Question: Please help with stats (econometrics ) questions b) 2. State any theorems/conditions that you use in determining your solutions. a) An initial investment of 8,320K

Please help with stats (econometrics ) questions

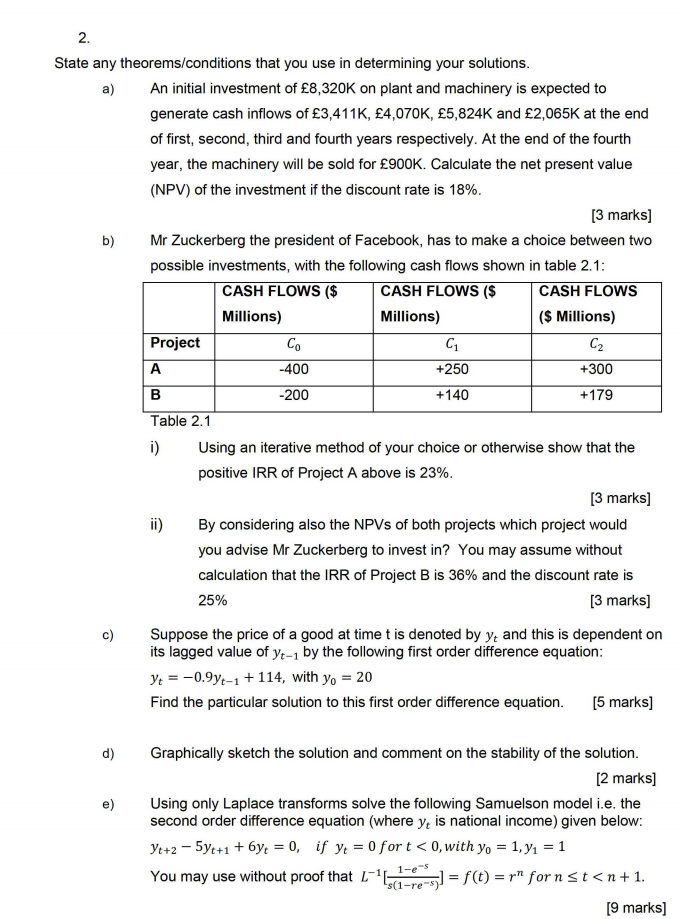

b) 2. State any theorems/conditions that you use in determining your solutions. a) An initial investment of 8,320K on plant and machinery is expected to generate cash inflows of 3,411K, 4,070K, 5,824K and 2,065K at the end of first, second, third and fourth years respectively. At the end of the fourth year, the machinery will be sold for 900K. Calculate the net present value (NPV) of the investment if the discount rate is 18%. [3 marks) b Mr Zuckerberg the president of Facebook, has to make a choice between two possible investments, with the following cash flows shown in table 2.1: CASH FLOWS ($ CASH FLOWS ($ CASH FLOWS Millions) Millions) ($ Millions) Project Co G C2 A -400 +250 +300 B -200 +140 +179 Table 2.1 i) Using an iterative method of your choice or otherwise show that the positive IRR of Project A above is 23%. [3 marks] ii) By considering also the NPVs of both projects which project would you advise Mr Zuckerberg to invest in? You may assume without calculation that the IRR of Project B is 36% and the discount rate is 25% [3 marks] c) Suppose the price of a good at time t is denoted by yz and this is dependent on its lagged value of yt-1 by the following first order difference equation: y = -0.9y-1 +114, with yo = 20 Find the particular solution to this first order difference equation. [5 marks) d) Graphically sketch the solution and comment on the stability of the solution. [2 marks] Using only Laplace transforms solve the following Samuelson model i.e. the second order difference equation (where y; is national income) given below: Ye+2 - 5ye+1 +6yx = 0, if yz = 0 for t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts