Question: please help with question 3 & 4 3) A company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined

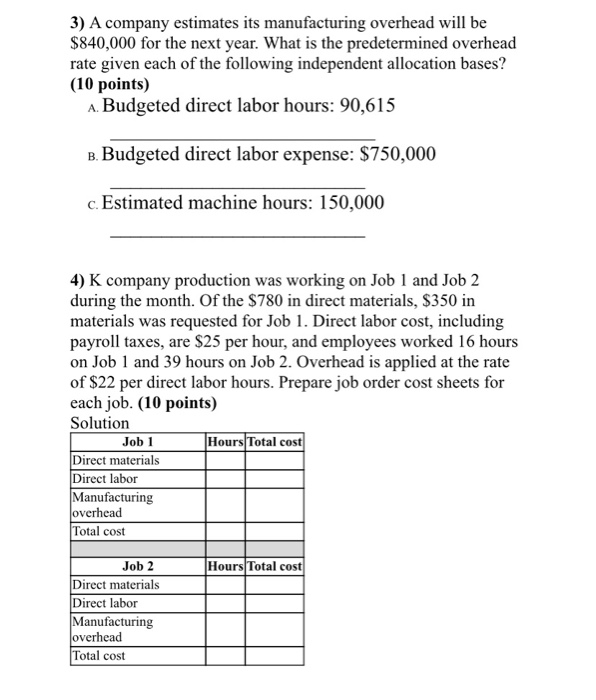

3) A company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following independent allocation bases? (10 points) A Budgeted direct labor hours: 90,615 B. Budgeted direct labor expense: $750,000 c. Estimated machine hours: 150,000 4) K company production was working on Job 1 and Job 2 during the month. Of the $780 in direct materials, $350 in materials was requested for Job 1. Direct labor cost, including payroll taxes, are $25 per hour, and employees worked 16 hours on Job 1 and 39 hours on Job 2. Overhead is applied at the rate of $22 per direct labor hours. Prepare job order cost sheets for each job. (10 points) Solution Job 1 Hours Total cost Direct materials Direct labor Manufacturing overhead Total cost Hours Total cost Job 2 Direct materials Direct labor Manufacturing overhead Total cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts