Question: Please help with Python DO NOT USE OTHER ANSWERS PLEASE Thanks The United States federal personal income tax is calculated based on filing status and

Please help with Python

DO NOT USE OTHER ANSWERS PLEASE

Thanks

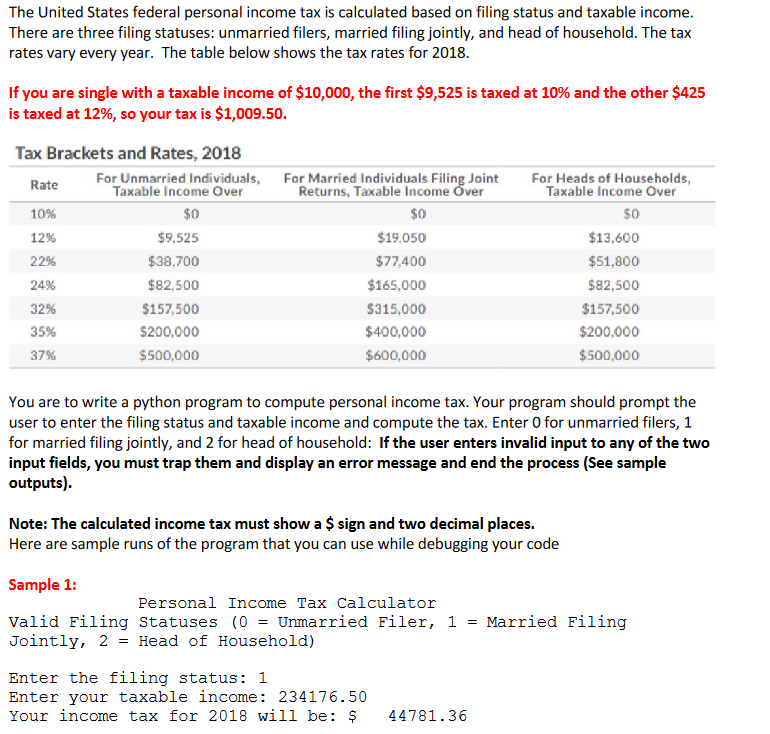

The United States federal personal income tax is calculated based on filing status and taxable income There are three filing statuses: unmarried filers, married filing jointly, and head of household. The tax rates vary every year. The table below shows the tax rates for 2018 If you are single with a taxable income of $10,000, the first $9,525 is taxed at 10% and the other $425 is taxed at 12%, so your tax is $1,009.50 Tax Brackets and Rates, 2018 For Unmarried Individuals,For Married Individuals Filing Joint For Heads of Households Taxable Income Over Rate 10% 12% 22% 24% 32% 35% 37% Taxable Income Over Returns, Taxable Income Over $0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 $0 $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 $0 $13.600 $51,800 $82,500 $157,500 $200,000 500,000 You are to write a python program to compute personal income tax. Your program should prompt the user to enter the filing status and taxable income and compute the tax. Enter O for unmarried filers, 1 for married filing jointly, and 2 for head of household: If the user enters invalid input to any of the two input fields, you must trap them and display an error message and end the process (See sample outputs) Note: The calculated income tax must show a $sign and two decimal places. Here are sample runs of the program that you can use while debugging your code Sample 1: Personal Income Tax Calculator valid Filing statuses (0 Unmarried Filer, 1 = Married Filing Jointly, 2 Head of Household) Enter the filing status: 1 Enter your taxable income: 234176.50 Your income tax for 2018 will be: 44781.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts