Question: Please help with question #9. The data is provided in the first picture. For question 9, I have already done question 8 so the info

Please help with question #9. The data is provided in the first picture.

For question 9, I have already done question 8 so the info is provided.

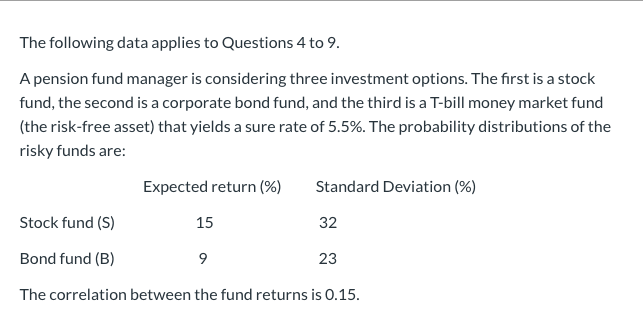

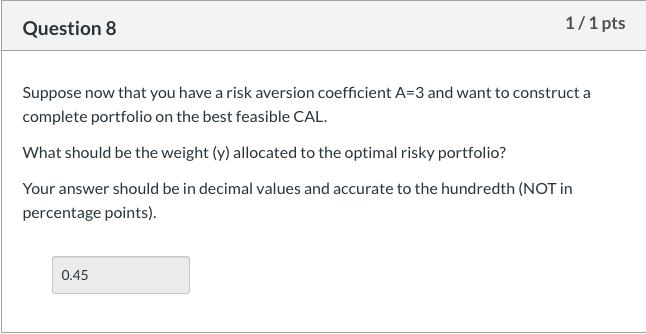

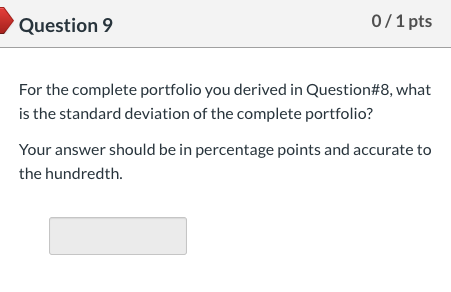

The following data applies to Questions 4 to 9. A pension fund manager is considering three investment options. The first is a stock fund, the second is a corporate bond fund, and the third is a T-bill money market fund (the risk-free asset) that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Standard Deviation (%) Expected return (%) 15 Stock fund (S) 32 Bond fund (B) 23 The correlation between the fund returns is 0.15. Question 8 1/1 pts Suppose now that you have a risk aversion coefficient A=3 and want to construct a complete portfolio on the best feasible CAL. What should be the weight (y) allocated to the optimal risky portfolio? Your answer should be in decimal values and accurate to the hundredth (NOT in percentage points). 0.45 Question 9 0/1 pts For the complete portfolio you derived in Question#8, what is the standard deviation of the complete portfolio? Your answer should be in percentage points and accurate to the hundredth. The following data applies to Questions 4 to 9. A pension fund manager is considering three investment options. The first is a stock fund, the second is a corporate bond fund, and the third is a T-bill money market fund (the risk-free asset) that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Standard Deviation (%) Expected return (%) 15 Stock fund (S) 32 Bond fund (B) 23 The correlation between the fund returns is 0.15. Question 8 1/1 pts Suppose now that you have a risk aversion coefficient A=3 and want to construct a complete portfolio on the best feasible CAL. What should be the weight (y) allocated to the optimal risky portfolio? Your answer should be in decimal values and accurate to the hundredth (NOT in percentage points). 0.45 Question 9 0/1 pts For the complete portfolio you derived in Question#8, what is the standard deviation of the complete portfolio? Your answer should be in percentage points and accurate to the hundredth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts