Question: Please help with red boxes and show any calculations!! The CPA Partnership operated by Cook, Parks, and Argo is being liquidated. A balance sheet prepared

Please help with red boxes and show any calculations!!

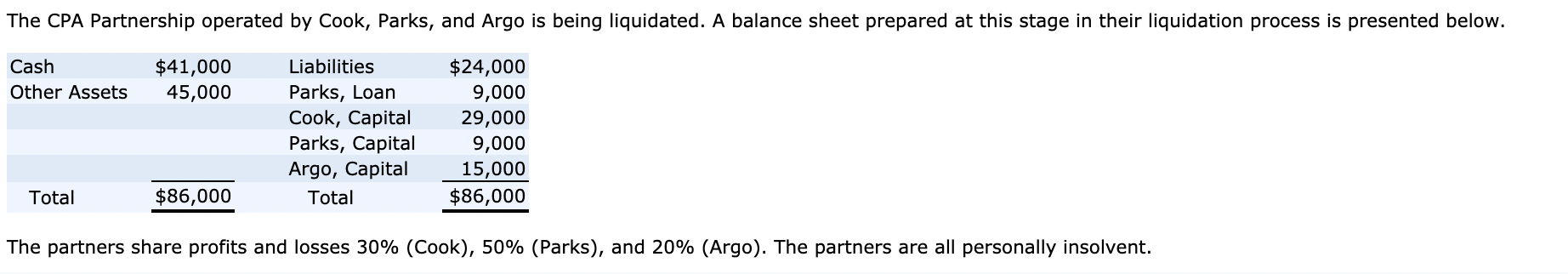

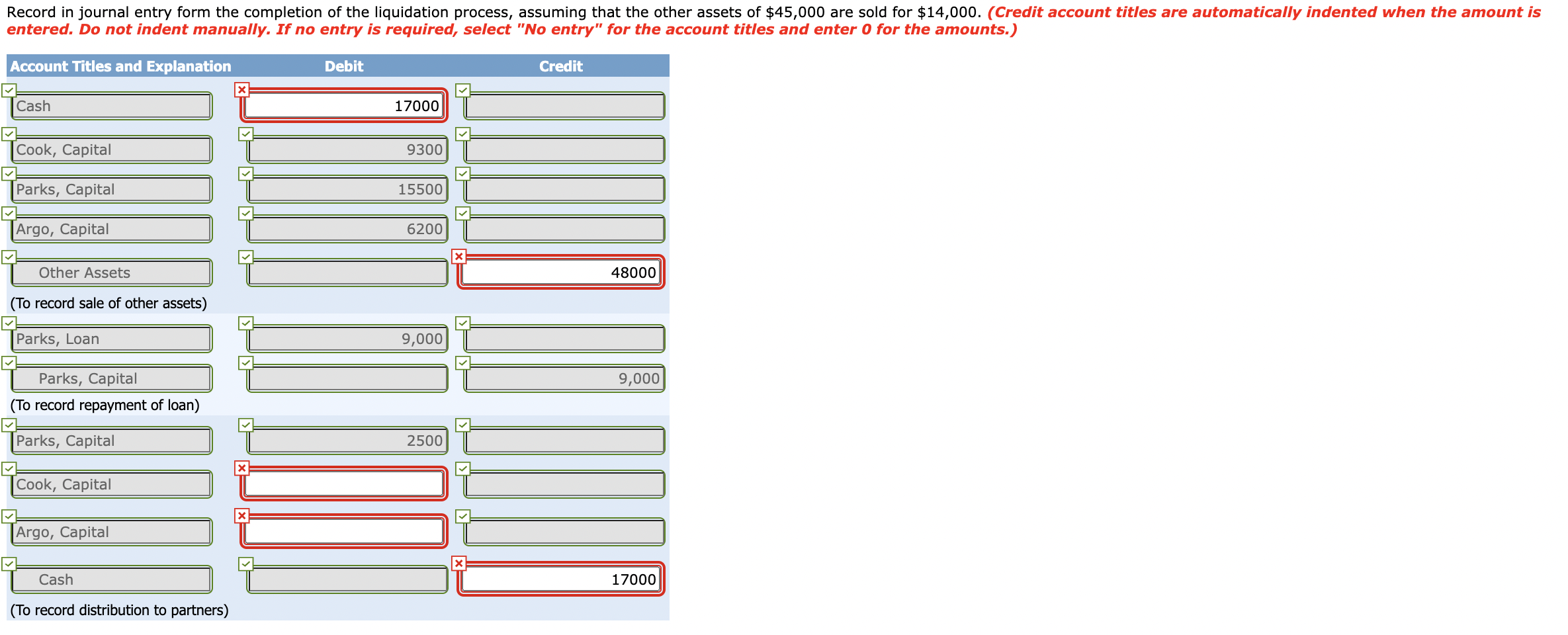

The CPA Partnership operated by Cook, Parks, and Argo is being liquidated. A balance sheet prepared at this stage in their liquidation process is presented below. Cash Other Assets $41,000 45,000 Liabilities Parks, Loan Cook, Capital Parks, Capital Argo, Capital Total $24,000 9,000 29,000 9,000 15,000 $86,000 Total $86,000 The partners share profits and losses 30% (Cook), 50% (Parks), and 20% (Argo). The partners are all personally insolvent. Record in journal entry form the completion of the liquidation process, assuming that the other assets of $45,000 are sold for $14,000. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Cash 17000 Cook, Capital 9300 Parks, Capital 15500 Argo, Capital 6200 Other Assets 48000 (To record sale of other assets) Parks, Loan 9,000 9,000 Parks, Capital (To record repayment of loan) Parks, Capital 2500 Cook, Capital > Argo, Capital x Cash 17000 (To record distribution to partners)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts