Question: PLease help with ROA ! A low ROA can result from a firm's decision to use more debt because high interest expenses will cause net

PLease help with ROA !

PLease help with ROA !

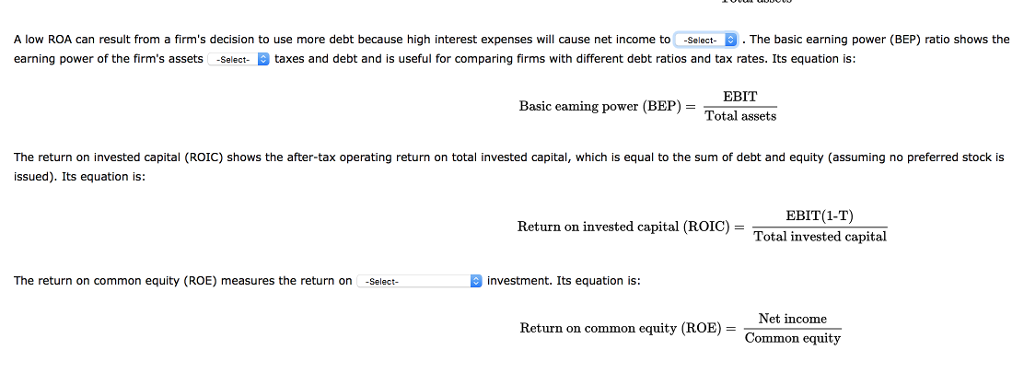

A low ROA can result from a firm's decision to use more debt because high interest expenses will cause net income to Select. The basic earning power (BEP) ratio shows the earning power of the firm's assets Se taxes and debt and is useful for comparing firms with different debt ratios and tax rates. Its equation is: EBIT Basic eaming powr(BEPotal assets The return on invested capital (ROIC) shows the after-tax operating return on total invested capital, which is equal to the sum of debt and equity (assuming no preferred stock is issued). Its equation is: EBIT(1-T) Total invested capital Return on invested capital (ROIC) The return on common equity (ROE) measures the return on -el investment. Its equation is: Return on common equity (ROE) = Common equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts