Question: please help with question e! thx Assume the market risk premium is 5%, and the risk-free rate is 2%. You have estimated the return rates

please help with question e! thx

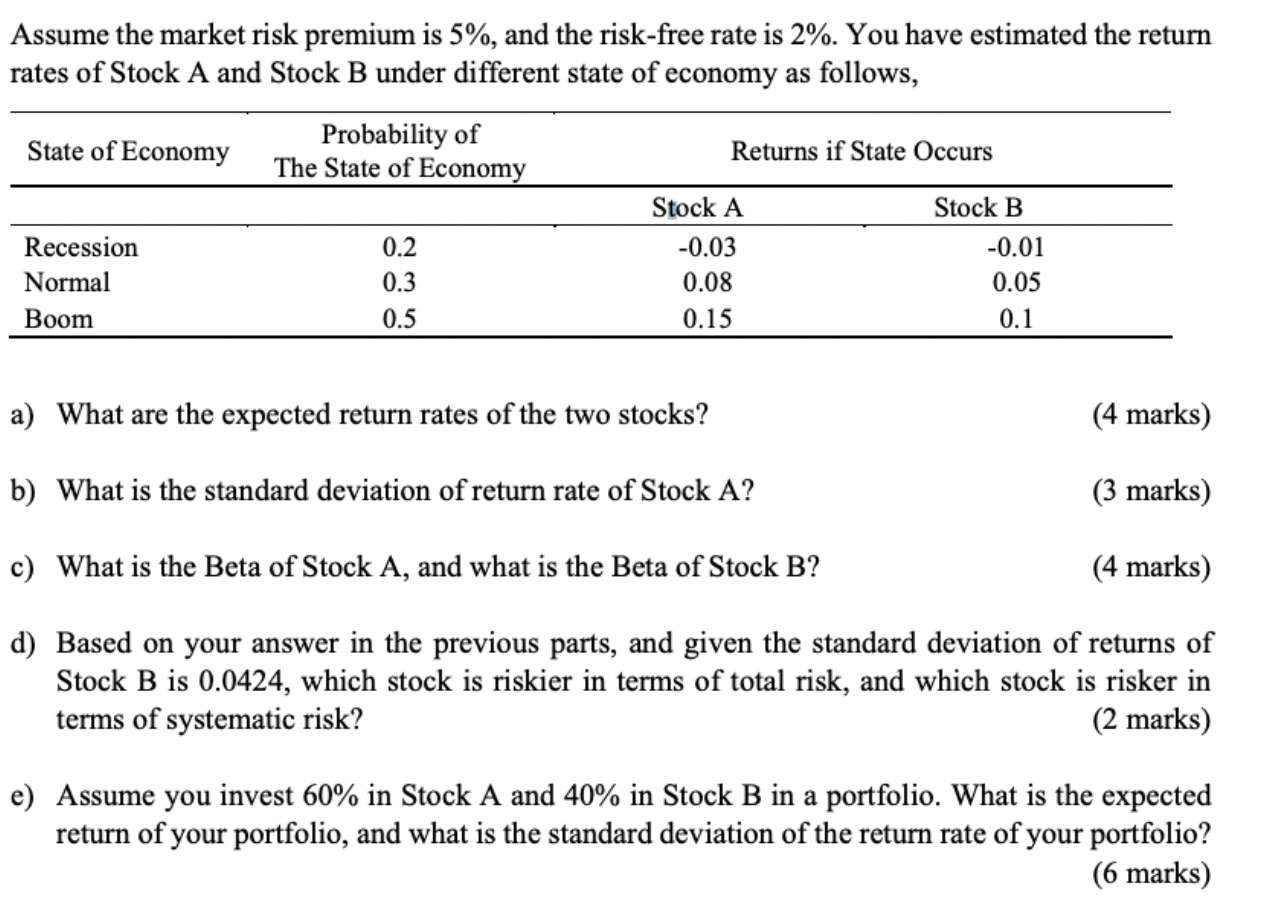

Assume the market risk premium is 5%, and the risk-free rate is 2%. You have estimated the return rates of Stock A and Stock B under different state of economy as follows, State of Economy Probability of The State of Economy Returns if State Occurs Stock B Recession Normal Boom 0.2 0.3 0.5 Stock A -0.03 0.08 0.15 -0.01 0.05 0.1 a) What are the expected return rates of the two stocks? (4 marks) b) What is the standard deviation of return rate of Stock A? (3 marks) c) What is the Beta of Stock A, and what is the Beta of Stock B? (4 marks) d) Based on your answer in the previous parts, and given the standard deviation of returns of Stock B is 0.0424, which stock is riskier in terms of total risk, and which stock is risker in terms of systematic risk? (2 marks) e) Assume you invest 60% in Stock A and 40% in Stock B in a portfolio. What is the expected return of your portfolio, and what is the standard deviation of the return rate of your portfolio? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts