Question: please help with red boxes Problem 1: Annual Dividends $ Required Rate of Return: Most recent annual Dividend: Analysis Period growth rate: Horizon Period growth

please help with red boxes

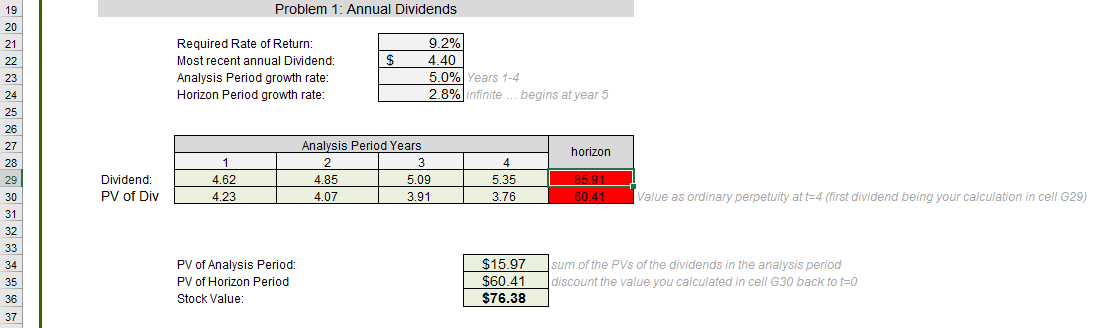

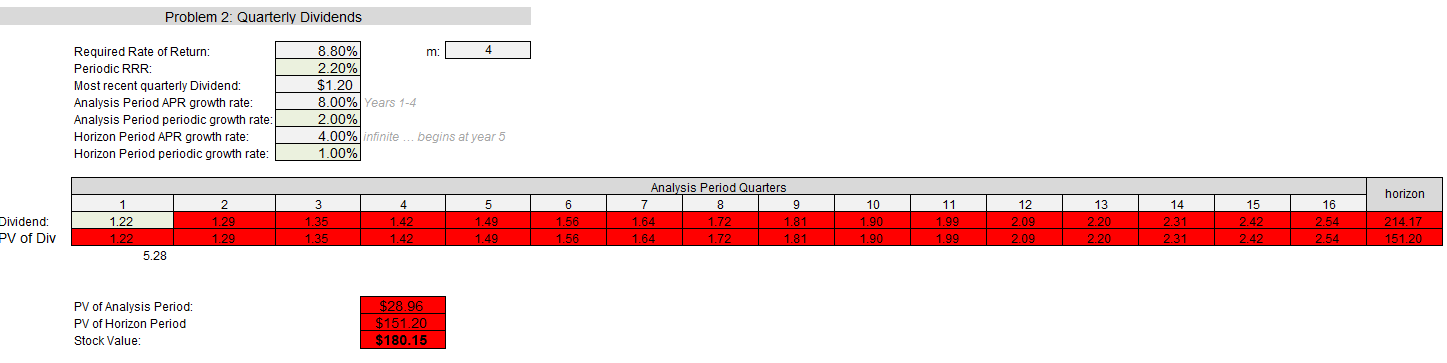

Problem 1: Annual Dividends $ Required Rate of Return: Most recent annual Dividend: Analysis Period growth rate: Horizon Period growth rate: 9.2% 4.40 5.0% Years 1-4 2.8% infinite ... begins at year 5 horizon 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 Analysis Period Years 2 3 4.85 5.09 4.07 3.91 1 4.62 4.23 Dividend: PV of Div 4 5.35 3.76 85.91 60.41 Value as ordinary perpetuity at t=4 (first dividend being your calculation in cell G29) PV of Analysis Period: PV of Horizon Period Stock Value: : $15.97 $60.41 $76.38 sum of the PVs of the dividends in the analysis period discount the value you calculated in cell G30 back to t=0 Problem 2: Quarterly Dividends A Required Rate of Return: Periodic RRR Most recent quarterly Dividend: Analysis Period APR growth rate: Analysis Period periodic growth rate: Horizon Period APR growth rate: Horizon Period periodic growth rate: 8.80% m: 4 2.20% $1.20 8.00% Years 1-4 2.00% 4.00% infinite... begins at year 5 1.00% horizon 2 1 1.22 1.22 Dividend: PV of Div 129 3 1.35 1.35 4 1.42 1.42 5 1.49 1.49 Analysis Period Quarters 7 8 9 1.64 1.72 1.81 1.64 1.72 1.81 6 1.56 1.56 10 1.90 1.90 11 1.99 1.99 12 209 2.09 13 2.20 2.20 14 2.31 2.31 15 2.42 2.42 16 2.54 2.54 214.17 151.20 1.29 5.28 PV of Analysis Period: PV of Horizon Period Stock Value: $28.96 $151.20 $180.15 Problem 1: Annual Dividends $ Required Rate of Return: Most recent annual Dividend: Analysis Period growth rate: Horizon Period growth rate: 9.2% 4.40 5.0% Years 1-4 2.8% infinite ... begins at year 5 horizon 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 Analysis Period Years 2 3 4.85 5.09 4.07 3.91 1 4.62 4.23 Dividend: PV of Div 4 5.35 3.76 85.91 60.41 Value as ordinary perpetuity at t=4 (first dividend being your calculation in cell G29) PV of Analysis Period: PV of Horizon Period Stock Value: : $15.97 $60.41 $76.38 sum of the PVs of the dividends in the analysis period discount the value you calculated in cell G30 back to t=0 Problem 2: Quarterly Dividends A Required Rate of Return: Periodic RRR Most recent quarterly Dividend: Analysis Period APR growth rate: Analysis Period periodic growth rate: Horizon Period APR growth rate: Horizon Period periodic growth rate: 8.80% m: 4 2.20% $1.20 8.00% Years 1-4 2.00% 4.00% infinite... begins at year 5 1.00% horizon 2 1 1.22 1.22 Dividend: PV of Div 129 3 1.35 1.35 4 1.42 1.42 5 1.49 1.49 Analysis Period Quarters 7 8 9 1.64 1.72 1.81 1.64 1.72 1.81 6 1.56 1.56 10 1.90 1.90 11 1.99 1.99 12 209 2.09 13 2.20 2.20 14 2.31 2.31 15 2.42 2.42 16 2.54 2.54 214.17 151.20 1.29 5.28 PV of Analysis Period: PV of Horizon Period Stock Value: $28.96 $151.20 $180.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts