Question: please help with Question 3.3 cost volume profit analysis The analysis also revealed the following budgeted information: Siqalo bread budgeted for 225 000 Corn bread

please help with Question 3.3 cost volume profit analysis

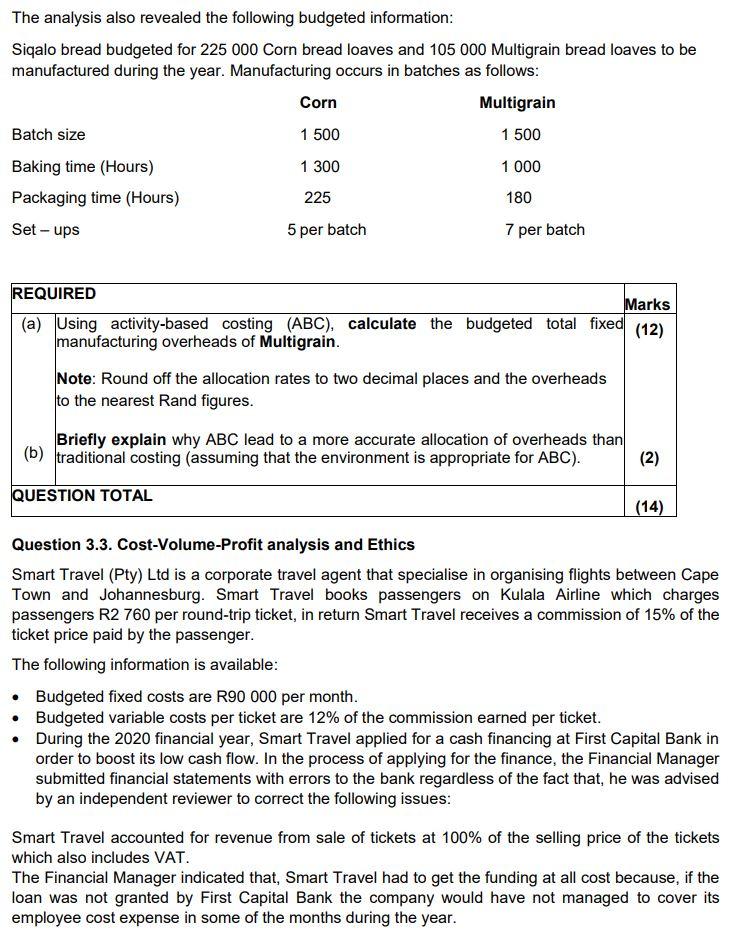

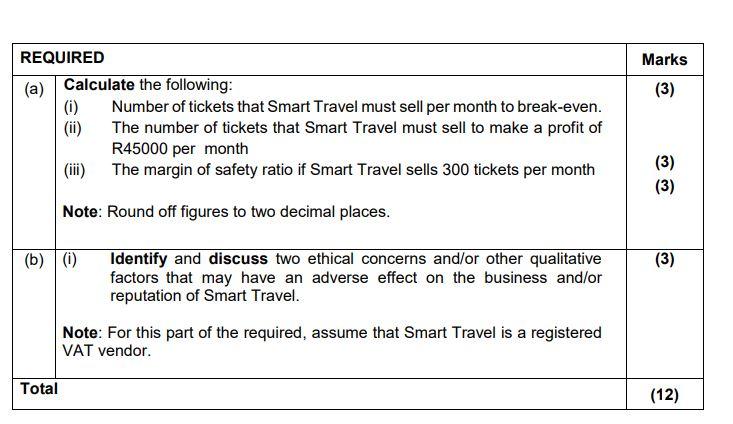

The analysis also revealed the following budgeted information: Siqalo bread budgeted for 225 000 Corn bread loaves and 105 000 Multigrain bread loaves to be manufactured during the year. Manufacturing occurs in batches as follows: Corn Multigrain Batch size 1 500 1 500 Baking time (Hours) 1 300 1 000 Packaging time (Hours) 225 180 Set-ups 5 per batch 7 per batch REQUIRED Marks (a) Using activity-based costing (ABC), calculate the budgeted total fixed (12) manufacturing overheads of Multigrain. Note: Round off the allocation rates to two decimal places and the overheads to the nearest Rand figures. Briefly explain why ABC lead to a more accurate allocation of overheads than (b) traditional costing (assuming that the environment is appropriate for ABC). (2) QUESTION TOTAL (14) Question 3.3. Cost-Volume-Profit analysis and Ethics Smart Travel (Pty) Ltd is a corporate travel agent that specialise in organising flights between Cape Town and Johannesburg. Smart Travel books passengers on Kulala Airline which charges passengers R2 760 per round-trip ticket, in return Smart Travel receives a commission of 15% of the ticket price paid by the passenger. The following information is available: Budgeted fixed costs are R90 000 per month. Budgeted variable costs per ticket are 12% of the commission earned per ticket. During the 2020 financial year, Smart Travel applied for a cash financing at First Capital Bank in order to boost its low cash flow. In the process of applying for the finance, the Financial Manager submitted financial statements with errors to the bank regardless of the fact that, he was advised by an independent reviewer to correct the following issues: Smart Travel accounted for revenue from sale of tickets at 100% of the selling price of the tickets which also includes VAT. The Financial Manager indicated that, Smart Travel had to get the funding at all cost because, if the loan was not granted by First Capital Bank the company would have not managed to cover its employee cost expense in some of the months during the year. Marks (3) REQUIRED (a) Calculate the following: (1) Number of tickets that Smart Travel must sell per month to break-even. (ii) The number of tickets that Smart Travel must sell to make a profit of R45000 per month (iii) The margin of safety ratio if Smart Travel sells 300 tickets per month (3) (3) Note: Round off figures to two decimal places. (b)(0) (3) Identify and discuss two ethical concerns and/or other qualitative factors that may have an adverse effect on the business and/or reputation of Smart Travel. Note: For this part of the required, assume that Smart Travel is a registered VAT vendor. Total (12)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts