Question: Please help with question 3 part A though E. Exchange Rate Overshooting Use the foreign exchange and money market diagrams to answer the following questions

Please help with question 3 part A though E.

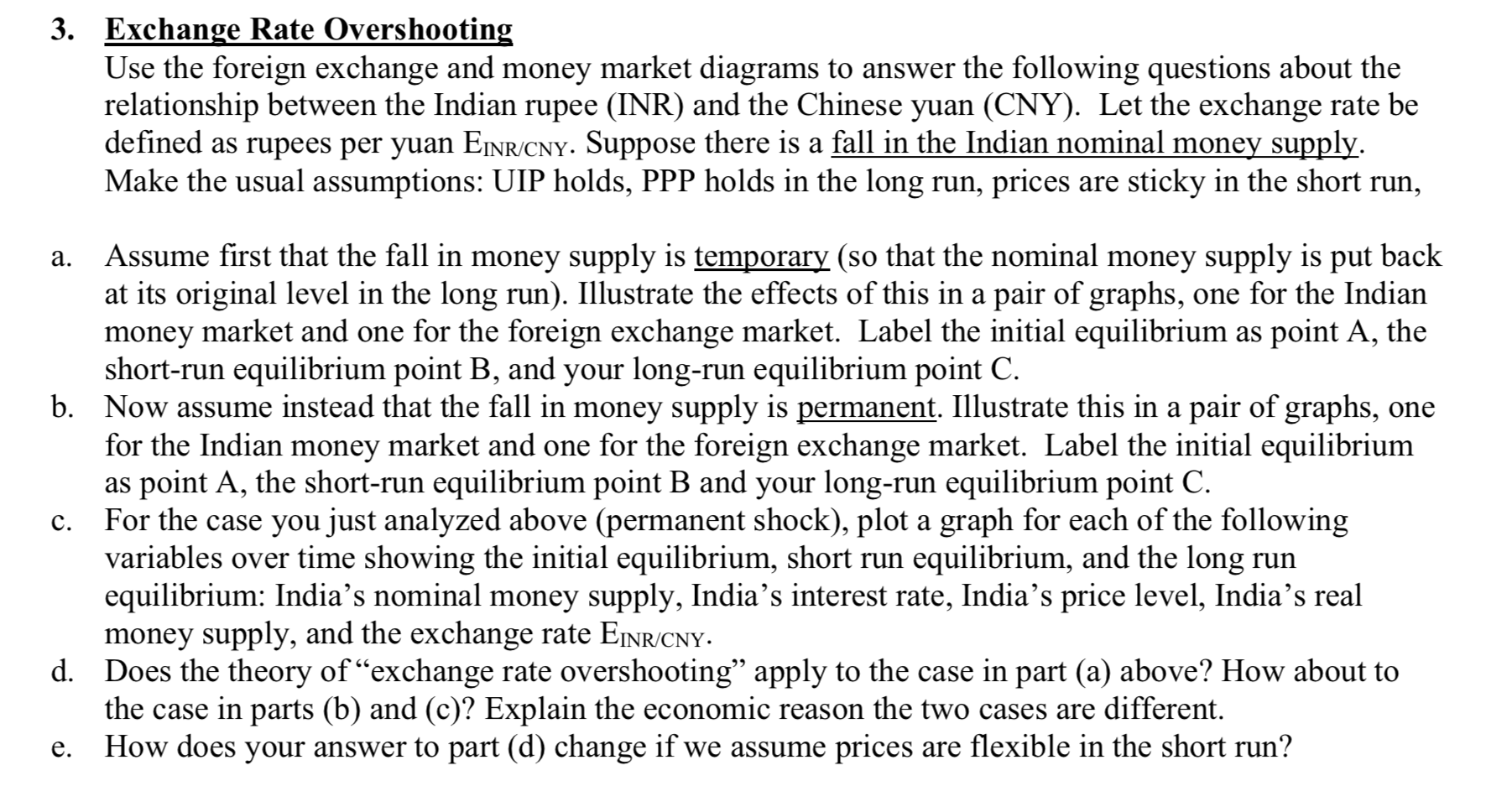

Exchange Rate Overshooting Use the foreign exchange and money market diagrams to answer the following questions about the relationship between the Indian rupee (INR) and the Chinese yuan (CNY). Let the exchange rate be dened as rupees per yuan Emu/cm. Suppose there is a fall in the Indian nominal money supply. Make the usual assumptions: UIP holds, PPP holds in the long run, prices are sticky in the short run, Assume rst that the fall in money supply is temporary (so that the nominal money supply is put back at its original level in the long run). Illustrate the effects of this in a pair of graphs, one for the Indian money market and one for the foreign exchange market. Label the initial equilibrium as point A, the short-run equilibrium point B, and your long-run equilibrium point C. Now assume instead that the fall in money supply is permanent. Illustrate this in a pair of graphs, one for the Indian money market and one for the foreign exchange market. Label the initial equilibrium as point A, the short-run equilibrium point B and your long-run equilibrium point C. For the case you just analyzed above (permanent shock), plot a graph for each of the following variables over time showing the initial equilibrium, short run equilibrium, and the long run equilibrium: India's nominal money supply, India's interest rate, India's price level, India's real money supply, and the exchange rate EmR/CNY. Does the theory of \"exchange rate overshooting\" apply to the case in part (a) above? How about to the case in parts (b) and (c)? Explain the economic reason the two cases are different. How does your answer to part (d) change if we assume prices are exible in the short run

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts