Question: Please help with questions 2c, and 4 (including a, b, c) PARTI Basic Option Calculations Assume the following table gives current market prices for XYZ

Please help with questions 2c, and 4 (including a, b, c)

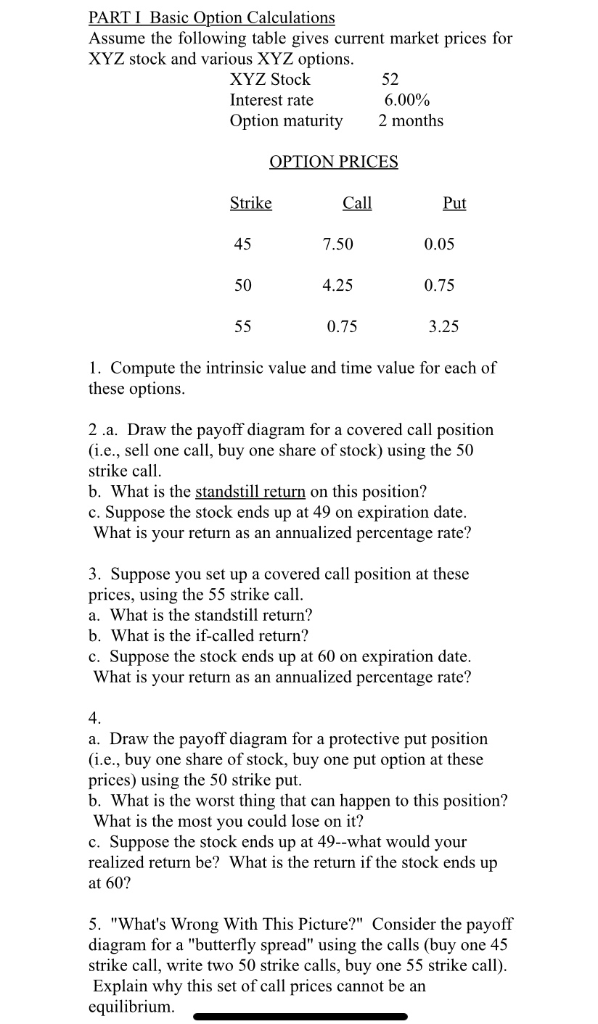

PARTI Basic Option Calculations Assume the following table gives current market prices for XYZ stock and various XYZ options XYZ Stock Interest rate Option maturity 52 6.00% 2 months Strike 45 50 Call 7.50 4.25 0.75 Put 0.05 3.25 1. Compute the intrinsic value and time value for each of these options 2.a. Draw the payoff diagram for a covered call position (i.e., sell one call, buy one share of stock) using the 50 strike call b. What is the standstill return on this position? c. Suppose the stock ends up at 49 on expiration date What is your return as an annualized percentage rate? 3. Suppose you set up a covered call position at these prices, using the 55 strike call a. What is the standstill return? b. What is the if-called return? c. Suppose the stock ends up at 60 on expiration date What is your return as an annualized percentage rate? 4 a. Draw the payoff diagram for a protective put position (i.e., buy one share of stock, buy one put option at these prices) using the 50 strike put b. What is the worst thing that can happen to this position? What is the most you could lose on it? c. Suppose the stock ends up at 49--what would your realized return be? What is the return if the stock ends up at 60? 5. "What's Wrong With This Picture?" Consider the payoff diagram for a "butterfly spread" using the calls (buy one 45 strike call, write two 50 strike calls, buy one 55 strike call) Explain why this set of call prices cannot be an equilibrium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts