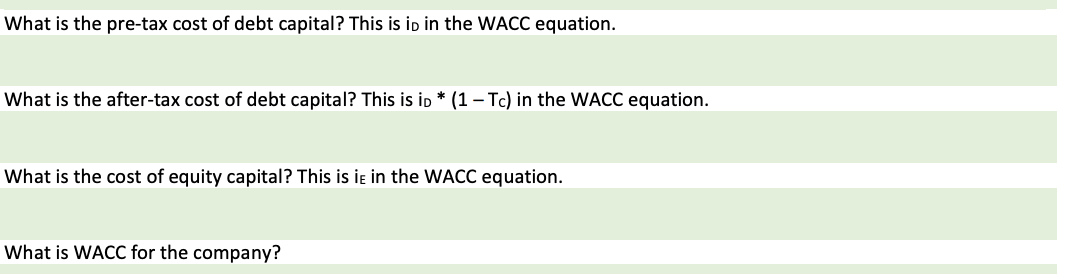

. Calculations Formatting: Market Value: answer is in millions (to two decimal places). For example, if you're given that there are 10 mil shares outstanding at a price of $50 each, the market value of equity is $500.00 mil, not $500,000,000. Cost of Capital: cost of capital (be it for debt or equity individually, or WACC as a whole) is a % and should be entered as a % (to two decimal places). For example, if the cost of debt is 4.50%, enter this as 4.50, not 0.045. . Note: canvas accepts a range of answers and the decimal places you enter don't matter. For example, suppose the answer to a question were to be 3.253%. The typical acceptable range would be +/-0.01 (3.263% - 3.243%). If you input 3.25%, its in the range, so it works. You do not get a question wrong just for failing to input to a specified number of decimal places. Our company has the following capital structure, and a 35% Effective Tax Rate. Suppose that the risk-free rate is 2% and the expected return of the market is 14%. Compute the WACC for the company. Capital Amount Outstanding Market Level YTM of 4.00% Debt $500 mil Notional Amount of 47% 10yr Bonds Corresponding to a Bond Price of 104.088 Bond Value $520.44 mil (104.088% * $500 mil) Common Equity 10 mil shares outstanding, no dividend Trading at $50 per common share with Beta 1.15 Therefore, Equity Value $500 mil (10 mil shares * $50 per share) What is the pre-tax cost of debt capital? This is id in the WACC equation. What is the after-tax cost of debt capital? This is id * (1 - Tc) in the WACC equation. What is the cost of equity capital? This is ie in the WACC equation. What is WACC for the company? . Calculations Formatting: Market Value: answer is in millions (to two decimal places). For example, if you're given that there are 10 mil shares outstanding at a price of $50 each, the market value of equity is $500.00 mil, not $500,000,000. Cost of Capital: cost of capital (be it for debt or equity individually, or WACC as a whole) is a % and should be entered as a % (to two decimal places). For example, if the cost of debt is 4.50%, enter this as 4.50, not 0.045. . Note: canvas accepts a range of answers and the decimal places you enter don't matter. For example, suppose the answer to a question were to be 3.253%. The typical acceptable range would be +/-0.01 (3.263% - 3.243%). If you input 3.25%, its in the range, so it works. You do not get a question wrong just for failing to input to a specified number of decimal places. Our company has the following capital structure, and a 35% Effective Tax Rate. Suppose that the risk-free rate is 2% and the expected return of the market is 14%. Compute the WACC for the company. Capital Amount Outstanding Market Level YTM of 4.00% Debt $500 mil Notional Amount of 47% 10yr Bonds Corresponding to a Bond Price of 104.088 Bond Value $520.44 mil (104.088% * $500 mil) Common Equity 10 mil shares outstanding, no dividend Trading at $50 per common share with Beta 1.15 Therefore, Equity Value $500 mil (10 mil shares * $50 per share) What is the pre-tax cost of debt capital? This is id in the WACC equation. What is the after-tax cost of debt capital? This is id * (1 - Tc) in the WACC equation. What is the cost of equity capital? This is ie in the WACC equation. What is WACC for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts