Question: Please help with Question 3 continued Question 3: (16 marks) a. The subsidiary in Australia generates a significant amount of profit, which can be utilized

Please help with "Question 3 continued"

Question 3: (16 marks)

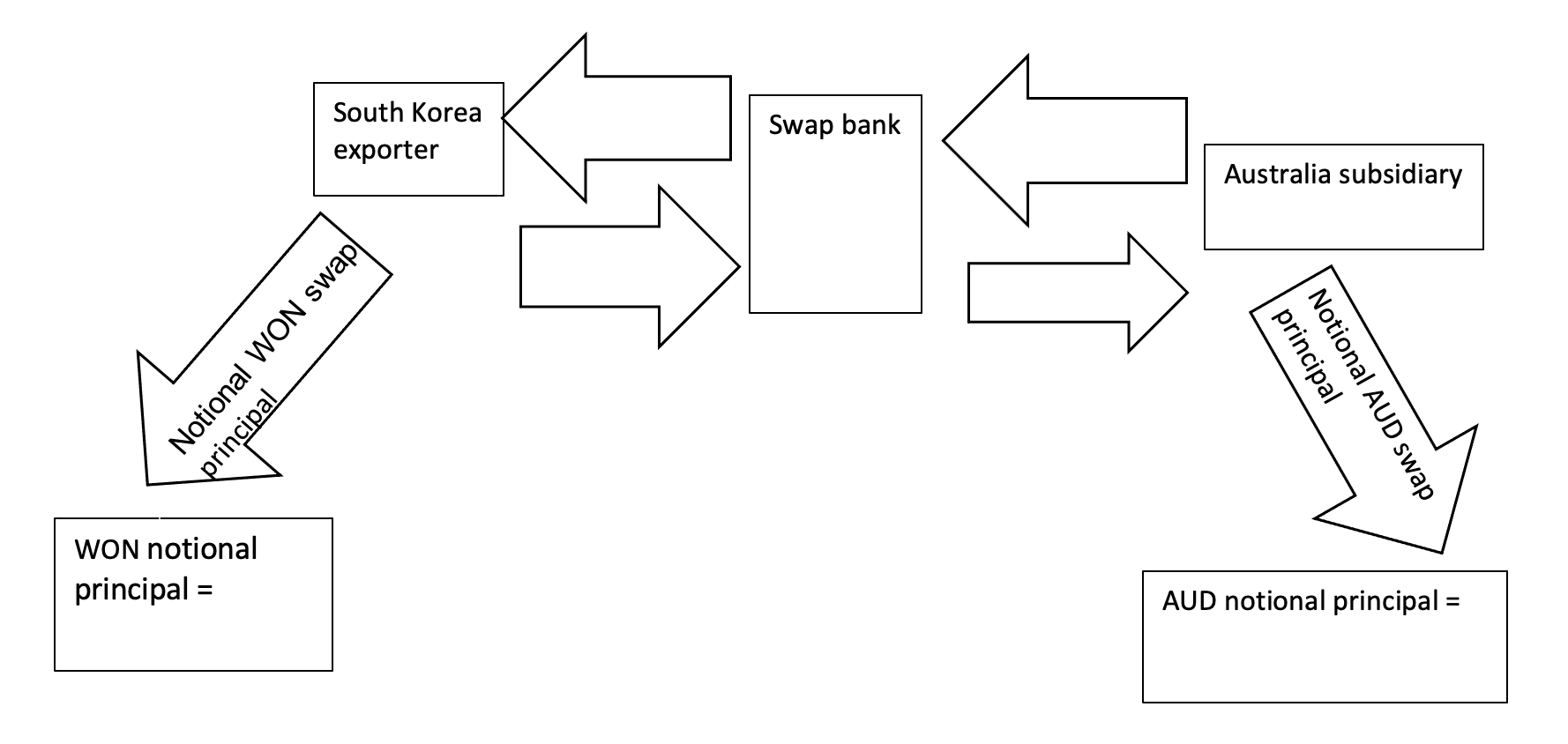

a. The subsidiary in Australia generates a significant amount of profit, which can be utilized to fund the import of manufacturing equipment from South Korea for the electronic component plant in Singapore. The CEO has initiated negotiations with the South Korean equipment supplier, who is willing to offer XYZ a payment period of 3 years. However, the payments must be made through quarterly installments of 62,000,000 WON by the Australia subsidiary. To facilitate this arrangement, the CEO has requested the construction of a currency swap that enables the utilization of the Australia subsidiary's profits to cover the equipment costs. To proceed with the three-year currency swap, you will apply the swap bank quotes. Additionally, a graphical representation of the swap will be provided to help the CEO visualize how the swap arrangement will function.

Workings:

Calculation of the notional principal of the hedge in South Korea WON:

| Provide your answers in the cells below | Marks | |

| Payments to be conducted by XYZ subsidiary in Australia | 62,000,000 | 0.5 mark |

| How often? Monthly = 12/ Quarterly = 4/Semi-annual = 2 | 4 | 0.5 mark |

| Swap bank WON Bid rate | 1.54 | 0.5 mark |

| Therefore, notional WON principal calculated with information above | 62,000,000 | 0.5 mark |

Calculation of the notional principal of the hedge in Australia AUD:

| Provide your answers in the cells below | Marks | |

| Spot exchange rate SGD/WON ask rate | 0.0008 | 0.5 mark |

| Spot exchange rate SGD/AUD bid rate | 0.7225 | 0.5 mark |

| Therefore, Australia AUD notional principal calculated with information above. | 49,600 | 0.5 mark |

| Swap bank AUD ask rate | 0.622 | 0.5 mark |

| Australia subsidiary pays quarterly: | 3,213.67 | 0.5 mark |

| AUD/WON Exchange rate locked in for three years: | 0.0006 | 0.5 mark |

Question 3 continued:

Complete the diagram below to show the swap transaction graphically by inserting the correct interest rate or currency values below: (6 marks)

\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts