Question: please help with steps if possible. im having a really hard time figuring this out. thank you! Suppose that you are considering a conventional, fixed-rate

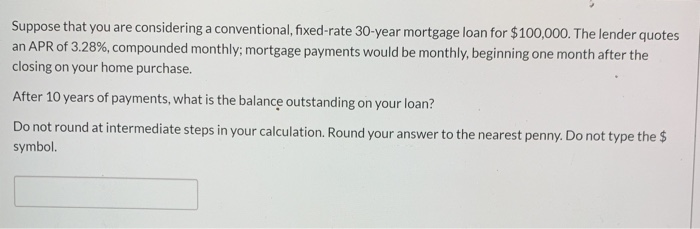

Suppose that you are considering a conventional, fixed-rate 30-year mortgage loan for $100,000. The lender quotes an APR of 3.28%, compounded monthly; mortgage payments would be monthly, beginning one month after the closing on your home purchase. After 10 years of payments, what is the balance outstanding on your loan? Do not round at intermediate steps in your calculation. Round your answer to the nearest penny. Do not type the $ symbol

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts