Question: Please help with question 4,5,6 Question 4: Question 5: Question 6: Identify each statement as true or false. 1. A partnership is an association of

Please help with question 4,5,6

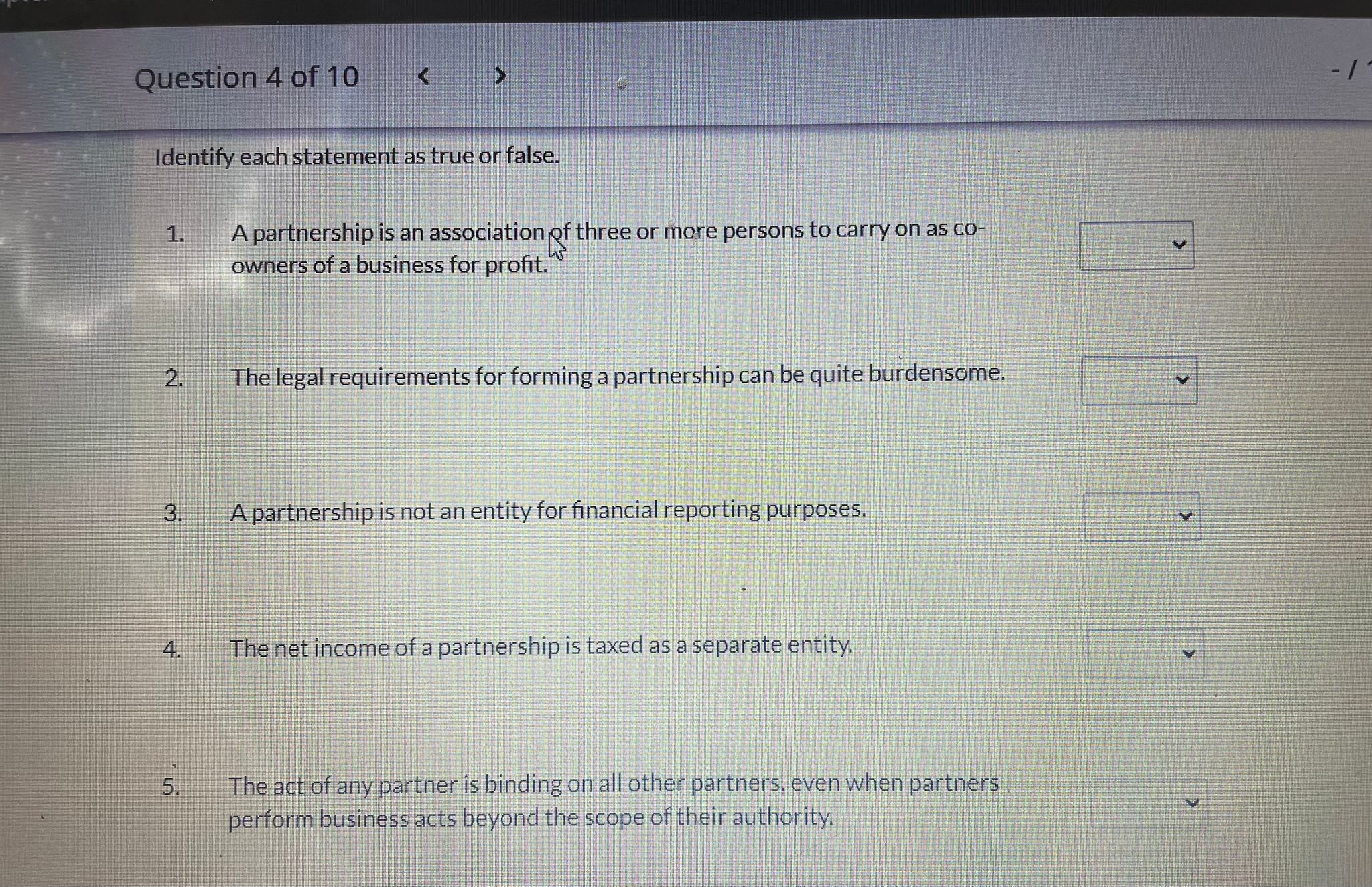

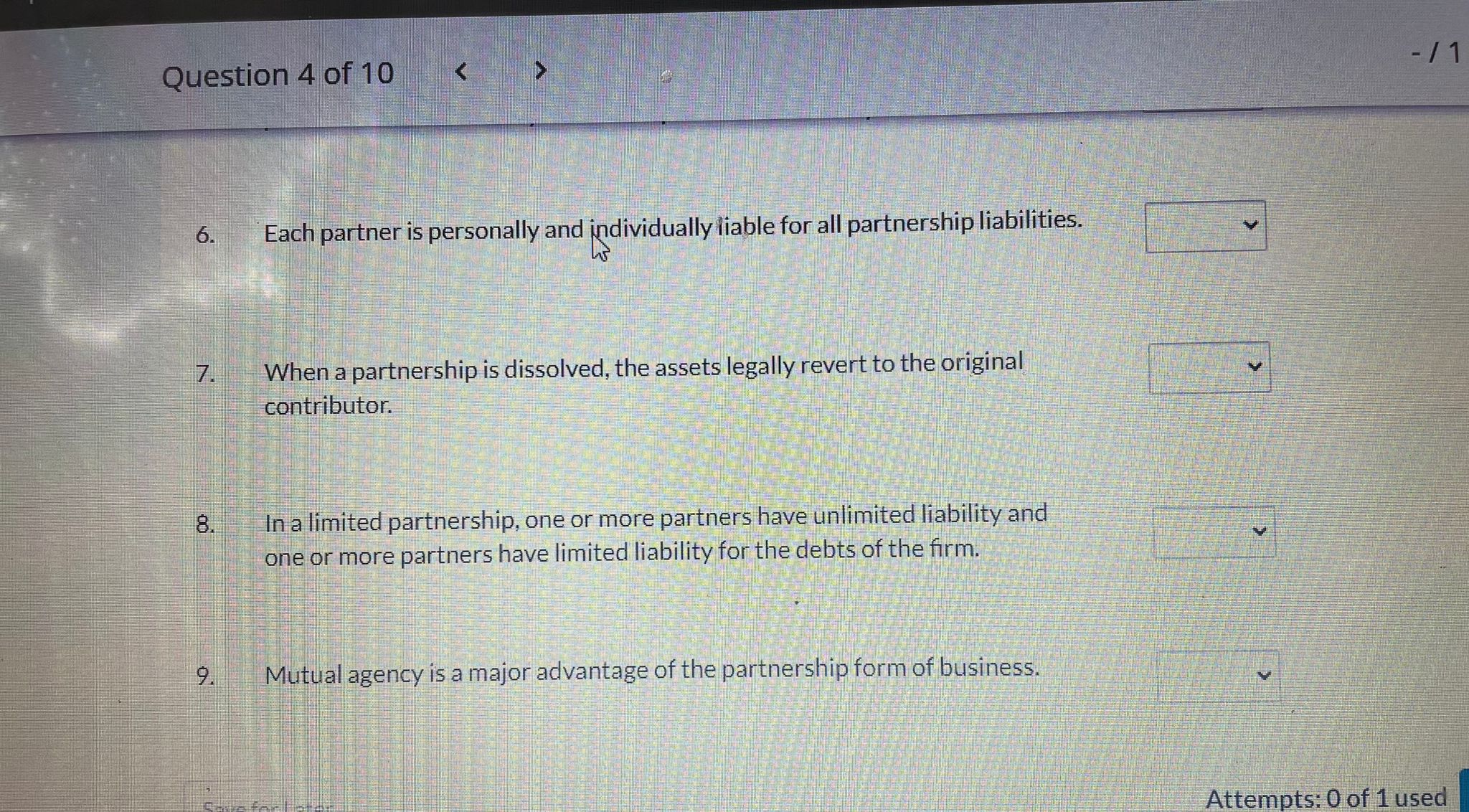

Question 4:

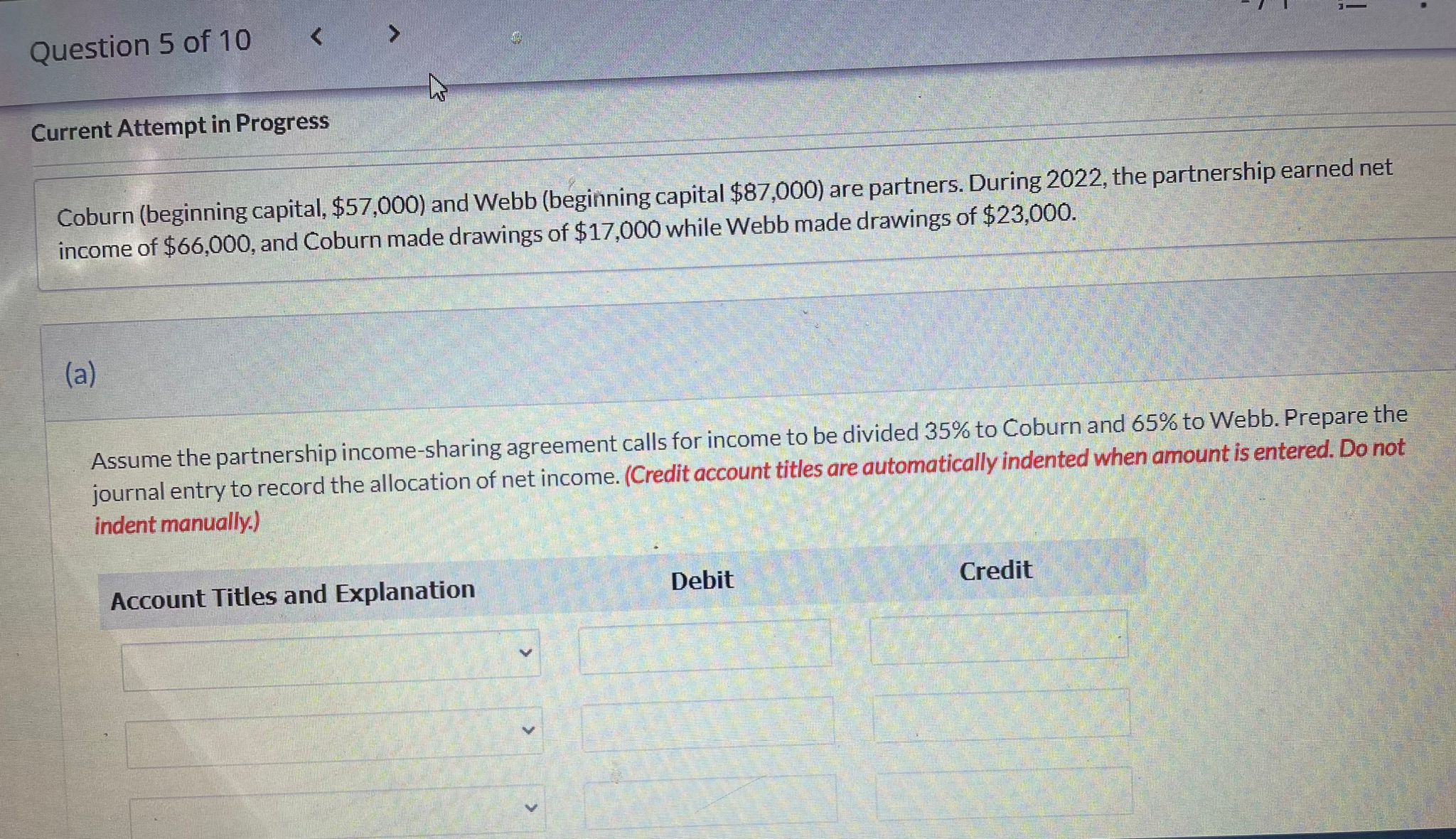

Question 5:

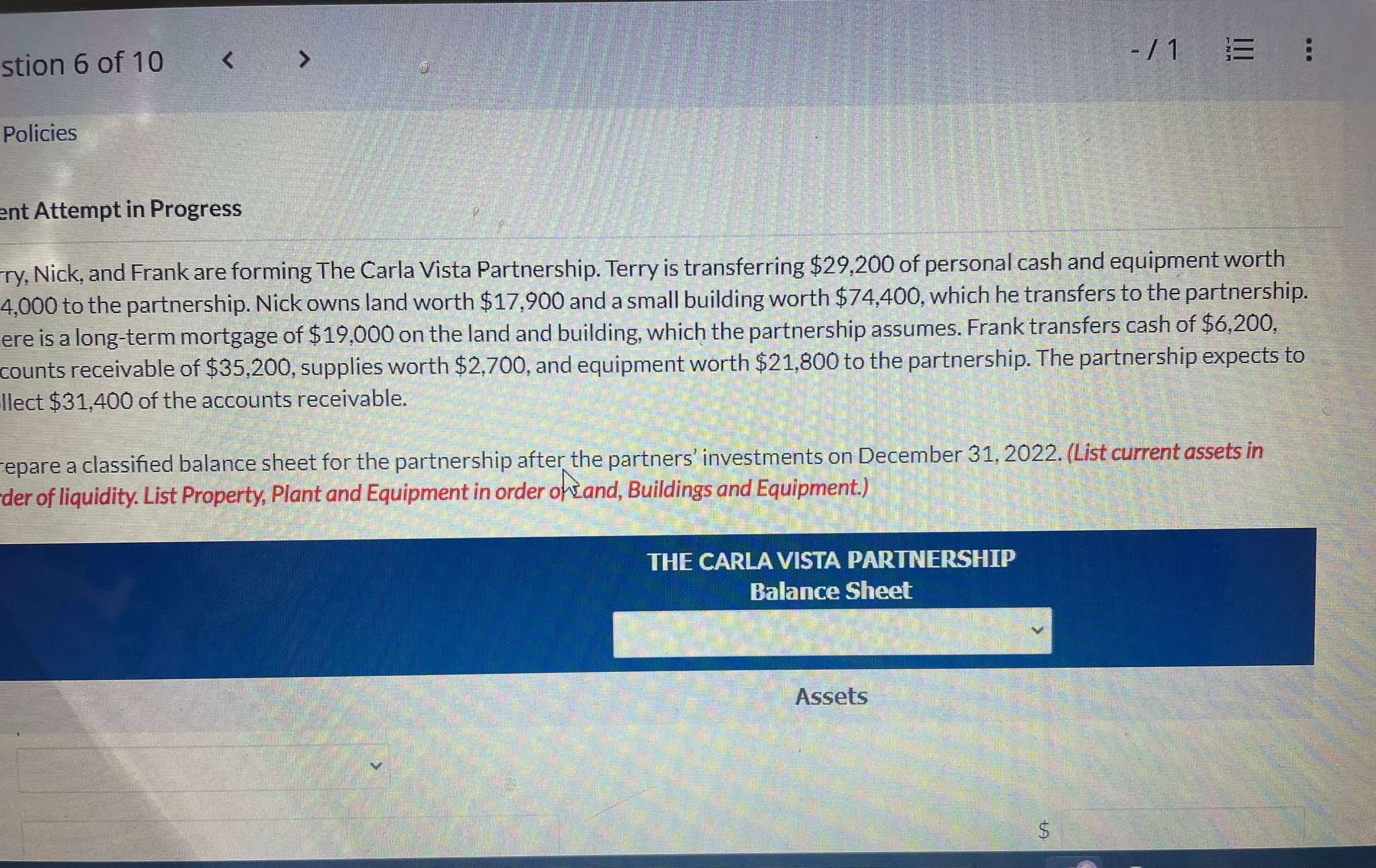

Question 6:

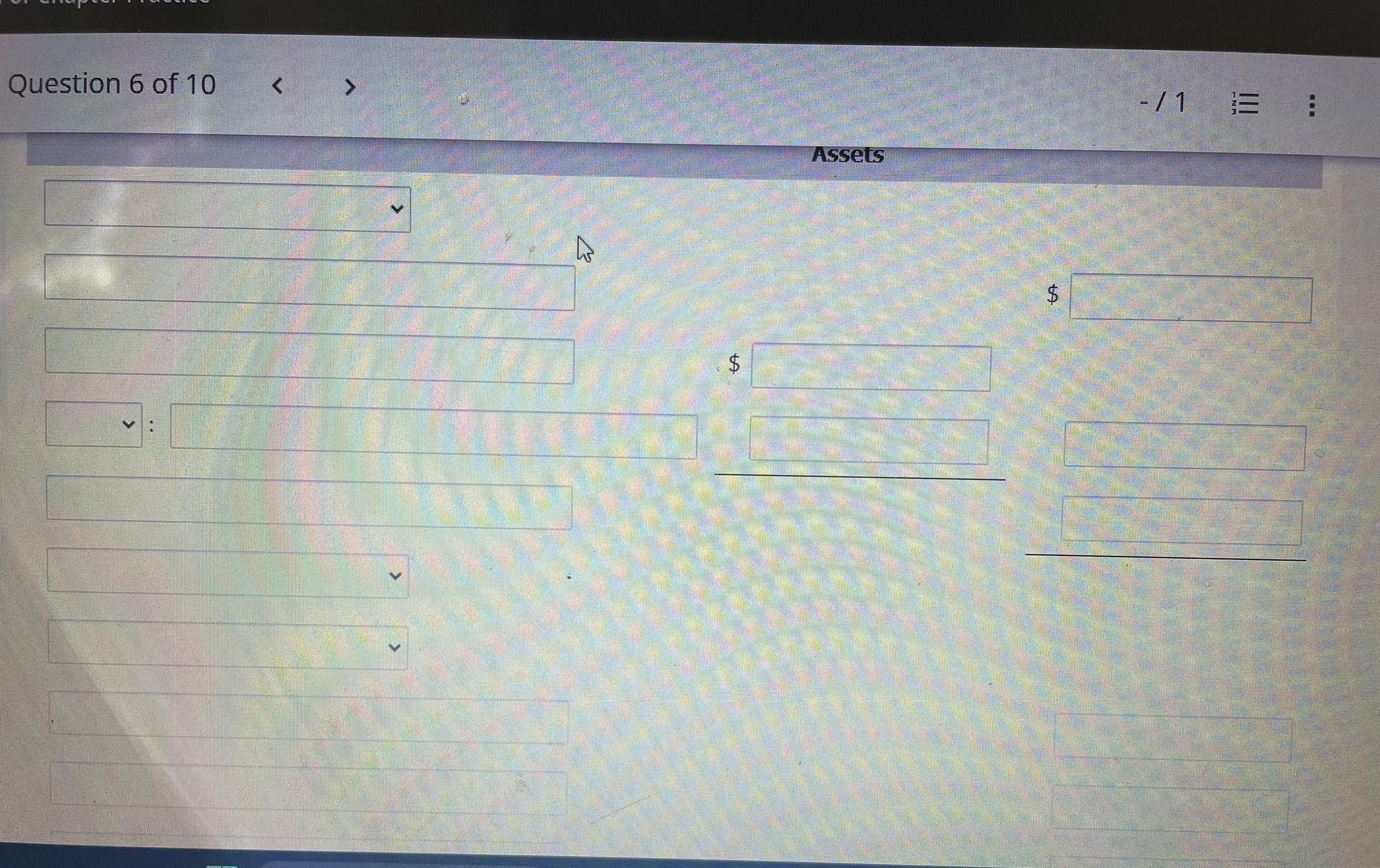

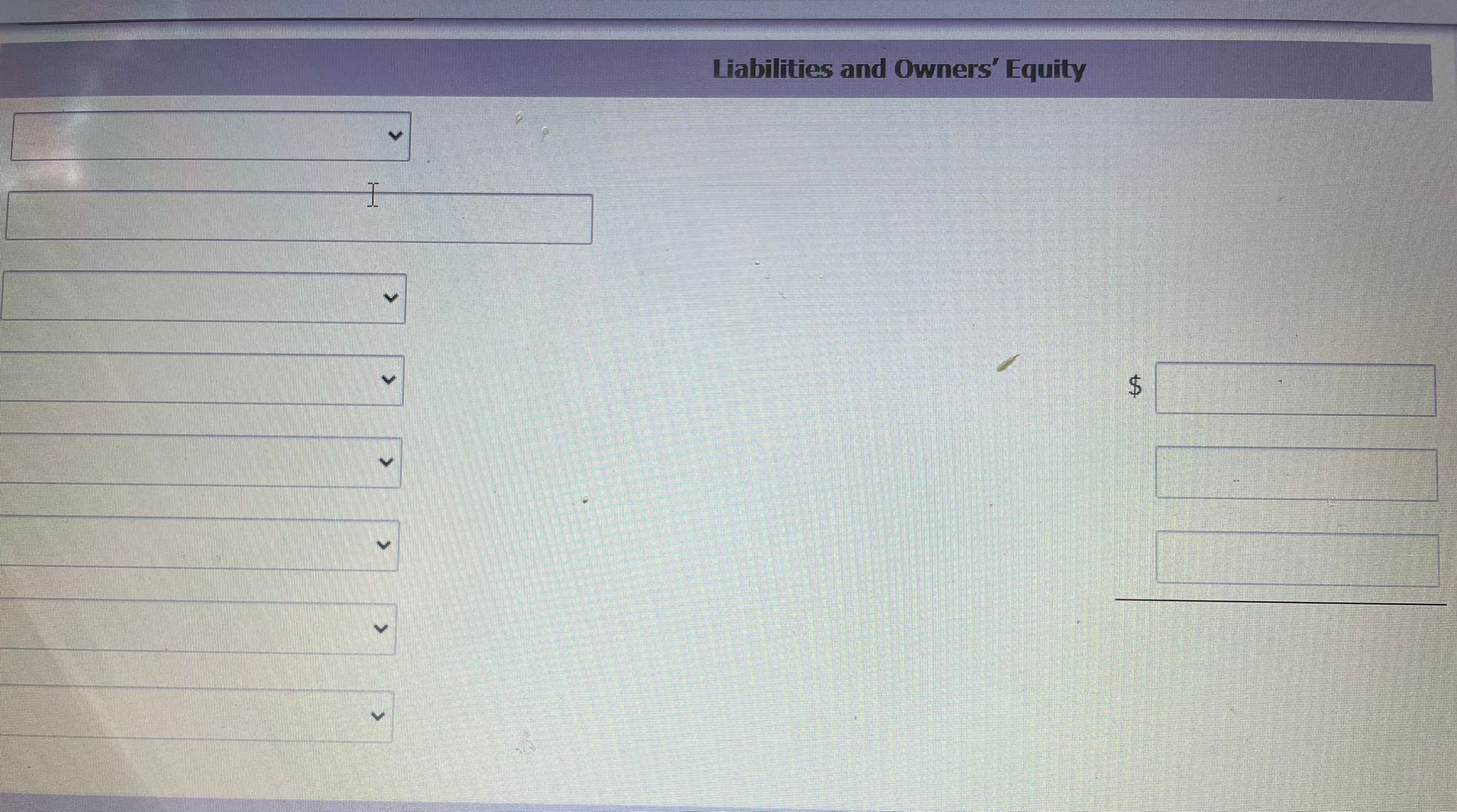

Identify each statement as true or false. 1. A partnership is an association of three or more persons to carry on as coowners of a business for profit. 2. The legal requirements for forming a partnership can be quite burdensome. 3. A partnership is not an entity for financial reporting purposes. 4. The net income of a partnership is taxed as a separate entity. 5. The act of any partner is binding on all other partners, even when partners perform business acts beyond the scope of their authority. 6. Each partner is personally and individually liable for all partnership liabilities. 7. When a partnership is dissolved, the assets legally revert to the original contributor. 8. In a limited partnership, one or more partners have unlimited liability and one or more partners have limited liability for the debts of the firm. 9. Mutual agency is a major advantage of the partnership form of business. Coburn (beginning capital, $57,000 ) and Webb (beginning capital $87,000 ) are partners. During 2022, the partnership earned net income of $66,000, and Coburn made drawings of $17,000 while Webb made drawings of $23,000. (a) Assume the partnership income-sharing agreement calls for income to be divided 35% to Coburn and 65% to Webb. Prepare the journal entry to record the allocation of net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) ry, Nick, and Frank are forming The Carla Vista Partnership. Terry is transferring $29,200 of personal cash and equipment worth 4,000 to the partnership. Nick owns land worth $17,900 and a small building worth $74,400, which he transfers to the partnership. ere is a long-term mortgage of $19,000 on the land and building, which the partnership assumes. Frank transfers cash of $6,200, counts receivable of $35,200, supplies worth $2,700, and equipment worth $21,800 to the partnership. The partnership expects to llect $31,400 of the accounts receivable. repare a classified balance sheet for the partnership after the partners' investments on December 31, 2022. (List current assets in der of liquidity. List Property, Plant and Equipment in order ofand, Buildings and Equipment.) Question 6 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts