Question: please help with tax accounting Exercise 4-21 (Algorithmic) (LO.2) Bigham Corporation, an accrual basis calendar year taxpayer, sells its services under 12- and 24-month contracts.

please help with tax accounting

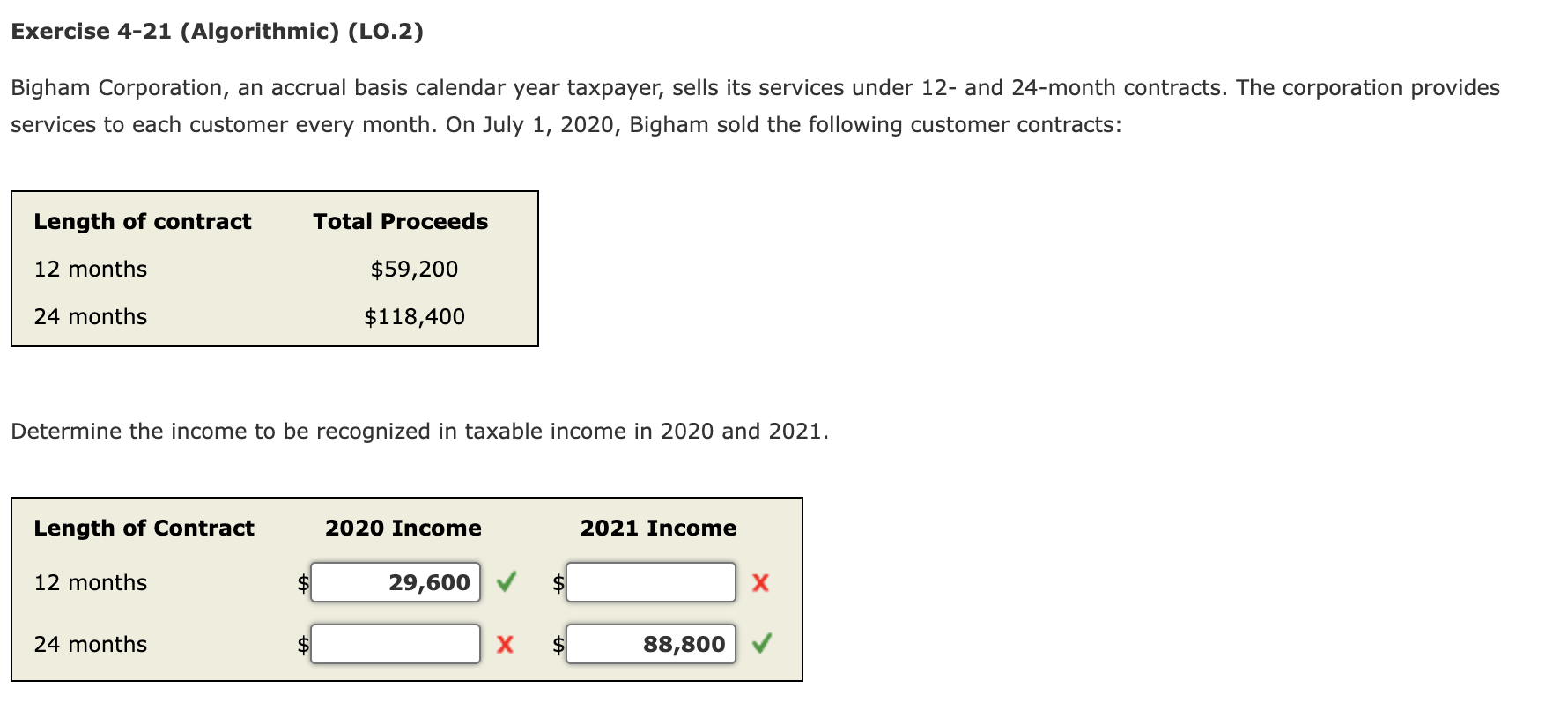

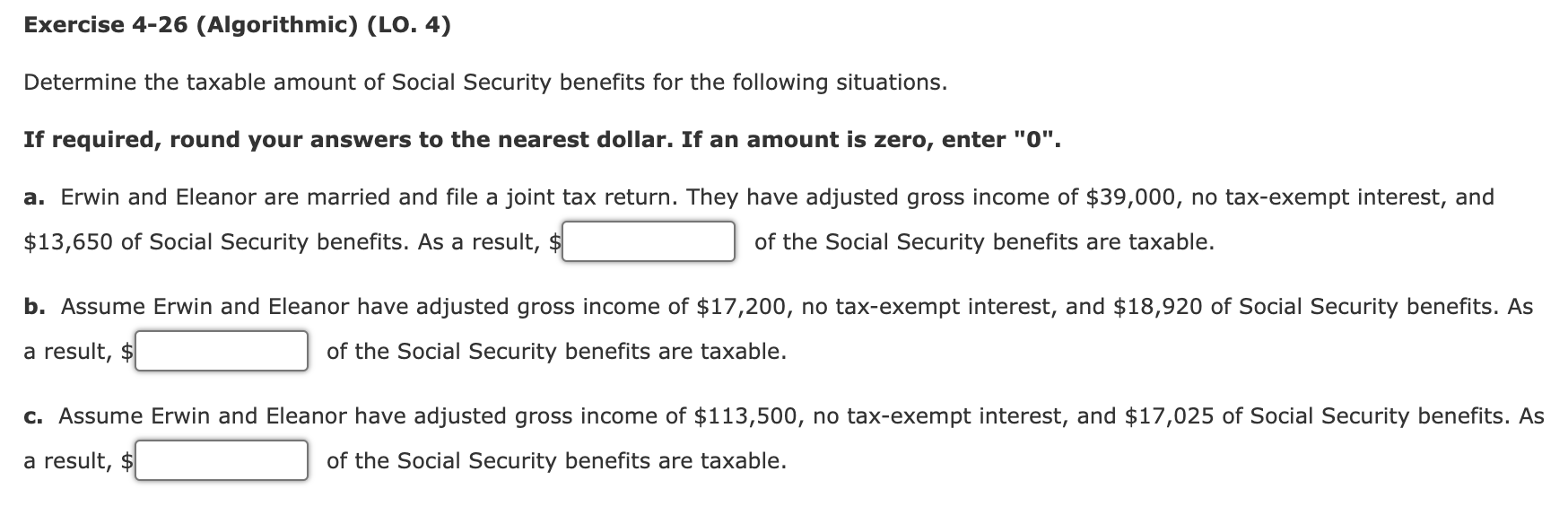

Exercise 4-21 (Algorithmic) (LO.2) Bigham Corporation, an accrual basis calendar year taxpayer, sells its services under 12- and 24-month contracts. The corporation provides services to each customer every month. On July 1, 2020, Bigham sold the following customer contracts: Length of contract Total Proceeds 12 months $59,200 24 months $118,400 Determine the income to be recognized in taxable income in 2020 and 2021. Length of Contract 2020 Income 2021 Income 12 months 29,600 $ 24 months $ 88,800 Exercise 4-26 (Algorithmic) (LO. 4) Determine the taxable amount of Social Security benefits for the following situations. If required, round your answers to the nearest dollar. If an amount is zero, enter "0". a. Erwin and Eleanor are married and file a joint tax return. They have adjusted gross income of $39,000, no tax-exempt interest, and $13,650 of Social Security benefits. As a result, $ of the Social Security benefits are taxable. b. Assume Erwin and Eleanor have adjusted gross income of $17,200, no tax-exempt interest, and $18,920 of Social Security benefits. As a result, $ of the Social Security benefits are taxable. C. Assume Erwin and Eleanor have adjusted gross income of $113,500, no tax-exempt interest, and $17,025 of Social Security benefits. As a result, $ of the Social Security benefits are taxable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts