Question: Please help with steps 13. A project has a life of 4 years. The initial cash outlay is $550. The cashflows in years 1,2,3, and

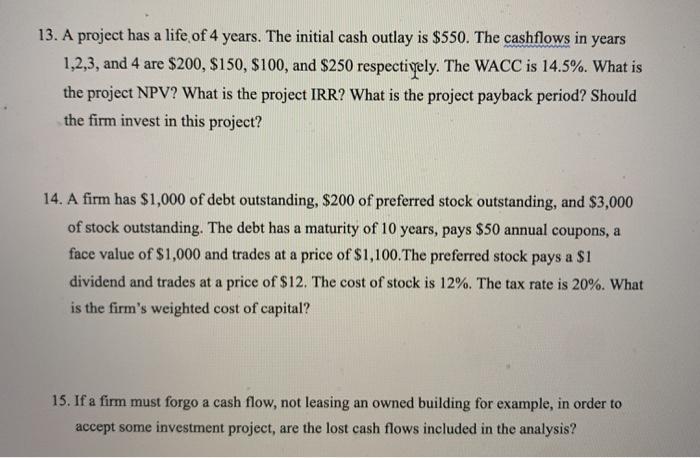

13. A project has a life of 4 years. The initial cash outlay is $550. The cashflows in years 1,2,3, and 4 are $200, $150, $100, and $250 respectiyely. The WACC is 14.5%. What is the project NPV? What is the project IRR? What is the project payback period? Should the firm invest in this project? 14. A firm has $1,000 of debt outstanding, $200 of preferred stock outstanding, and $3,000 of stock outstanding. The debt has a maturity of 10 years, pays $50 annual coupons, a face value of $1,000 and trades at a price of $1,100. The preferred stock pays a $1 dividend and trades at a price of $12. The cost of stock is 12%. The tax rate is 20%. What is the firm's weighted cost of capital? 15. If a firm must forgo a cash flow, not leasing an owned building for example, in order to accept some investment project, are the lost cash flows included in the analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts