Question: Please Help with Questions 1 and 2 information provided below Thanks in advance QUESTION1 Using the financial information from the case study and the information

Please Help with Questions 1 and 2

information provided below Thanks in advance

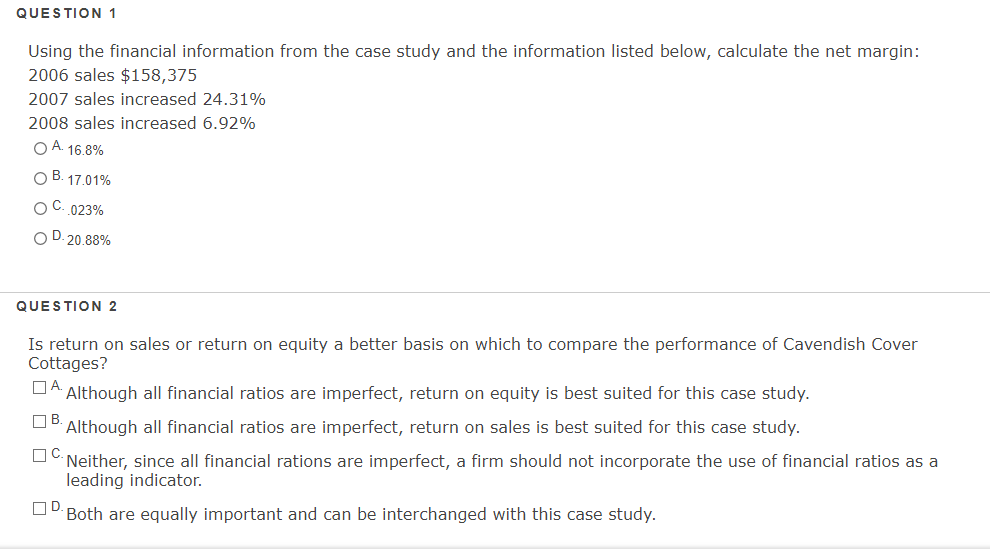

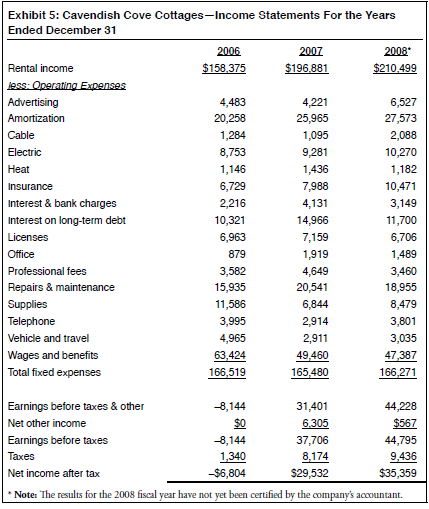

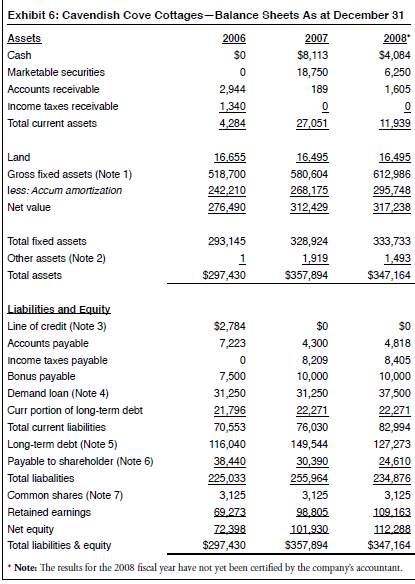

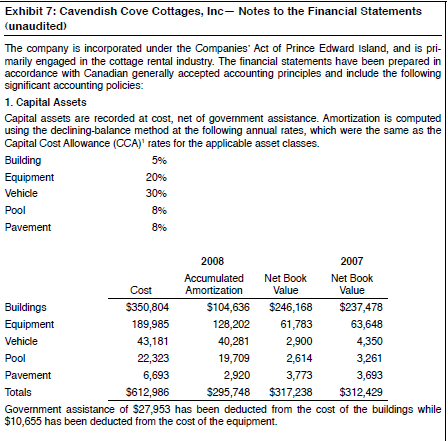

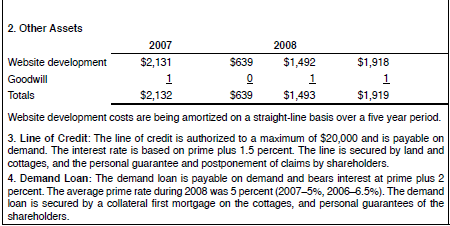

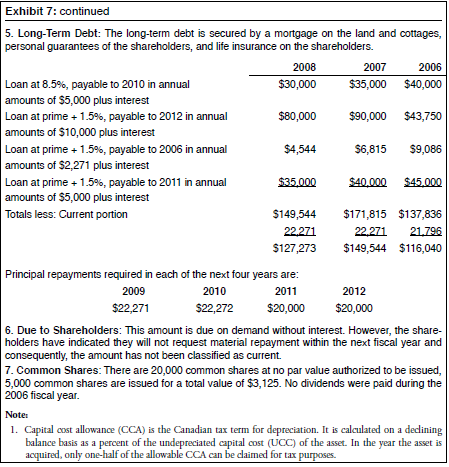

QUESTION1 Using the financial information from the case study and the information listed below, calculate the net margin: 2006 sales $158,375 2007 sales increased 24.31% 2008 sales increased 6.92% 0A168% OR 17.01% C. .023% OD 20.88% QUESTION 2 Is return on sales or return on equity a better basis on which to compare the performance of Cavendish Cover Cottages? Although all financial ratios are imperfect, return on equity is best suited for this case study. Although all financial ratios are imperfect, return on sales is best suited for this case study. Neither, since all financial rations are imperfect, a firm should not incorporate the use of financial ratios as a leading indicator. Both are equally important and can be interchanged with this case study

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts