Question: Please help!!! with step!! Thanks!b (30 points) The accountant for Marlin Corporation has developed the following information for the company's defined-benefit pension plan for 2020

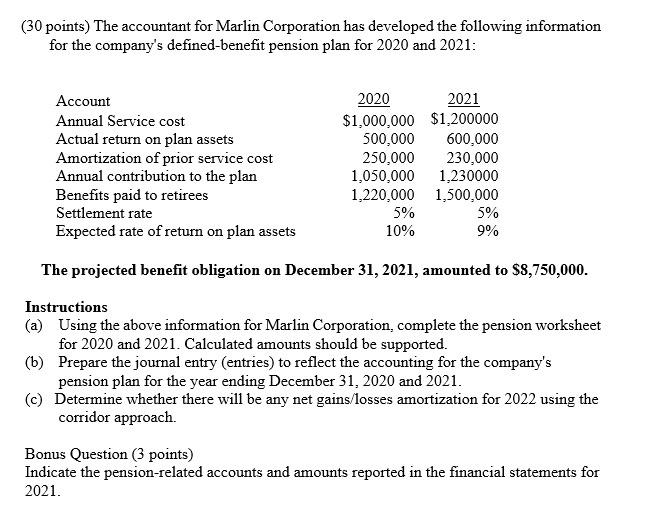

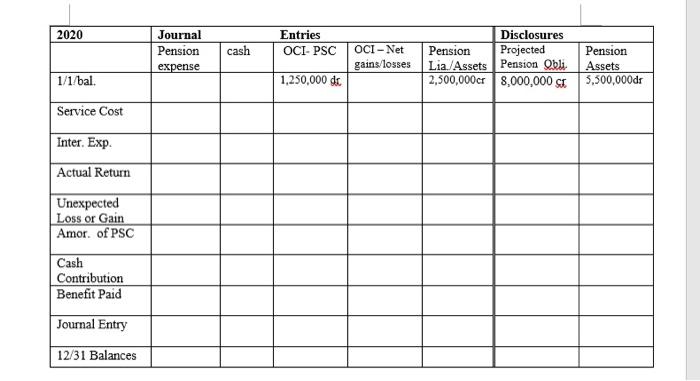

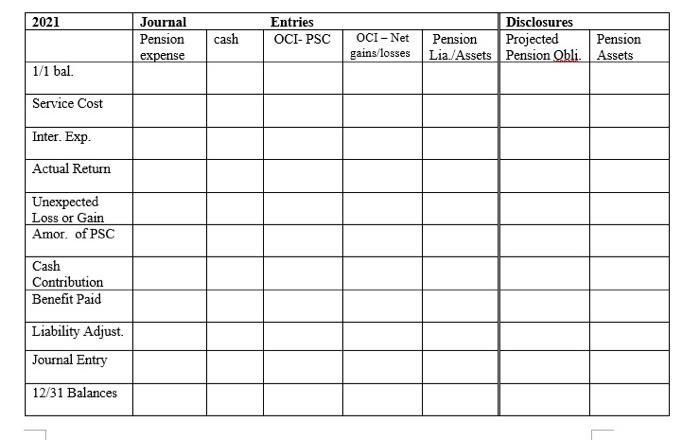

(30 points) The accountant for Marlin Corporation has developed the following information for the company's defined-benefit pension plan for 2020 and 2021 : The projected benefit obligation on December 31,2021 , amounted to $8,750,000. Instructions (a) Using the above information for Marlin Corporation, complete the pension worksheet for 2020 and 2021 . Calculated amounts should be supported. (b) Prepare the journal entry (entries) to reflect the accounting for the company's pension plan for the year ending December 31,2020 and 2021. (c) Determine whether there will be any net gains/losses amortization for 2022 using the corridor approach. Bonus Question ( 3 points) Indicate the pension-related accounts and amounts reported in the financial statements for 2021 \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|} \hline \multicolumn{1}{|l|}{ Journal } & \multicolumn{3}{l|}{ Entries } & \multicolumn{1}{l|}{ Disclosures } \\ \hline & Pension expense & cash & OCI- PSC & OCI - Net gains/losses & Pension Lia/Assets & Projected Pension Qbli. & Pension Assets \\ \hline 1/1/bal. & & & 1,250,000dx & & 2,500,000cr & 8,000,000cr & 5,500,000dr \\ \hline Service Cost & & & & & & & \\ \hline Inter. Exp. & & & & & & & \\ \hline Actual Return Loss or Gain & & & & & & & \\ \hline Amor. of PSC & & & & & & & \\ \hline Cash Contribution & & & & & & \\ \hline Benefit Paid & & & & & & \\ \hline Journal Entry & & & & & & \\ \hline 12/31 Balances & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts