Question: please help with required D1 A European put option contract with an exercise price of $2.45 per pound and a contract size of 36,000 is

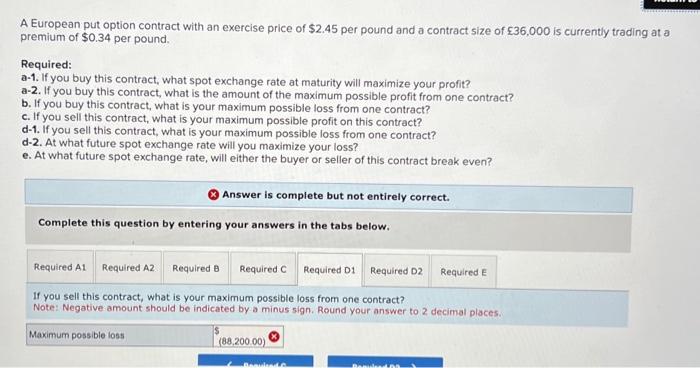

A European put option contract with an exercise price of $2.45 per pound and a contract size of 36,000 is currently trading at a premium of $0.34 per pound. Required: a-1. If you buy this contract, what spot exchange rate at maturity will maximize your profit? a-2. If you buy this contract, what is the amount of the maximum possible profit from one contract? b. If you buy this contract, what is your maximum possible loss from one contract? c. If you sell this contract, what is your maximum possible profit on this contract? d-1. If you sell this contract, what is your maximum possible loss from one contract? d-2. At what future spot exchange rate will you maximize your loss? e. At what future spot exchange rate, will either the buyer or seller of this contract break even? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. If you sell this contract, what is your maximum possible loss from one contract? Note: Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts