Question: Please help with question 3-7. the uploaded image contains the table for 3-3 cash flow. thank you P 3-12. 3-5. What is the undiscolll investment

Please help with question 3-7. the uploaded image contains the table for 3-3 cash flow. thank you

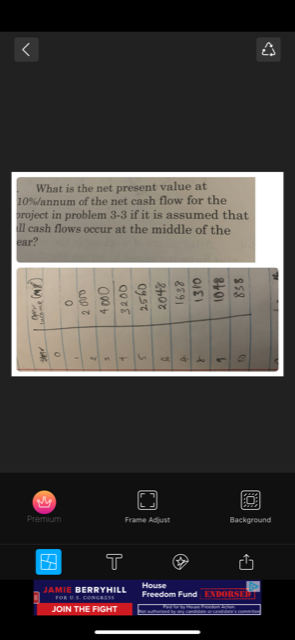

P 3-12. 3-5. What is the undiscolll investment (ROI) for the project Il 3-3? What is the undiscounted profit to investment ratio where profit = net cash flow? Ans: 3.11 ROIE P:/= 2.11 3-6. What is the undiscounted return on investment (ROI) for the project in problem 3.4? What is the undiscounted profit: investment ratio where profit = net cash flow? 3-7. What is the net present value at 10%/annum of the net cash flow for the project in problem 3-3 if it is assumed that all cash flows occur at the middle of the year? Ans: 6831 M$ 3-8. What is the net present value at 15%/annum of the net cash flow for the project in problem 3-4 if it is assumed that all cash flows occur at the middle of the year? 3-9. Plot the present value profile for the project in problem 3-3 assuming all cash What is the net present value at 10%/annum of the net cash flow for the project in problem 3-3 if it is assumed that Il cash flows occur at the middle of the ear? 3200 2 000 4000 $58 2560 2048 1310 1048 8591 Premium Frame Adjust Background JAMIE BERRYHILL Freedom Fund ENDORSED JOIN THE FIGHT STE P 3-12. 3-5. What is the undiscolll investment (ROI) for the project Il 3-3? What is the undiscounted profit to investment ratio where profit = net cash flow? Ans: 3.11 ROIE P:/= 2.11 3-6. What is the undiscounted return on investment (ROI) for the project in problem 3.4? What is the undiscounted profit: investment ratio where profit = net cash flow? 3-7. What is the net present value at 10%/annum of the net cash flow for the project in problem 3-3 if it is assumed that all cash flows occur at the middle of the year? Ans: 6831 M$ 3-8. What is the net present value at 15%/annum of the net cash flow for the project in problem 3-4 if it is assumed that all cash flows occur at the middle of the year? 3-9. Plot the present value profile for the project in problem 3-3 assuming all cash What is the net present value at 10%/annum of the net cash flow for the project in problem 3-3 if it is assumed that Il cash flows occur at the middle of the ear? 3200 2 000 4000 $58 2560 2048 1310 1048 8591 Premium Frame Adjust Background JAMIE BERRYHILL Freedom Fund ENDORSED JOIN THE FIGHT STE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts