Question: please help with req 2&3 ChecAtack makes candy bars for vending machines and sets them to vendors in cases of 30 bars. Although ChocAttack makes

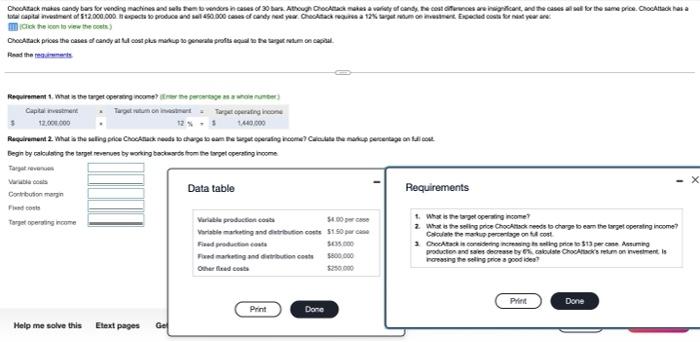

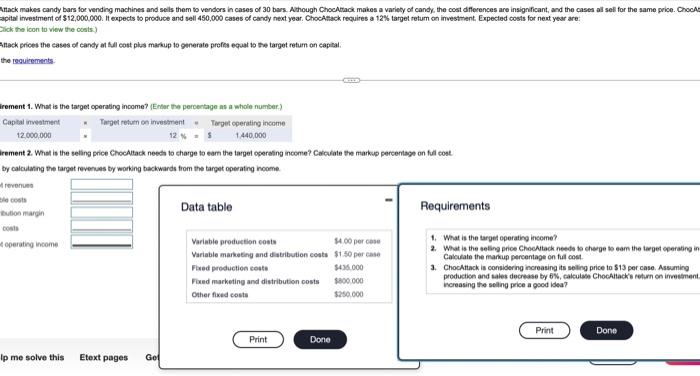

ChecAtack makes candy bars for vending machines and sets them to vendors in cases of 30 bars. Although ChocAttack makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. ChocAttack has a capital investment of $12.000.000 expects to produce and sell 450.000 cases of candy next year CheoAtack requires a 12% sapat tum on investment Expected costs for a year a Click the icon to view the costs) ChocAttack prices the cases of candy at full cost plus markup to generate profits equal to the target reatum on capital Read the Requirement 1. What is the target operating income? ner the percentage) Capital investment 12.000.000 Contribution margin Fixed costs Target operating income Target on instant 12 % Requirement 2. What is the selling price Choctack needs to charge to eam the target operating income? Calculate the markup percentage on full cost Begin by calculating the target revenues by working backwards from the target operating income Target revenues Help me solve this Target operating income 1,440,000 Etext pages Ge Data table Variable production cos Variable marketing and distribution costs $1.50 Fed production costs $435.000 Fixed marketing and distribution costs $800,000 Othered costs Print $4.00 percase Done Requirements 1. What is the target operating income? 2. What is the selling price ChocAttack needs to change to eam the target operating income? Calculate the markup percentage on full cost 1 ChocAtack is considering increasing the selling price to $13 per case Assuming production and sales decrease by calculate ChocAttack's return on investment is increasing the selling price a good idea? Print Done Attack makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although ChocAttack makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. ChocAt capital investment of $12,000,000. It expects to produce and sell 450,000 cases of candy next year. ChocAttack requires a 12% target return on investment. Expected costs for next year are: Click the icon to view the costs) Attack prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital. the requirements irement 1. What is the target operating income? (Enter the percentage as a whole number) Capital investment Target return on investment Target operating income 12,000,000 12 % S 1.440,000 irement 2. What is the selling price ChocAttack needs to charge to earn the target operating income? Calculate the markup percentage on full cost by calculating the target revenues by working backwards from the target operating income revenues le costs bution margin operating income Ip me solve this Etext pages Get Data table Variable production costs $4.00 per case Variable marketing and distribution costs $1.50 per case Fixed production costs $435.000 $800,000 Fixed marketing and distribution costs Other fixed costs $250,000 Print Done Requirements 1. What is the target operating income? 2. What is the selling price ChocAttack needs to charge to eam the target operating in Calculate the markup percentage on full cost. 3. ChocAttack is considering increasing its selling price to $13 per case. Assuming production and sales decrease by 6%, calculate ChocAttack's return on investment. increasing the selling price a good idea? Print Done ChecAtack makes candy bars for vending machines and sets them to vendors in cases of 30 bars. Although ChocAttack makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. ChocAttack has a capital investment of $12.000.000 expects to produce and sell 450.000 cases of candy next year CheoAtack requires a 12% sapat tum on investment Expected costs for a year a Click the icon to view the costs) ChocAttack prices the cases of candy at full cost plus markup to generate profits equal to the target reatum on capital Read the Requirement 1. What is the target operating income? ner the percentage) Capital investment 12.000.000 Contribution margin Fixed costs Target operating income Target on instant 12 % Requirement 2. What is the selling price Choctack needs to charge to eam the target operating income? Calculate the markup percentage on full cost Begin by calculating the target revenues by working backwards from the target operating income Target revenues Help me solve this Target operating income 1,440,000 Etext pages Ge Data table Variable production cos Variable marketing and distribution costs $1.50 Fed production costs $435.000 Fixed marketing and distribution costs $800,000 Othered costs Print $4.00 percase Done Requirements 1. What is the target operating income? 2. What is the selling price ChocAttack needs to change to eam the target operating income? Calculate the markup percentage on full cost 1 ChocAtack is considering increasing the selling price to $13 per case Assuming production and sales decrease by calculate ChocAttack's return on investment is increasing the selling price a good idea? Print Done Attack makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although ChocAttack makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. ChocAt capital investment of $12,000,000. It expects to produce and sell 450,000 cases of candy next year. ChocAttack requires a 12% target return on investment. Expected costs for next year are: Click the icon to view the costs) Attack prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital. the requirements irement 1. What is the target operating income? (Enter the percentage as a whole number) Capital investment Target return on investment Target operating income 12,000,000 12 % S 1.440,000 irement 2. What is the selling price ChocAttack needs to charge to earn the target operating income? Calculate the markup percentage on full cost by calculating the target revenues by working backwards from the target operating income revenues le costs bution margin operating income Ip me solve this Etext pages Get Data table Variable production costs $4.00 per case Variable marketing and distribution costs $1.50 per case Fixed production costs $435.000 $800,000 Fixed marketing and distribution costs Other fixed costs $250,000 Print Done Requirements 1. What is the target operating income? 2. What is the selling price ChocAttack needs to charge to eam the target operating in Calculate the markup percentage on full cost. 3. ChocAttack is considering increasing its selling price to $13 per case. Assuming production and sales decrease by 6%, calculate ChocAttack's return on investment. increasing the selling price a good idea? Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts