Question: Please help with question 2,3, and 5. I will rate quickly, thank you. Exercise 14-2 (Algo) Determine the price of bonds in various situations [LO14-2]

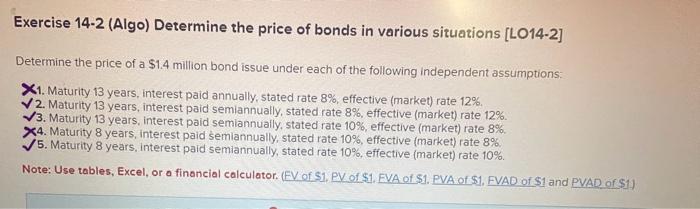

Exercise 14-2 (Algo) Determine the price of bonds in various situations [LO14-2] Determine the price of a $1.4 million bond issue under each of the following independent assumptions: 1. Maturity 13 years, interest paid annually, stated rate 8%, effective (market) rate 12%. 2. Maturity 13 years, interest paid semiannually, stated rate 8%, effective (market) rate 12%. 3. Maturity 13 years, interest paid semiannuaily, stated rate 10%, effective (market) rate 8%. 4. Maturity 8 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. 5. Maturity 8 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%. Note: Use tables, Excel, or a financial calculator. (FV of S1, PV of \$1. EVA of \$1. PVA of \$1, FVAD of S1 and PVAD of S1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts