Question: Please help with Problem 3... ... X Worksheet used to determine governmental activities for the Village of Pine Hill at 12/31/21 Governmental funds Internal service

Please help with Problem 3...

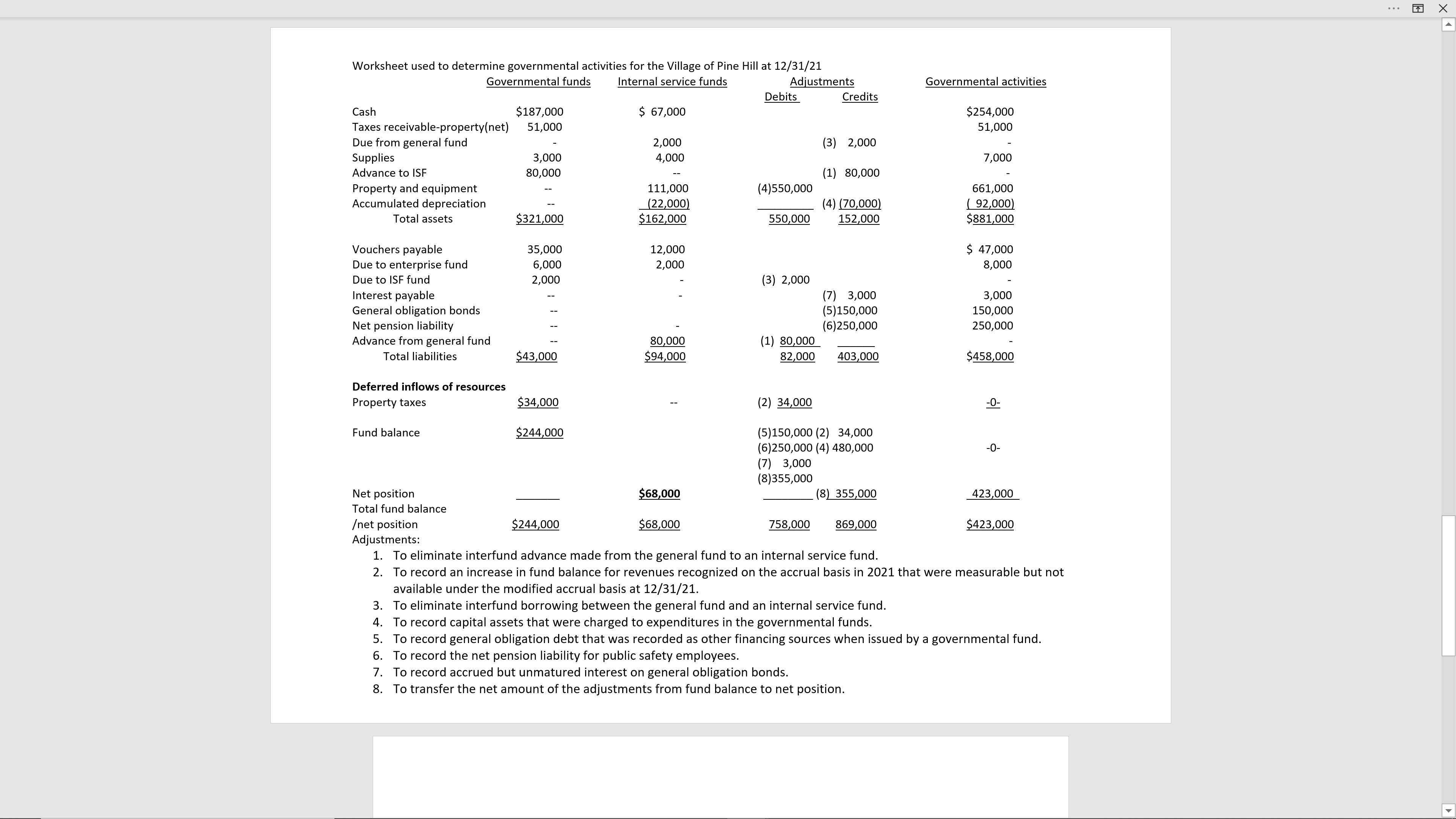

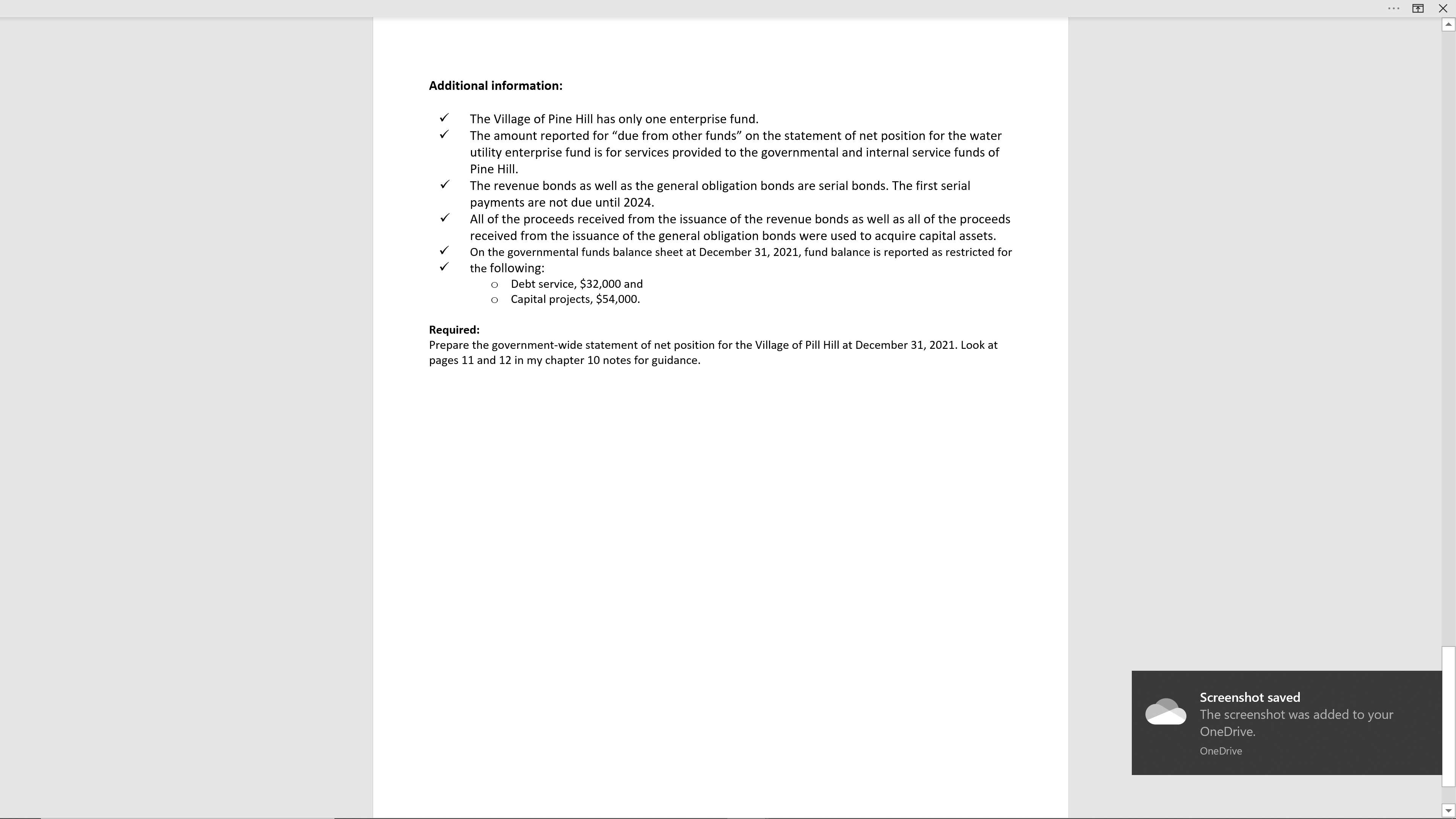

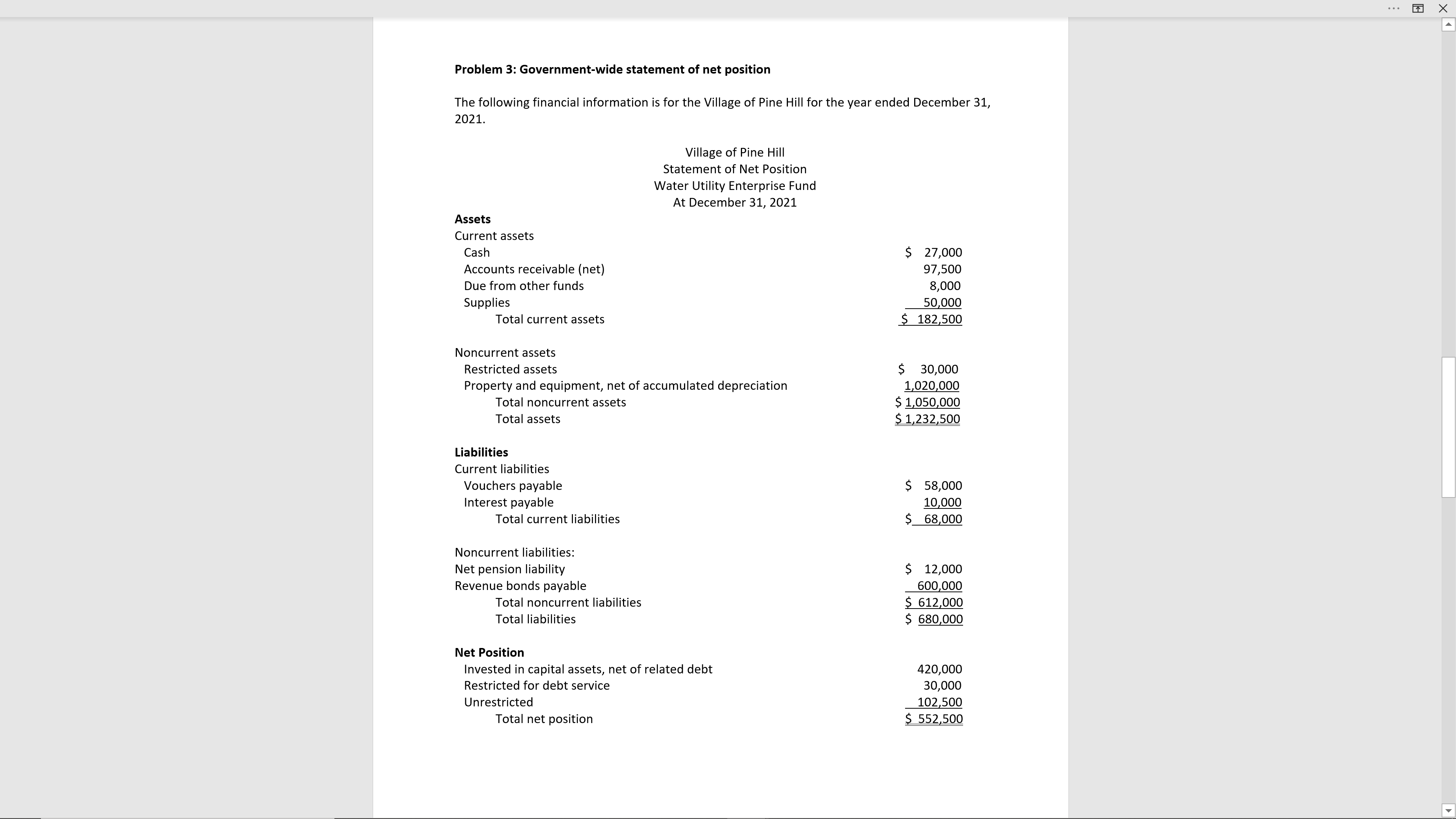

... X Worksheet used to determine governmental activities for the Village of Pine Hill at 12/31/21 Governmental funds Internal service funds Adjustments Governmental activities Debits Credits Cash $187,000 $ 67,000 $254,000 Taxes receivable-property(net) 51,000 51,000 Due from general fund 2,000 (3) 2,000 Supplies 3,000 4,000 7,000 Advance to IS 80,000 (1) 80,000 Property and equipment 111,000 (4)550,000 661,000 Accumulated depreciation (22,000) (4) (70,000) (92,000) Total assets $321,000 $162,000 550,000 152,000 $881,000 Vouchers payable 35,000 12,000 $ 47,000 Due to enterprise fund 6,000 2,000 8,000 Due to ISF fund 2,000 (3) 2,000 nterest payable 7) 3,000 3,000 General obligation bonds (5)150,000 150,000 Net pension liability (6)250,000 250,000 Advance from general fund 80,000 (1) 80,000 Total liabilities $43,000 $94,000 82,000 403,000 $458,000 Deferred inflows of resou Property taxes $34,000 (2) 34,000 -0- Fund balance $244,000 (5)150,000 (2) 34,000 6)250,000 (4) 480,000 -0- (7) 3,000 (8)355,000 Net position $68,000 (8) 355,000 423,000 Total fund balance et position $244,000 $68,000 758,000 869,000 $423,000 Adjustments: 1. To eliminate interfund advance made from the general fund to an internal service fund. 2. To record an increase in fund balance for revenues recognized on the accrual basis in 2021 that were measurable but not available under the modified accrual basis at 12/31/21. 3. To eliminate interfund borrowing between the general fund and an internal service fund. 4. To record capital assets that were charged to expenditures in the governmental funds. 5. To record general obligation debt that was recorded as other financing sources when issued by a governmental fund. 6. To record the net pension liability for public safety employees. 7. To record accrued but unmatured interest on general obligation bonds. 8. To transfer the net amount of the adjustments from fund balance to net position.Additional iniormation: ./ The Village of Pine Hill has only one enterprise fund. / The amount reported for "due from other funds\" on the statement of net position for the water utility enterprise fund is for services provided to the governmental and internal service funds of Pine Hill. / The revenue bonds as well as the general obligation bonds are serial bonds The first serial payments are not due until 2024, \\/ All of the proceeds received from the issuance of the revenue bonds as well as all of the proceeds received from the issuance of the general obligation bonds were used to acquire capital assetst / 0n the governmental funds balance sheet at December 31, 2021, fund balance is reported as restricted for / the following: 0 Debt service, $32,000 and 0 Capital projects, $54,000 Required: Prepare the government-wide statement of net position for the Village at Pill Hill at December 31, 2021. Look at pages 11 and 12 in my chapter 10 notes for guidance. Screenshot saved . X Village of Pine Hill Statement of Net Position At December 31, 2021 Problem 3 Governmental Business-type Activities Activities Totals Assets: Liabilities: Net position:... X Problem 3: Government-wide statement of net position The following financial information is for the Village of Pine Hill for the year ended December 31, 2021. Village of Pine Hill Statement of Net Position Water Utility Enterprise Fund At December 31, 2021 Assets Current assets Cash $ 27,000 Accounts receivable (net) 97,500 Due from other funds 8,000 Supplies 50,000 Total current assets $ 182,500 current asse Restricted assets $ 30,000 Property and equipment, net of accumulated depreciation 1,020,000 Total noncurrent assets $ 1,050,000 Total assets $ 1,232,500 Liabilities Current liabilities Vouchers payable $ 58,000 Interest payable 10,000 al current liabilities $ 68,000 Noncurrent liabilities: Net pension liability $ 12,000 Revenue bonds payable 600,000 Total noncurrent liabilities $ 612,000 Total liabilities $ 680,000 Net Position Invested in capital assets, net of related debt 420,000 Restricted for debt service 30,000 Unrestricted 102,500 Total net position $ 552,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts