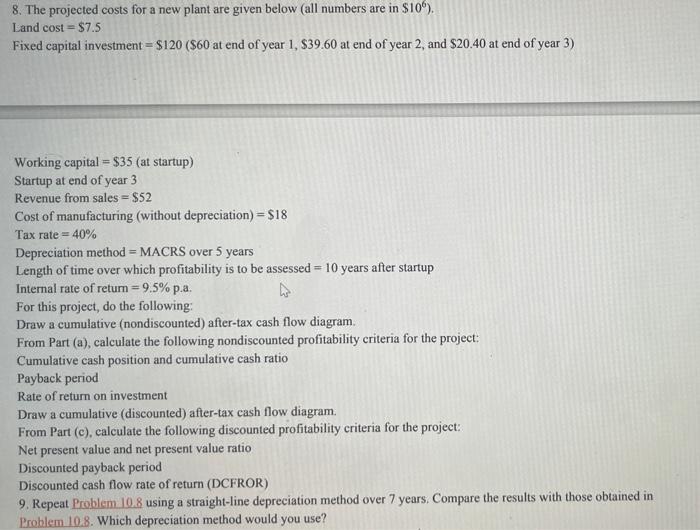

Question: Please help with question 9 8. The projected costs for a new plant are given below (all numbers are in $106 ). Land cost =$7.5

8. The projected costs for a new plant are given below (all numbers are in $106 ). Land cost =$7.5 Fixed capital investment =$120($60 at end of year 1,$39.60 at end of year 2 , and $20.40 at end of year 3 ) Working capital =$35 (at startup) Startup at end of year 3 Revenue from sales =$52 Cost of manufacturing (without depreciation) =$18 Tax rate =40% Depreciation method = MACRS over 5 years Length of time over which profitability is to be assessed =10 years after startup Internal rate of retum =9.5% p.a. For this project, do the following: Draw a cumulative (nondiscounted) after-tax cash flow diagram. From Part (a), calculate the following nondiscounted profitability criteria for the project: Cumulative cash position and cumulative cash ratio Payback period Rate of return on investment Draw a cumulative (discounted) after-tax cash flow diagram. From Part (c), calculate the following discounted profitability criteria for the project: Net present value and net present value ratio Discounted payback period Discounted cash flow rate of return (DCFROR) 9. Repeat Problem 10.8 using a straight-line depreciation method over 7 years. Compare the results with those 8. The projected costs for a new plant are given below (all numbers are in $106 ). Land cost =$7.5 Fixed capital investment =$120($60 at end of year 1,$39.60 at end of year 2 , and $20.40 at end of year 3 ) Working capital =$35 (at startup) Startup at end of year 3 Revenue from sales =$52 Cost of manufacturing (without depreciation) =$18 Tax rate =40% Depreciation method = MACRS over 5 years Length of time over which profitability is to be assessed =10 years after startup Internal rate of retum =9.5% p.a. For this project, do the following: Draw a cumulative (nondiscounted) after-tax cash flow diagram. From Part (a), calculate the following nondiscounted profitability criteria for the project: Cumulative cash position and cumulative cash ratio Payback period Rate of return on investment Draw a cumulative (discounted) after-tax cash flow diagram. From Part (c), calculate the following discounted profitability criteria for the project: Net present value and net present value ratio Discounted payback period Discounted cash flow rate of return (DCFROR) 9. Repeat Problem 10.8 using a straight-line depreciation method over 7 years. Compare the results with those

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts