Question: Please help with question 3.3 Comp-IT (Pty) Ltd incurred the following expenditures during the year ended 31 December 2023. Useful life of the intangible asset

Please help with question 3.3

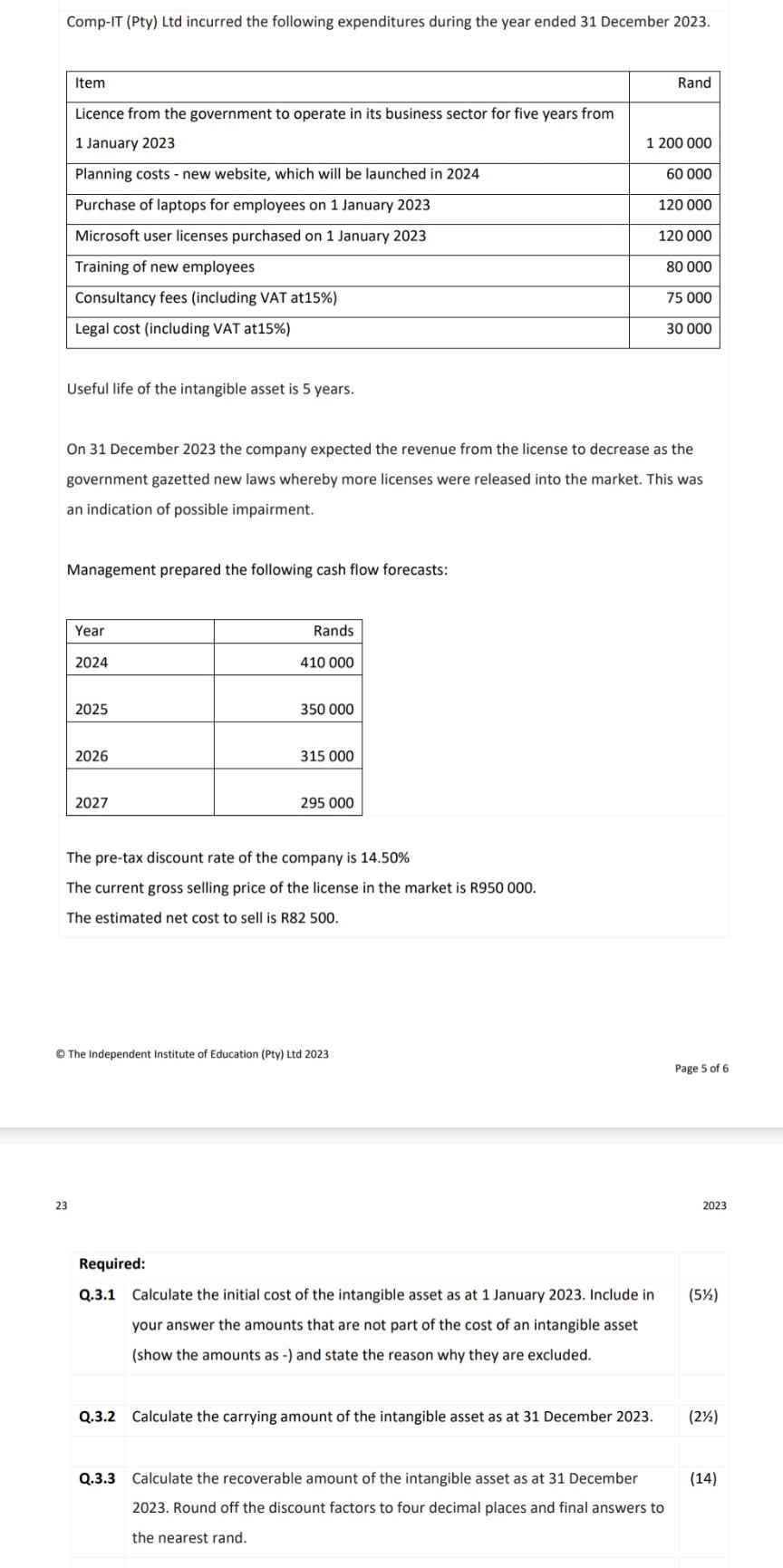

Comp-IT (Pty) Ltd incurred the following expenditures during the year ended 31 December 2023. Useful life of the intangible asset is 5 years. On 31 December 2023 the company expected the revenue from the license to decrease as the government gazetted new laws whereby more licenses were released into the market. This was an indication of possible impairment. Management prepared the following cash flow forecasts: The pre-tax discount rate of the company is 14.50% The current gross selling price of the license in the market is R950 000 . The estimated net cost to sell is R82500. (C) The independent Institute of Education (Pty) Ltd 2023 Page 5 of Comp-IT (Pty) Ltd incurred the following expenditures during the year ended 31 December 2023. Useful life of the intangible asset is 5 years. On 31 December 2023 the company expected the revenue from the license to decrease as the government gazetted new laws whereby more licenses were released into the market. This was an indication of possible impairment. Management prepared the following cash flow forecasts: The pre-tax discount rate of the company is 14.50% The current gross selling price of the license in the market is R950 000 . The estimated net cost to sell is R82500. (C) The independent Institute of Education (Pty) Ltd 2023 Page 5 of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts