Question: please help with solution QUESTION 3 (20) 3.1 Prepare a projected statement of comprehensive income for the year ended 31 December 2021 to determine the

please help with solution

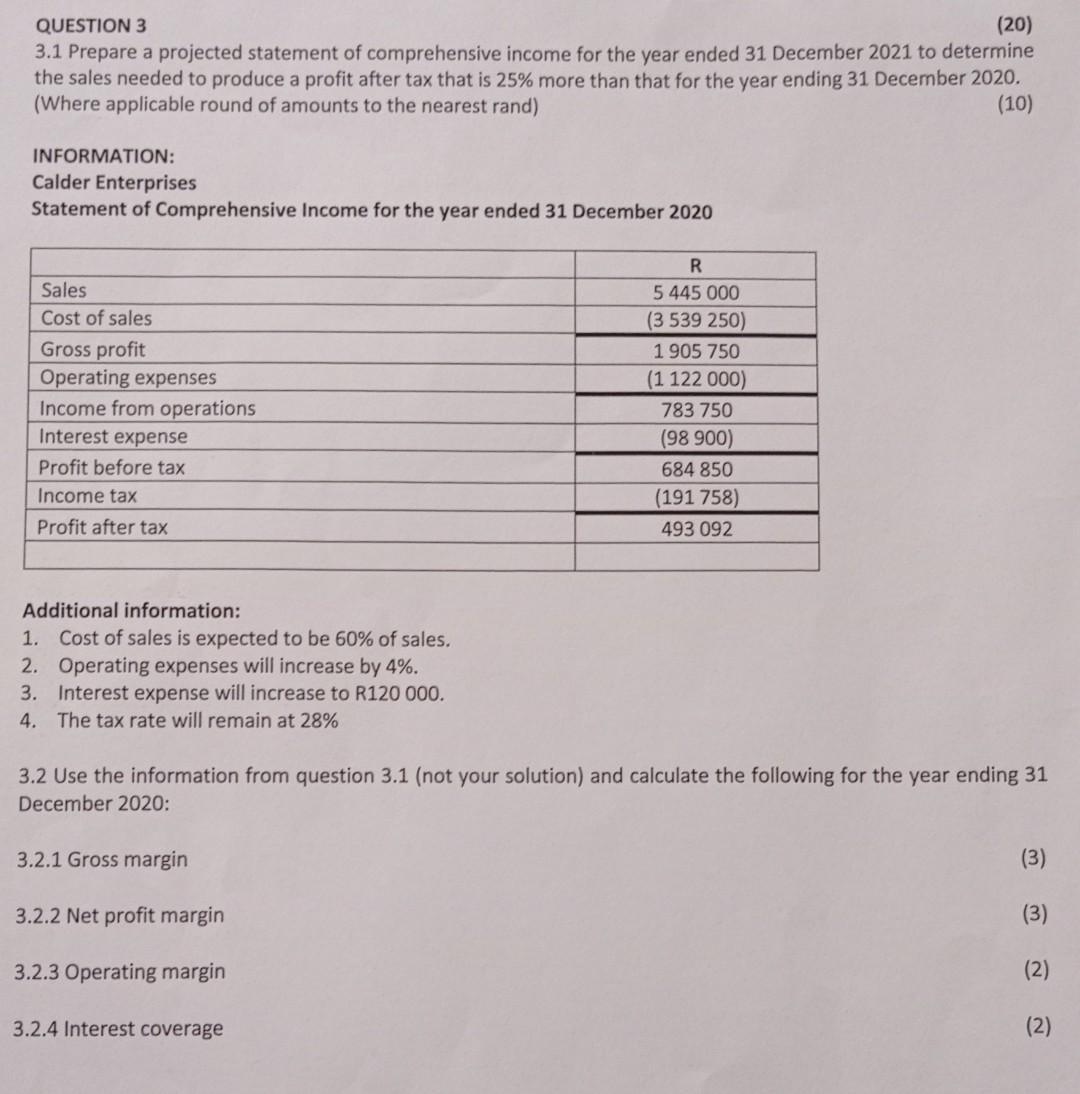

QUESTION 3 (20) 3.1 Prepare a projected statement of comprehensive income for the year ended 31 December 2021 to determine the sales needed to produce a profit after tax that is 25% more than that for the year ending 31 December 2020. (Where applicable round of amounts to the nearest rand) (10) INFORMATION: Calder Enterprises Statement of Comprehensive Income for the year ended 31 December 2020 Sales Cost of sales Gross profit Operating expenses Income from operations Interest expense Profit before tax Income tax Profit after tax R 5 445 000 (3 539 250) 1 905 750 (1 122 000) 783 750 (98 900) 684 850 (191 758) 493 092 Additional information: 1. Cost of sales is expected to be 60% of sales. 2. Operating expenses will increase by 4%. 3. Interest expense will increase to R120 000. 4. The tax rate will remain at 28% 3.2 Use the information from question 3.1 (not your solution) and calculate the following for the year ending 31 December 2020: 3.2.1 Gross margin (3) 3.2.2 Net profit margin (3) 3.2.3 Operating margin (2) 3.2.4 Interest coverage (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts